Difference between revisions of "Billing"

| (110 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | + | <p style="font-size:30px">NEW!! Find all of your answers in the [https://helpdesk.growthzone.com/kb/article/1263-contents-billing// GrowthZone Knowledge Base!]</p> | |

=='''<span style="color:#800080">Overview'''</span>== | =='''<span style="color:#800080">Overview'''</span>== | ||

---- | ---- | ||

| Line 72: | Line 72: | ||

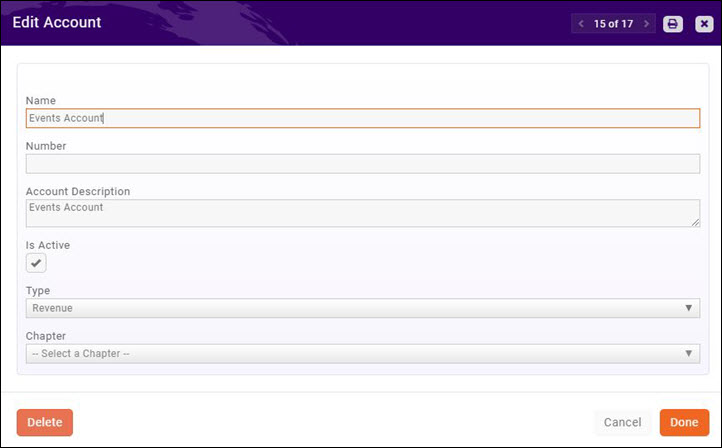

#:[[File:CP Edit Account.jpg|center]] | #:[[File:CP Edit Account.jpg|center]] | ||

#Clear the '''Is Active''' check-box. | #Clear the '''Is Active''' check-box. | ||

| + | #Click '''Done'''. | ||

| + | |||

| + | ===='''<span style="color:#800080">Import Chart of Accounts'''</span>==== | ||

| + | ---- | ||

| + | If you need to add multiple accounts to GrowthZone, this can be done by importing a spreadsheet. The spreadsheet must be an .xlsx or .xls file and '''MUST'' have these column headers on the first row: | ||

| + | *'''Name''': Required if Number is not populated | ||

| + | *'''Number''': Required if Name is not populated | ||

| + | *'''Description''': Optional | ||

| + | *'''Type''': Type '''Must''' be Current Asset, Fixed Asset, Equity, Expense, Current Liability, Liability, Non Current Liability, Other Income, Revenue, Sale, Other Asset or Fund | ||

| + | |||

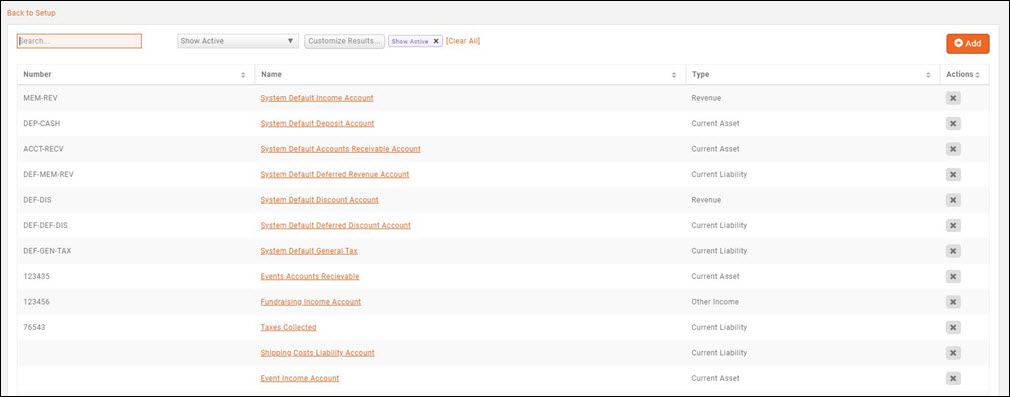

| + | #Click '''Setup''' in the Navigation panel. | ||

| + | #Click '''Chart of Accounts''' in the '''Finance''' section. A list to the accounts currently configured in your system will be displayed. | ||

| + | #:[[File:CP Chart of Accounts.jpg|center]] | ||

| + | #Click the '''Import Accounts''' button. | ||

| + | #Click '''Choose File''' and navigate to your file. | ||

#Click '''Done'''. | #Click '''Done'''. | ||

| Line 98: | Line 113: | ||

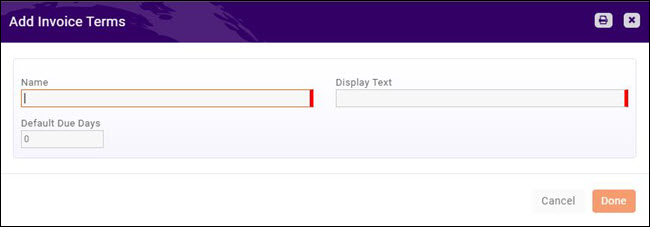

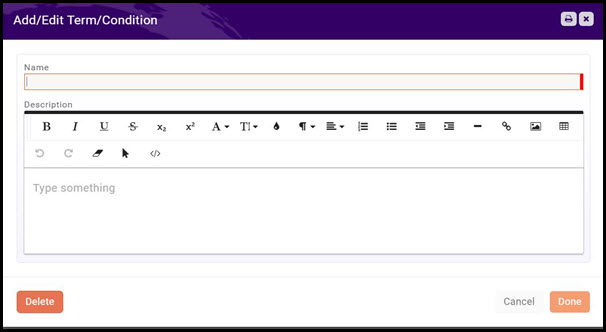

==='''<span style="color:#800080">Setup Your Terms & Conditions'''</span>=== | ==='''<span style="color:#800080">Setup Your Terms & Conditions'''</span>=== | ||

---- | ---- | ||

| − | + | In various locations, you will be able to require acceptance of terms and conditions. Including: | |

| + | *'''Info Hub''': The first time a member logs in, you can require that they accept terms & conditions. These are configured under Setup > Info Hub settings. See '''[https://supportwiki.memberzone.org/Info_Hub#Info_Hub_Terms.2FAcceptance Info Hub Terms/Acceptance]''' for further instructions. | ||

| + | *'''Membership Application''' You can set your application to require Terms & Conditions/Privacy Policy by going to Memberships> Applications. See '''[https://supportwiki.memberzone.org/Membership_Management#View.2FCreate_your_Membership_Application_Form View/Create Application Form]''' for further instructions. | ||

| + | *'''Exhibitors''': When setting up an event with exhibitors, you can include terms/conditions that must be agreed to. See '''[https://supportwiki.memberzone.org/Event_Management#Setup_Exhibitor_Registration_Page Setup Exhibitor Registration Form]''' for further instructions. | ||

| + | Terms/Conditions can be created "on the fly" when configuring the above, or you may proactively create terms and conditions under Setup: | ||

#Click '''Setup''' in the Navigation Panel. | #Click '''Setup''' in the Navigation Panel. | ||

#Click '''Terms/Conditions''' in the '''Services, Products and Commerce''' section. | #Click '''Terms/Conditions''' in the '''Services, Products and Commerce''' section. | ||

| Line 107: | Line 126: | ||

#Click '''Done'''. | #Click '''Done'''. | ||

| − | ==='''<span style="color:#800080">Setup GrowthZone Pay'''</span>=== | + | ==='''<span style="color:#800080">GrowthZone Pay'''</span>=== |

| + | ---- | ||

| + | Payment processing for associations is a key feature of GrowthZone AMS, allowing easy payment processing directly within the membership management software. Association staff save valuable time and effort by automating previously manual processes and capturing completed payments directly into membership profiles.GZPay is an extension of GrowthZone AMS, which allows you the option to accept payments for online membership applications, event registrations, educational courses, store products, sponsorships, fundraisers and more. | ||

| + | |||

| + | Streamline operations with automatic payments: | ||

| + | |||

| + | *Membership applicants have the option to set up automatic payments during the online application process – this way, renewals are automatic. | ||

| + | *Existing members can set up autopay themselves in the Member Information Center. | ||

| + | *You can automatically charge monthly, quarterly, semi-annual, or annual membership dues on a specific day without having to routinely log into your software or even click a button. | ||

| + | |||

| + | [https://youtu.be/BUPZ_tMfFXg Learn More!] | ||

| + | |||

| + | ===='''<span style="color:#800080">How Does GrowthZone Pay Help My Association?'''</span>==== | ||

| + | ---- | ||

| + | Choose GZPay to help achieve the following objectives: | ||

| + | *Modernization: In today’s world, automatic payment processing is expected. Allow your members to instantly pay for events, dues, and other items with a few clicks. | ||

| + | *Simplification: Access billing data with one password, one portal, and one customer service point of contact. | ||

| + | *Retain Members: Member retention just got easier, now that they can conveniently elect to automate their recurring payments, so they never miss a deadline. | ||

| + | *Process Cashless Payments: With integrated billing, you can process card payments, run single direct charges, process real-time statements, gather bank deposit and transfer reports, and automate invoicing. | ||

| + | *Accept Payments On-the-Go: GZPay’s mobile card reader lets you accept payments at events with no hassle. Simply scan with any mobile device and send an automated receipt via email. | ||

| + | *Integrate: If you have your own payment processor you love, we can integrate with third-party processors like Authorize.net, Infintech, Beanstream, First Data, and PayPal, among others. Curious? Just ask! | ||

| + | *Increase Security: Safely store payment information for convenient retrieval. GZPay uses Stripe for credit card processing, so card data is not stored in your database. All transactions are Secure Socket Layer protected, PCI Service Provider Level 1 compliant, and fully encrypted. | ||

| + | *Save Time: Bank, credit, and debit accounts are charged and deposited to your bank account immediately. You’ll not only save time but receive payments faster than ever! Think of how many hours staff members will save without having to call delinquent members, match payments to invoices, or manually enter card data. | ||

| + | *Save Money: Best of all, you pay one simple rate. There are NO setup, gateway, batch, or statement fees! | ||

| + | *Reduce Error: There is no more manual credit card payment/invoice matching required on your end. Payments are automatically linked with the correct invoices and confirmation emails sent. | ||

| + | *Streamline Operations: Forego the renewal process by allowing membership applicants to autopay. Set up charge notifications for monthly, quarterly, semi-annual, or annual dues collection on a specific day. | ||

| + | |||

| + | ===='''<span style="color:#800080">Configure Gateway Notifications for Disputes/Charge Failures'''</span>==== | ||

| + | ---- | ||

| + | |||

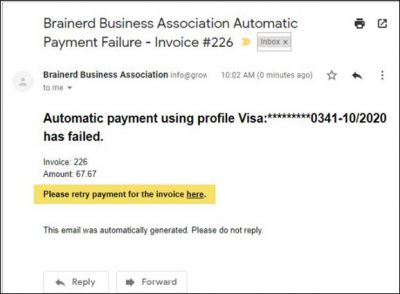

| + | Automated notification may be sent to your staff when a GrowthZone Pay charge fails or when a charge is disputed. | ||

| + | |||

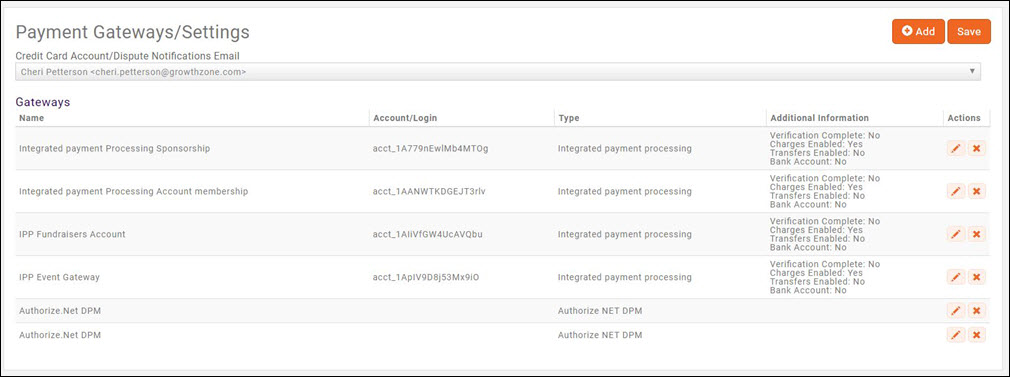

| + | #Click '''Setup''' in the Navigation panel. | ||

| + | #Click '''Payment Gateways''' in the '''Finance''' section. | ||

| + | #:[[File:Gateway Notification.jpg|800px|center]] | ||

| + | #Select the staff member to whom notifications should be sent from the '''Credit Card Account/Dispute Notifications Email''' list. All active staff members will be displayed. | ||

| + | #Click '''Save'''. | ||

| + | |||

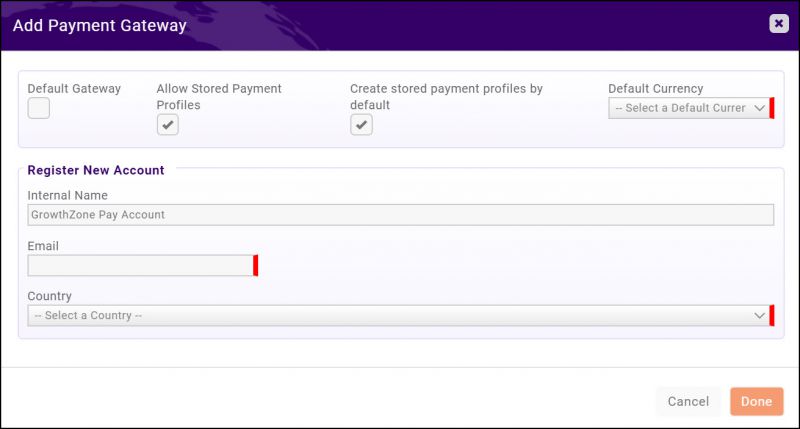

| + | ===='''<span style="color:#800080">Setup GrowthZone Pay (Original)'''</span>==== | ||

---- | ---- | ||

{| class="wikitable" | {| class="wikitable" | ||

| Line 113: | Line 170: | ||

| | | | ||

[[File:Smallest.png|25px]] | [[File:Smallest.png|25px]] | ||

| − | | style="width: 100%"| '''NOTE:''' You may setup and configure your GrowthZone Pay gateway. If you are using a different gateway, contact [mailto:support@growthzone.com support@growthzone.com]for assistance. | + | | style="width: 100%"| '''NOTE:''' You may setup and configure your GrowthZone Pay gateway. If you are using a different gateway, contact [mailto:support@growthzone.com support@growthzone.com] for assistance. Fees are assessed for the use of an alternate gateway. |

|} | |} | ||

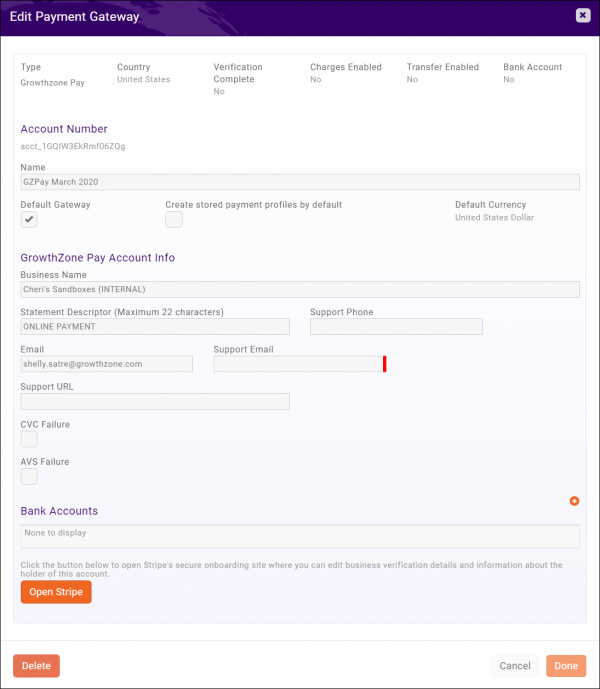

| Line 147: | Line 204: | ||

#:*'''Default Currency''' - this field is populated with your previous choice. It is not modifiable. | #:*'''Default Currency''' - this field is populated with your previous choice. It is not modifiable. | ||

#:*'''Business Name''' - this field is automatically populated with the name of your business. | #:*'''Business Name''' - this field is automatically populated with the name of your business. | ||

| − | #:*'''Statement Descriptor (Maximum 22 characters) ''' - The statement descriptor appears on purchasers statements, so best practice is to enter a descriptor that allows the purchaser to easily identify your organization. Statement descriptors are limited to 22 characters, cannot use the special characters <, >, ', or ", and must not consist solely of numbers. | + | #:*'''Statement Descriptor (Maximum 22 characters) ''' - The statement descriptor appears on purchasers statements, so best practice is to enter a descriptor that allows the purchaser to easily identify your '''organization'''. It is important that it is contains your organization’s name and isn’t generic like “Online payment” or “Thank you”. For Example: ABC Company. Statement descriptors are limited to 22 characters, cannot use the special characters <, >, ', or ", and must not consist solely of numbers. If you make no change, the descriptor will default to the first 22 characters of your organization name. |

#:*'''Support Phone''' - (Optional) Enter a specific phone number responsible for supporting this gateway. | #:*'''Support Phone''' - (Optional) Enter a specific phone number responsible for supporting this gateway. | ||

#:*'''Email''' - this field is populated with your previous choice. You may modify it if needed. | #:*'''Email''' - this field is populated with your previous choice. You may modify it if needed. | ||

| Line 163: | Line 220: | ||

As part of the GrowthZone Pay service, GrowthZone is committed to taking reasonable '''“Know Your Customer”''' steps to assure that customers applying for a payment gateway account are legitimate and not impersonating as an association or chamber for unlawful or harmful purposes. As part of our validation process, once a payment gateway application is submitted, the account requires an additional verification step by GrowthZone. While this verification due diligence is completed, the payment gateway is not yet fully available for processing. Once GrowthZone has completed the verification, the gateway is enabled and transactions can be processed. | As part of the GrowthZone Pay service, GrowthZone is committed to taking reasonable '''“Know Your Customer”''' steps to assure that customers applying for a payment gateway account are legitimate and not impersonating as an association or chamber for unlawful or harmful purposes. As part of our validation process, once a payment gateway application is submitted, the account requires an additional verification step by GrowthZone. While this verification due diligence is completed, the payment gateway is not yet fully available for processing. Once GrowthZone has completed the verification, the gateway is enabled and transactions can be processed. | ||

| − | ===='''<span style="color:#800080">Verify Status of | + | ====='''<span style="color:#800080">Verify Status of GrowthZone Pay (Original) Gateway'''</span>===== |

---- | ---- | ||

| Line 183: | Line 240: | ||

|} | |} | ||

| − | = | + | ====='''<span style="color:#800080">Change GrowthZone Pay (Original) Deposit Account'''</span>===== |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | ===='''<span style="color:#800080">Change GrowthZone Pay Deposit Account'''</span>==== | ||

---- | ---- | ||

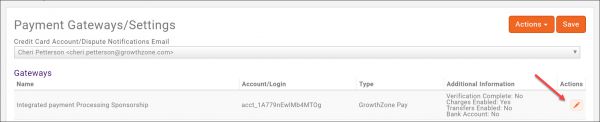

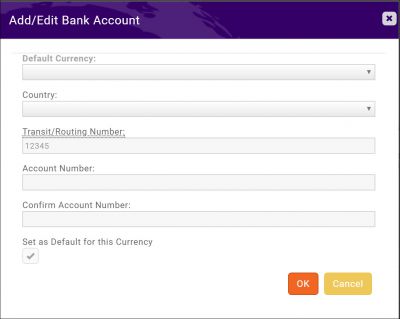

#Select '''Setup''' in the left-hand navigation panel. | #Select '''Setup''' in the left-hand navigation panel. | ||

| Line 208: | Line 254: | ||

#Click the [[File:Cp orange pencil.jpg|25px]] icon '''Actions''' column and verify that the new account has saved. | #Click the [[File:Cp orange pencil.jpg|25px]] icon '''Actions''' column and verify that the new account has saved. | ||

| − | ===='''<span style="color:#800080">Payouts from GrowthZone Pay Credit Card Transactions'''</span>==== | + | ====='''<span style="color:#800080">Payouts from GrowthZone Pay (Original) Credit Card Transactions'''</span>===== |

---- | ---- | ||

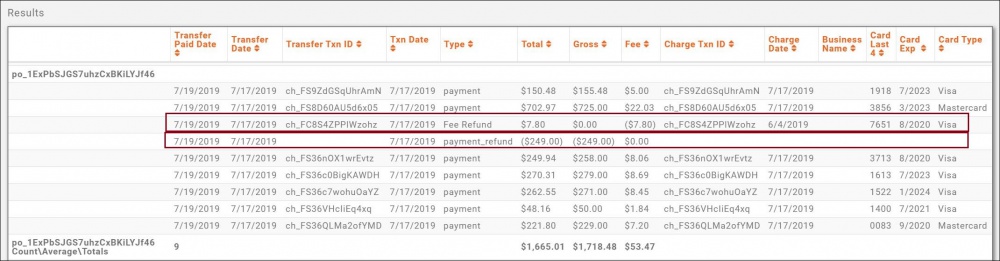

Deposits into the specified bank account from the credit card transactions are typically done on a daily basis. The process may take 2-4 business days to be completed. Stripe will be depositing the net amount of the transaction, which means, you will receive the full transaction amount minus the fees charged by the processor. If you prefer to have deposits made weekly or monthly, please contact GrowthZone Support. Please keep in mind that fees will be taken at the same frequency the deposits are made. If deposits are selected to be made weekly, fees will be taken on a weekly basis. | Deposits into the specified bank account from the credit card transactions are typically done on a daily basis. The process may take 2-4 business days to be completed. Stripe will be depositing the net amount of the transaction, which means, you will receive the full transaction amount minus the fees charged by the processor. If you prefer to have deposits made weekly or monthly, please contact GrowthZone Support. Please keep in mind that fees will be taken at the same frequency the deposits are made. If deposits are selected to be made weekly, fees will be taken on a weekly basis. | ||

| Line 214: | Line 260: | ||

The frequency at which payouts are made is dependent on your country. See full payout details at this [https://stripe.com/docs/payouts#payout-schedule link]. | The frequency at which payouts are made is dependent on your country. See full payout details at this [https://stripe.com/docs/payouts#payout-schedule link]. | ||

| − | ===='''<span style="color:#800080">Is Storing Cards and Bank Accounts with GrowthZone Pay Safe?'''</span>==== | + | ====='''<span style="color:#800080">Is Storing Cards and Bank Accounts with GrowthZone Pay (Original) Safe?'''</span>===== |

---- | ---- | ||

Yes! GrowthZone Pay uses Stripe as the credit card processor. Cards are '''NOT''' stored in your GrowthZone database. | Yes! GrowthZone Pay uses Stripe as the credit card processor. Cards are '''NOT''' stored in your GrowthZone database. | ||

| Line 226: | Line 272: | ||

Click [https://stripe.com/docs/security/stripe here] for further information on Stripe Security. | Click [https://stripe.com/docs/security/stripe here] for further information on Stripe Security. | ||

| − | ===='''<span style="color:#800080"> | + | ====='''<span style="color:#800080">GrowthZone Pay (Original) - what bank accounts for ACH what countries are supported?'''</span>===== |

---- | ---- | ||

United States banks only. | United States banks only. | ||

| + | |||

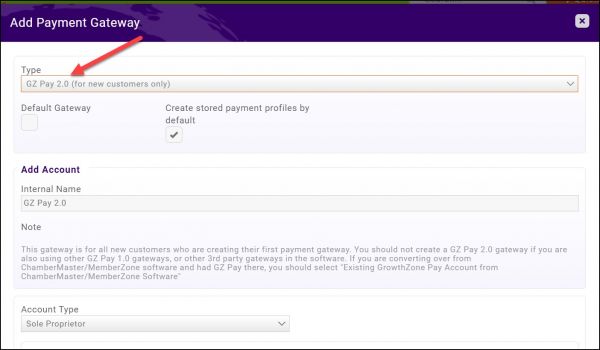

| + | ===='''<span style="color:#800080">Setup GrowthZone Pay 2.0'''</span>==== | ||

| + | ---- | ||

| + | GrowthZone Pay 2.0 allows your contacts to enter their credit card or bank account information into a secured page to pay invoices, event registration, donations, etc. By checking to save this account, users can apply this automatically to recurring fees (e.g. membership) or other one-time purchases. '''IMPORTANT''': GrowthZone Pay 2.0 gateways should only be setup if you are a new customer, if you are an existing GrowthZone Pay customer, and you are adding an additional gateway, you must setup a standard GrowthZone Pay gateway. GrowthZone Pay 2.0 is available to US Customers Only. | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | | | ||

| + | [[File:Smallest.png|25px]] | ||

| + | | style="width: 100%"| '''NOTE:''' You may setup and configure your GrowthZone Pay 2.0 gateway. If you are using a different gateway, contact [mailto:support@growthzone.com support@growthzone.com] for assistance. Fees are assessed for the use of an alternate gateway. | ||

| + | |} | ||

| + | |||

| + | #Click '''Setup''' in the Navigation panel. | ||

| + | #Click '''Payment Gateways''' in the '''Finance''' section. | ||

| + | #Click the '''Actions''' button and select '''Add Other Account'''. | ||

| + | #:[[File:Add 2.0 gateway.jpg|600px|center]] | ||

| + | #On the '''Add Payment Gateway''' screen, configure the following (NOTE: Some fields will vary dependent on the '''Account Type''' you select): | ||

| + | #:*'''Internal Name''' - This name is the name you will see internally for this account. You may have multiple processing accounts, perhaps one for your memberships and one for fundraising. In this event, you would add additional GrowthZone Pay 2.0 gateways for these. This is a way for you to internally recognize with account is used for which transaction. | ||

| + | #:*'''Default Gateway''' - Select this check-box if this will be used as your default gateway. | ||

| + | #:*'''Account Type''': Choose the appropriate type based on your business structure. The identifying fields for the account owner/responsible individual/signer will be displayed. These fields, and which are required, will vary dependent on the Account Type you have selected. These fields will include contact information for the account and identifying information such as date of birth and social security information of the account holder. Personal information is required to validate that the account is valid and not fraudulent. | ||

| + | #:*'''Entity Information''': These fields will also vary dependent on the Account Type selected. If this information is the same as the account owner/responsible individual/signer information, you can simply select '''Copy from Above'''. | ||

| + | #:*'''Basic Information''': | ||

| + | #::*'''Statement Descriptor''': The statement descriptor appears on purchasers statements, so best practice is to enter a descriptor that allows the purchaser to easily identify your '''organization'''. It is important that it is contains your organization’s name and isn’t generic like “Online payment” or “Thank you”. For Example: ABC Company. Statement descriptors are limited to 22 characters, cannot use the special characters <, >, ', or ", and must not consist solely of numbers. If you make no change, the descriptor will default to the first 22 characters of your organization name. | ||

| + | #::*'''Merchant Category Code''': Merchant category codes (MCCs), or merchant classification codes, are a four-digit identifier that describes the type of goods or services a business provides. The list is populated with the typical codes needed by GrowthZone users. If the appropriate code is not available for your organization, contact our support team. | ||

| + | #::*'''Currently Accept Credit Cards''': Check this box to indicate that you currently accept credit cards. When selected, the '''Annual Credit Card Sales''' text box will be displayed and must be populated. | ||

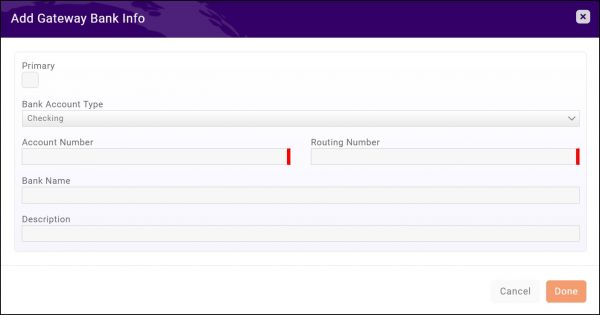

| + | #:*'''Bank Information''': Click the [[File:orange plus icon.jpg]] icon to add bank information. | ||

| + | #:[[File:Add gateway bank info 2021.jpg|600px|center]] | ||

| + | #:**Enter banking account information | ||

| + | #Click '''Done''' | ||

| + | #Click '''Done''' to save the payment gateway. | ||

| + | |||

| + | ====='''<span style="color:#800080">GZ Pay 2.0 Payout Schedule'''</span>===== | ||

| + | ---- | ||

| + | SEE '''[https://helpdesk.growthzone.com/home THE NEW GROWTHZONE KNOWLEDGE BASE]''' FOR UPDATED INFORMATION! | ||

| + | |||

| + | Transfers/Deposit to the bank will have an initial 5 business day hold after the first charge before the first payout. Going forward it will be daily except for weekends and holidays. | ||

| + | |||

| + | Payouts of your available account balance are made daily except holidays and weekends and typically contain payments processed two business days prior. For example, payments received on a Tuesday before 9:30 pm ET are typically paid out on Thursday, and payments received on a Friday before 9:30 pm ET are typically paid out on Tuesday. | ||

| + | |||

| + | Payrix will be depositing the net amount of the transaction, which means, you will receive the full transaction amount minus the fees charged by the processor. | ||

| + | |||

| + | ====='''<span style="color:#800080">Is Storing Credit Cards with GrowthZone Pay 2.0 safe?'''</span>===== | ||

| + | ---- | ||

| + | Yes! GrowthZone Pay 2.0 uses Payrix as the Credit Card Processor. Credit cards are NOT stored in the GrowthZone database, they are securely stored by Payrix. Read more about Payrix PCI compliance [https://payrix.atlassian.net/servicedesk/customer/portal/5/article/56000580?src=-1552018672 here]. | ||

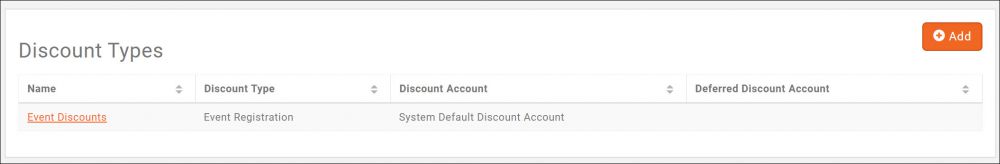

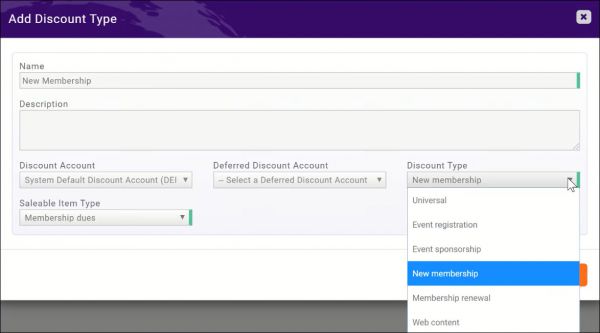

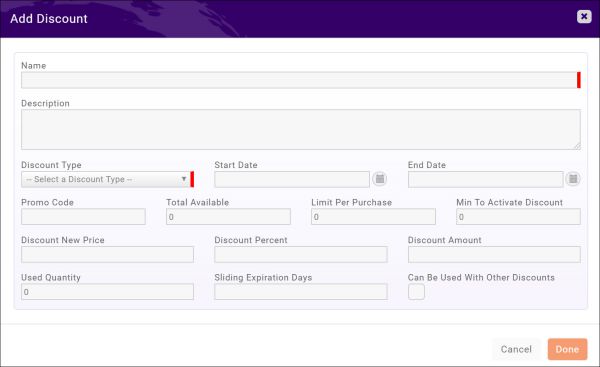

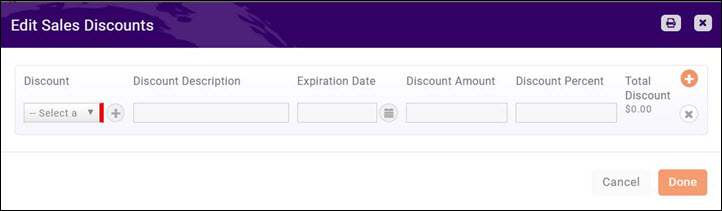

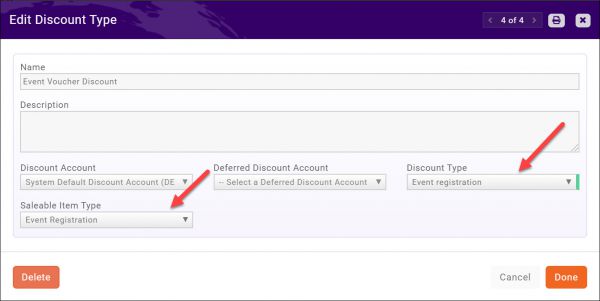

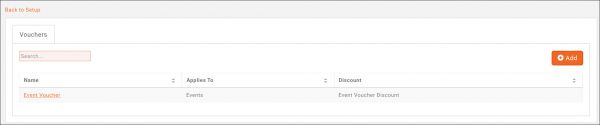

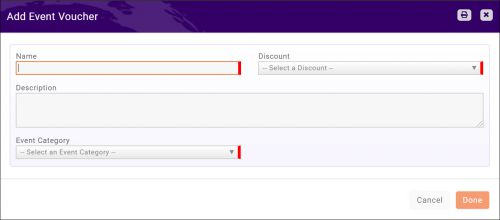

==='''<span style="color:#800080">Setup Discounting'''</span>=== | ==='''<span style="color:#800080">Setup Discounting'''</span>=== | ||

| Line 400: | Line 490: | ||

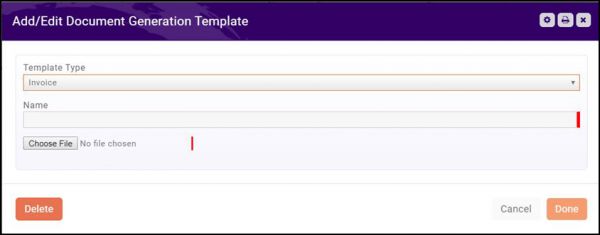

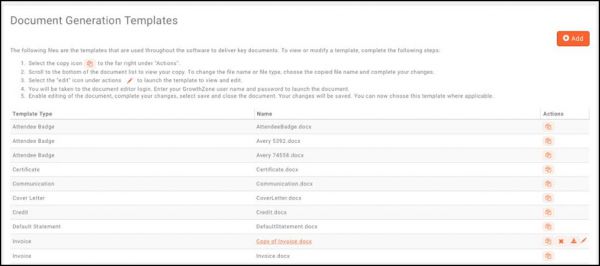

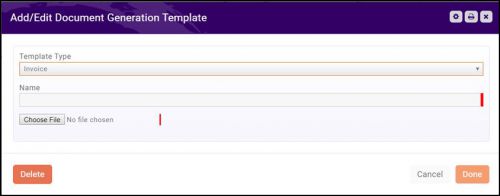

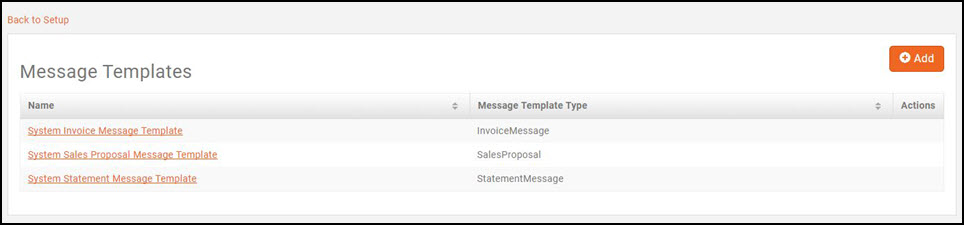

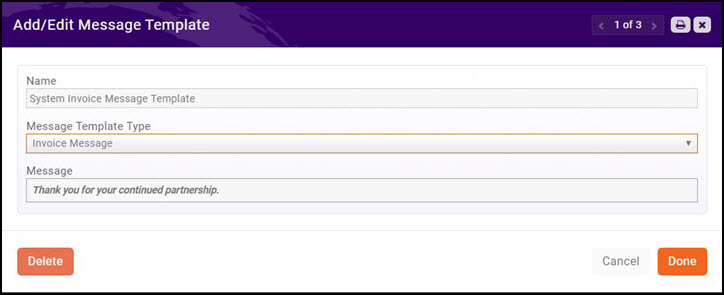

#Click '''Done'''. You will now be able to choose this template where applicable. | #Click '''Done'''. You will now be able to choose this template where applicable. | ||

| − | ====='''<span style="color:#800080">View/Modify Invoice Template (MAC Instructions)'''</span> | + | {| class="wikitable" |

| + | |- | ||

| + | | | ||

| + | [[File:One Row.png|25px]] | ||

| + | | style="width: 100%"| '''Did you know...''' When Upcoming Billing is run, to generate invoices for recurring fees, the invoice date will reflect the '''Next Bill Date'''. You have the option to display the date that the invoice was created, rather than the next bill date. If you wish to include the created date on your invoices, use the '''UFPurchaseCreatedDate''' merge field. See '''[[Billing#Enable_Option_to_Display_Invoice_Created_Date|Enable Option to Display Invoice Created Date]]''' for further information. | ||

| + | |} | ||

| + | |||

| + | ===='''<span style="color:#800080">View/Modify Invoice Template (MAC Instructions)'''</span>==== | ||

---- | ---- | ||

#Click '''Setup''' in the Navigation Panel. | #Click '''Setup''' in the Navigation Panel. | ||

| Line 441: | Line 538: | ||

#Click '''Setup''' in the Navigation panel. | #Click '''Setup''' in the Navigation panel. | ||

#Click '''General Settings''' in the '''Finance''' section. | #Click '''General Settings''' in the '''Finance''' section. | ||

| − | #Click the pencil icon below '''Logo for Invoices and Statements'''. '''NOTE:''' the icon is visible when you | + | #Click the pencil icon below '''Logo for Invoices and Statements'''. '''NOTE:''' the pencil icon is visible when you hover the mouse below the "Logo for Invoices and Statements" text. '''Recommended size is 500 pixels wide by 150 pixels tall.''' |

#Click '''Upload''' to browse to the location of your logo. | #Click '''Upload''' to browse to the location of your logo. | ||

#Click '''Open'''. | #Click '''Open'''. | ||

#Crop the image as needed, then click '''Crop & Save'''. The logo will now be displayed on all of your invoices and statements. | #Crop the image as needed, then click '''Crop & Save'''. The logo will now be displayed on all of your invoices and statements. | ||

#For each of the listed accounts, select your default. This default will automatically be applied when you create goods & services, but you will be able to over-ride if needed. | #For each of the listed accounts, select your default. This default will automatically be applied when you create goods & services, but you will be able to over-ride if needed. | ||

| − | #Select your '''Default Invoice Template'''. This is the template that will be used for all of your invoicing, but may be over-ridden. | + | #Select your '''Default Invoice Template'''. This is the template that will be used for all of your invoicing, but may be over-ridden in several areas: |

| + | #:*You can apply a specific invoice to a good/service item: '''[[Billing#Setting_Goods.2FServices|Set Up Goods/Services]]''' | ||

| + | #:*You can apply a specific invoice template to a membership type: '''[[Membership_Management#Add_Pricing_to_a_Membership_Type|Add Pricing to A Membership Type]]''' | ||

| + | #:*You can apply a specific invoice template when delivering invoices: '''[[Billing#Deliver_Invoices_via_E-mail|Deliver Invoices via Email]]''' and '''[[Billing#Print_Invoices_for_Delivery|Print Invoices for Delivery]]''' | ||

| + | #:*You can apply a specific invoice template when re-delivering invoices: '''[[Billing#Re-deliver_Past_Due_Invoices_via_Email|Re-Deliver Past Due Invoices via Email]]''' and '''[[Billing#Re-deliver_Past_Due_Invoices_via_Print|Re-Deliver Past Due Invoices via Print]]''' | ||

| + | #:Refer to '''[[Billing#Setting_Up_Your_Invoice_Template|Setting Up Your Invoice Template]]''' for details on setting up a template. | ||

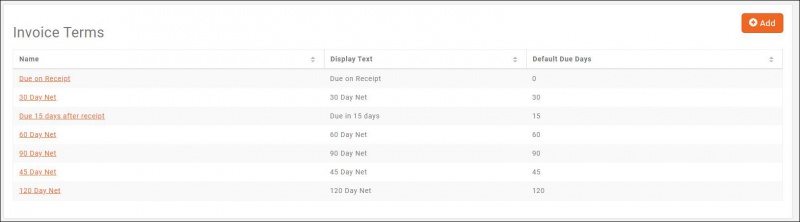

#Select your '''Default Invoice Terms'''. Select the terms you wish to use by default. | #Select your '''Default Invoice Terms'''. Select the terms you wish to use by default. | ||

#'''Transaction Deletion''' - This setting determines the number of days in which an invoice or payment may be deleted. Best practice is to limit the transaction window, as once an invoice is deleted, it is completed removed from your view which could cause issues with audits and/or reconciling. Additionally, there is risk that an invoice deleted from the database may already have been posted to your general accounting software. This would cause the two systems to become out of sync. The system provides a '''Void''' option that can be used instead of deleting. A void will create a counter entry. | #'''Transaction Deletion''' - This setting determines the number of days in which an invoice or payment may be deleted. Best practice is to limit the transaction window, as once an invoice is deleted, it is completed removed from your view which could cause issues with audits and/or reconciling. Additionally, there is risk that an invoice deleted from the database may already have been posted to your general accounting software. This would cause the two systems to become out of sync. The system provides a '''Void''' option that can be used instead of deleting. A void will create a counter entry. | ||

| Line 465: | Line 567: | ||

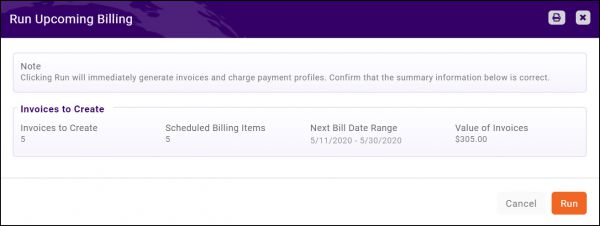

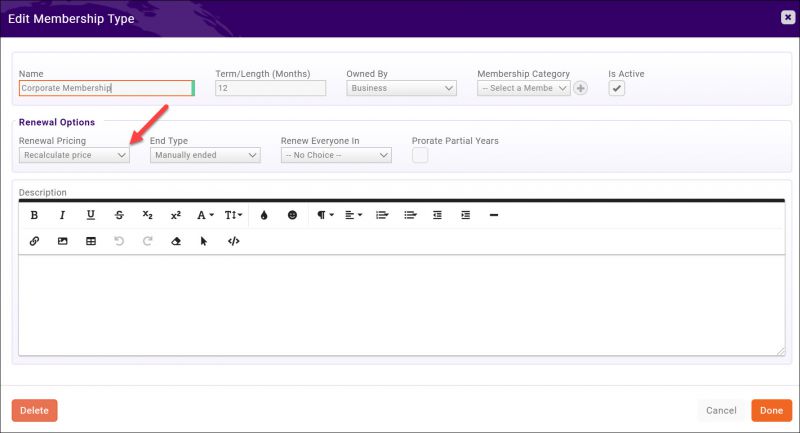

===='''<span style="color:#800080">Setup System to Automatically Generate Invoices for Scheduled Billing'''</span>==== | ===='''<span style="color:#800080">Setup System to Automatically Generate Invoices for Scheduled Billing'''</span>==== | ||

---- | ---- | ||

| − | You can configure your system to automatically create invoices for scheduled fees. If enabled, the system will create invoices X numbers of days prior to the next bill date. | + | You can configure your system to automatically create invoices for scheduled fees. If enabled, the system will create invoices X numbers of days prior to the next bill date. If you choose not to enabled Automated Billing, you will manually generated the invoices from the Billing module '''Upcoming Billing''' tab. See '''[[Billing#Generating_Invoices_for_Upcoming_.28Recurring.29_Billing|Generating Invoices for Upcoming (Recurring) Billing]]''' for further information. |

#Click '''Setup''' in the left-hand navigation panel. | #Click '''Setup''' in the left-hand navigation panel. | ||

| Line 478: | Line 580: | ||

| | | | ||

[[File:Smallest.png|25px]] | [[File:Smallest.png|25px]] | ||

| − | | style="width: 100%"| '''NOTE | + | | style="width: 100%"| '''NOTE''': If the contact has a stored profile, then the invoice is automatically created on the '''Next Bill Date''' and the payment profile is charged. |

|} | |} | ||

| − | ===='''<span style="color:#800080">Disable Automated Scheduled Billing'''</span>==== | + | ===='''<span style="color:#800080">Configure System to Automatically Email Invoices for Scheduled Billing'''</span>==== |

| + | ---- | ||

| + | '''***COMING SOON***''' | ||

| + | Save time by configuring your system to automatically deliver, via email, your renewal invoices. | ||

| + | #Click '''Setup''' in the left-hand navigation panel. | ||

| + | #Click '''General Settings''' in the '''Finance''' section. | ||

| + | #:[[File:Automatic invoice emails 2020.jpg|600px|center]] | ||

| + | #In the '''Automatic Invoice Emails''' section: | ||

| + | #*Enable the '''Enable Automatic Invoice Emails''' setting. | ||

| + | #*Select the communication '''Template''' you wish to use for the email. | ||

| + | #Click '''Save'''. | ||

| + | |||

| + | '''How it Works''' | ||

| + | :When this setting is enabled, if '''Use Automated Billing''' is enabled (see '''[https://supportwiki.memberzone.org/Billing#Setup_System_to_Automatically_Generate_Invoices_for_Scheduled_Billing Setup System to Automatically Generate Invoices for Scheduled Billing]''') when the invoices are generated, the system will automatically send out the invoices using the email template selected. '''NOTE:''' If an email address is not available, the system will place these invoices on the '''Pending Delivery''' tab. | ||

| + | :'''OR''' | ||

| + | :If invoices are manually generated from the '''Upcoming Billing''' tab (see '''[https://supportwiki.memberzone.org/Billing#Manage_Invoices_for_Upcoming_.28Recurring.29_Billing Manage Invoices for Upcoming Billing]'''), the system will prompt you to choose whether you wish to deliver your invoices. If you choose to send, the system will automatically send out the invoices using the email template selected. '''NOTE''': If an email address is not available, the system will place these invoices on the '''Pending Delivery''' tab. | ||

| + | |||

| + | ====='''<span style="color:#800080">Disable Automated Scheduled Billing'''</span>===== | ||

---- | ---- | ||

#Click '''Setup''' in the left-hand navigation panel. | #Click '''Setup''' in the left-hand navigation panel. | ||

| Line 488: | Line 607: | ||

#Click '''Done'''. | #Click '''Done'''. | ||

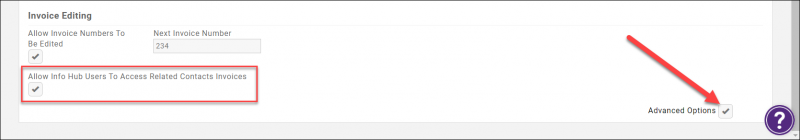

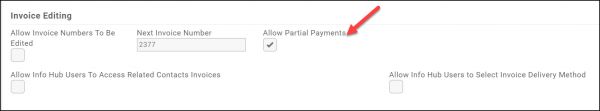

| − | ==='''<span style="color:#800080"> | + | ===='''<span style="color:#800080">Prevent Members from Making Partial Payments'''</span>==== |

---- | ---- | ||

| + | At times, you members may wish to "cherry pick" the items they are paying for on an invoice, and make a partial payment. When a partial payment is made, it will be applied from smallest line item to largest. | ||

| − | + | If you do not wish to allow partial payments: | |

| + | #Click '''Setup''' in the left-hand navigation panel. | ||

| + | #Click '''General Settings''' in the '''Finance''' section. | ||

| + | #:[[File:Allow partial payments 2020.jpg|600px|center]] | ||

| + | #In the '''Invoice Editing''' section, deselect the '''Allow Partial Payments''' check-box. | ||

| + | #Click '''Done'''. | ||

| + | |||

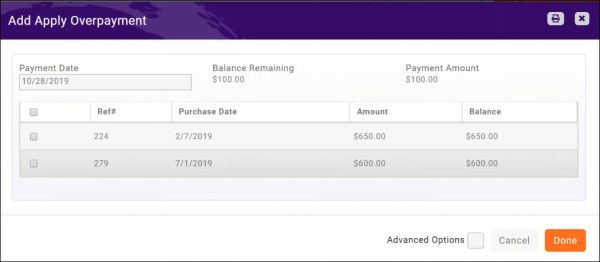

| + | ===='''<span style="color:#800080">Configure System to Auto-apply Credits/Overpayments'''</span>==== | ||

| + | ---- | ||

| − | #Click '''Setup''' in the | + | If you enable '''Auto-Apply Credits to Newly Created Invoices''' under your Finance '''General Settings''' over-payments will automatically be applied to newly created invoices. |

| − | #Click ''' | + | #Click '''Setup''' in the left-hand navigation panel. |

| − | #Click | + | #Click '''General Settings''' in the '''Finance''' section. |

| − | + | #In the '''Automated Scheduled Billing ''' section, select '''Auto-Apply Credits to Newly Created Invoices'''. | |

| − | + | #Click '''Done'''. | |

| − | + | ||

| − | + | {| class="wikitable" | |

| − | + | |- | |

| − | + | | | |

| − | + | [[File:One Row.png|25px]] | |

| − | # | + | | style="width: 100%"| '''NOTE:''' The Auto-apply function will only impact future invoices, not existing invoices. |

| − | # | + | |} |

| − | # | + | ===='''<span style="color:#800080">Enable Option to Display Invoice Created Date'''</span>==== |

| − | # | + | ---- |

| − | + | By design, when invoices are created for recurring billing, the invoice date reflects the '''Next Bill Date'''. For example, if the next bill date is January 1st, this date will show as the invoice date, regardless of when the invoice was created. If you are running and delivering your invoices several months ahead of the next bill date, you may wish to display the invoice created date rather than the invoice date. This will display in multiple locations: | |

| − | # | + | *On the "My Billing" tab in the Info Hub |

| − | + | *On the invoice payment page (accessible from the pay online link on PDF or .doc invoices) | |

| − | # | + | *On invoices and statement, if you have included the invoice created date merge field. To display this field on invoices, use the merge field '''UFPurchaseCreatedDate'''. |

| − | # | + | This option is enabled under the '''Setup''' > '''Finance''' > '''General Settings''': |

| − | + | #Click '''Setup''' in the left-hand navigation panel. | |

| − | # | + | #Click '''General Settings''' in the '''Finance''' section. |

| − | # | + | #Enable '''Show invoice creation date instead of invoice date'''. |

| − | # | + | #Click '''Save'''. |

| − | + | ||

| − | #:: | + | ===='''<span style="color:#800080">Configure Payment Terms & Conditions'''</span>==== |

| − | # | + | ---- |

| − | #: | + | If you wish to display payment terms, such as your refund policy, in all places where payments are collected: |

| − | # | + | #Select Setup in the left-hand navigation panel. |

| − | + | #Click '''General Settings''' in the '''Finance''' section. | |

| − | # | + | #:[[File:Payment terms and conditions.jpg|600px|center]] |

| − | + | #Enable the '''Payment Terms Visible''' check-box. | |

| − | # Click ''' | + | #'''Payment Terms Title''' Enter your terminology for the terms, for example "Payment Terms" or "Refund Policy" |

| + | #'''Payment Term Summary''': This verbiage will display on the payment page. | ||

| + | #'''Payment Terms of Use''': (Optional) For a lengthy policy, you can choose to select previously created '''terms of use''' or create new. '''Read Full Policy''' will be displayed allowing the payor to view. | ||

| + | #Click '''Done'''. | ||

| + | |||

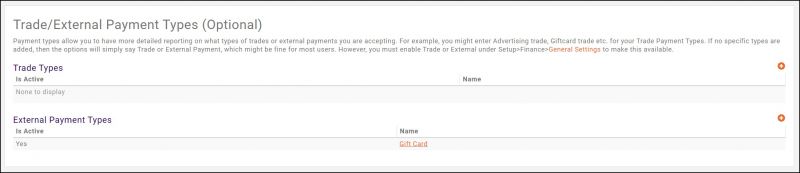

| + | ===='''<span style="color:#800080">Setup Trade & External Payment Types'''</span>==== | ||

| + | ---- | ||

| + | Payment types allow you to have more detailed reporting on what types of trades or external payments you are accepting. For example, you might enter Advertising trade, Giftcard trade etc. for your Trade Payment Types. Or, if you are using an outside credit card processor, you may have an external type called Square. The system provides two default types. If you do not create specific types, options available will simply be Trade or External Payment, which might be fine for most users. To use these payment types you must enable Trade or External under '''Setup>Finance>General Settings'''. | ||

| + | <br> | ||

| + | Setting you Trade & External Payment Types is a two step process: | ||

| + | #Create your Trade & External Payment Types | ||

| + | #Enable Trade & External Payment Types | ||

| + | |||

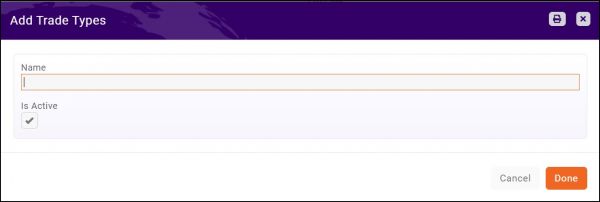

| + | '''Create your Trade & External Payment Types''' | ||

| + | #Select '''Setup''' in the left-hand navigation panel. | ||

| + | #Select '''Trade/External Payment Types''' in the '''Finance''' section. A list of payment types you have currently setup for your organization will be displayed. | ||

| + | #:[[File:Payment types 2021.jpg|800px|center]] | ||

| + | #Click the [[File:orange plus icon.jpg]] icon for the desired payment type. | ||

| + | #:[[File:Add trade type 2021.jpg|600px|center]] | ||

| + | #Enter a '''Name''' for the payment type. This is the name that will be available to you for selection when accepting payments. | ||

| + | #Click '''Done'''. | ||

| + | You may add as many payment types as needed to support your business processes. | ||

| + | '''Enable Trade & External Payment Types''' | ||

| + | #Click '''Setup''' in the left-hand navigation panel. | ||

| + | #Click '''General Settings''' in the '''Finance''' section. | ||

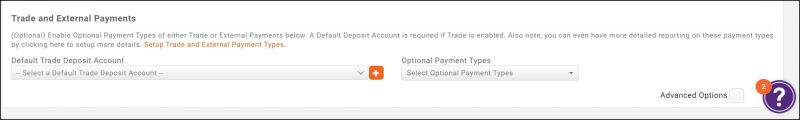

| + | #:[[File:Trade and External Payments 2021.jpg|800px|center]] | ||

| + | #Select the appropriate '''Default Trade Deposit Account'''. When processing a payment, the system must understand which account should be debited. This will be used by the system as the default if an alternate account is not specified when processing the goods/service. | ||

| + | #Select the '''Optional Payment Types''' you wish to enable in your system. | ||

| + | #Click '''Save'''. | ||

| − | + | ==='''<span style="color:#800080">Setting Up Goods/Services'''</span>=== | |

---- | ---- | ||

| − | + | Goods and Services allow you to define the “products” for the memberships, event registrations, sponsorships, etc. you provide. Upon initial setup of the system you will add high level categories of the items that you offer. Additional good/services may be added as your business requires. | |

| − | |||

| − | |||

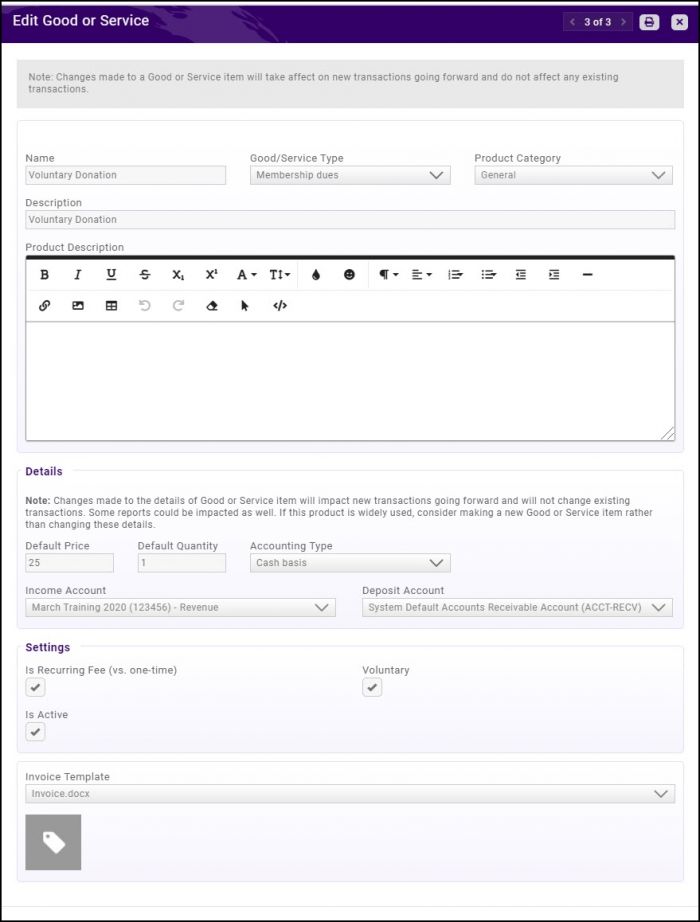

| + | ==='''<span style="color:#800080">Setup Standard Goods/Services'''</span>=== | ||

| + | ---- | ||

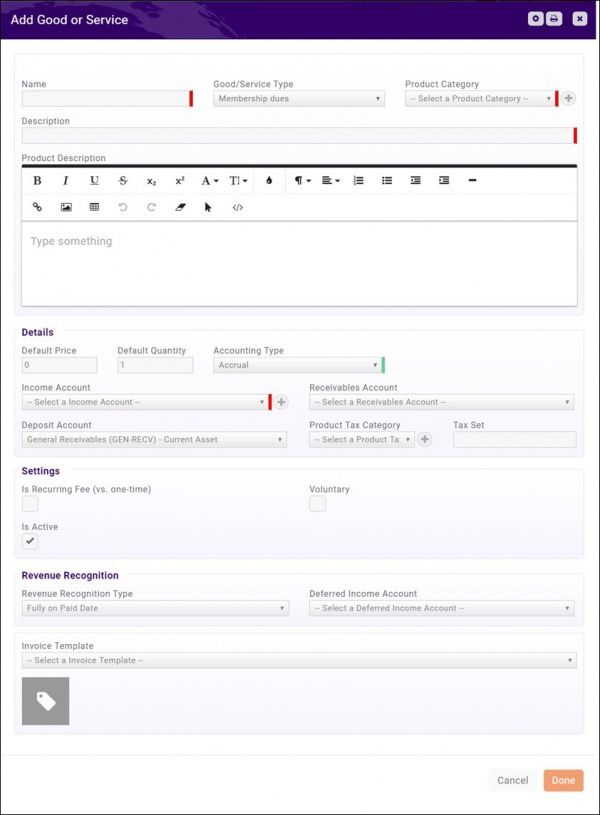

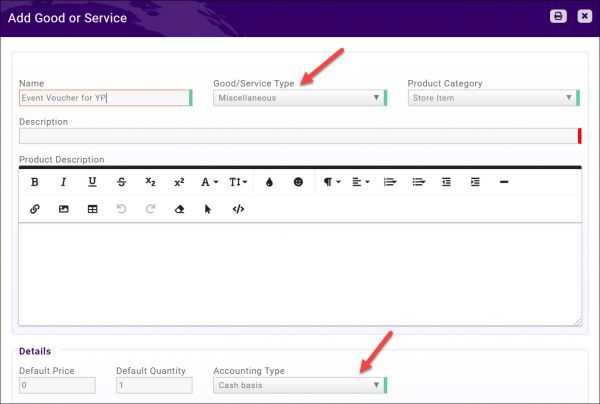

#Click '''Setup''' in the Navigation panel. | #Click '''Setup''' in the Navigation panel. | ||

#Click '''Goods/Services''' in the '''Services, Products and Commerce''' section. A list of Goods/Services currently configured in your system will be displayed. | #Click '''Goods/Services''' in the '''Services, Products and Commerce''' section. A list of Goods/Services currently configured in your system will be displayed. | ||

#Click the '''New''' button. | #Click the '''New''' button. | ||

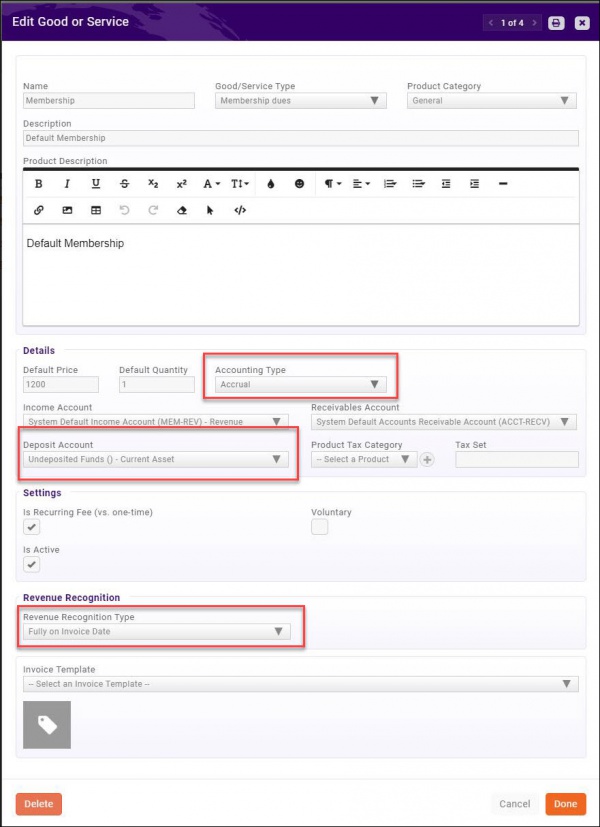

| − | #:[[File:Add | + | #:[[File:Add Goods Service.jpg|600px|center]] |

#On the '''Add/Edit Good or Service''' screen, configure the following: | #On the '''Add/Edit Good or Service''' screen, configure the following: | ||

#:*'''Name''' - Provide a name for the good/service. This will be displayed when you are selecting goods or services. | #:*'''Name''' - Provide a name for the good/service. This will be displayed when you are selecting goods or services. | ||

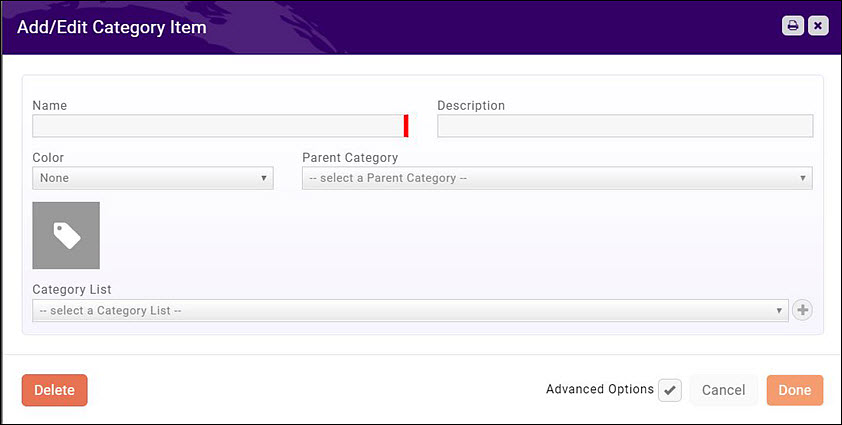

| − | #:*'''Good/Service Type''' - Select | + | #:*'''Good/Service Type''' - Select a type from the drop-down list. Type is used for filtering and reporting. |

#:*'''Product Category''' - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the '''+''' sign. | #:*'''Product Category''' - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the '''+''' sign. | ||

#:[[File:Add Edit Category Item.jpg|center]] | #:[[File:Add Edit Category Item.jpg|center]] | ||

| Line 548: | Line 704: | ||

#:*'''Description''' - Enter a description of the good/service. This description is displayed in the Goods/Services list. | #:*'''Description''' - Enter a description of the good/service. This description is displayed in the Goods/Services list. | ||

#:*'''Product Description''' - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description. | #:*'''Product Description''' - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description. | ||

| − | |||

#:*'''Default Price''' - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service. | #:*'''Default Price''' - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service. | ||

#:*'''Default Quantity''' - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service. | #:*'''Default Quantity''' - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service. | ||

| − | #:*''' | + | #:*'''Accounting Type''' - Select either '''Cash''' or '''Accrual'''. If '''Accrual''' is selected, the '''Revenue Recognition Type''' drop-down list will be displayed at the bottom of the screen. This is the account that is used to "hold" revenue throughout the recognition period. |

| − | + | #:*'''Income Account''' - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the '''+''' sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements. This is the account the will be credited when this goods & service is invoiced. | |

| − | + | #:*'''Receivables Account''': Select the accounts receivable account for this good/service. When using accrual basis this is the A/R account that will be used to "hold" the revenue until payment is received. The drop-down list will be populated with the receivables account configured in your Chart of Accounts. This is the account that will be debited when this goods & service is invoiced. | |

| − | #:*'''Income Account''' - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the '''+''' sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements. | + | #:*'''Deferred Income Account''': Select the deferred income account for this good/service. If using accrual accounting. The drop-down list will be populated with the deferred income accounts configured in you Chart of Accounts. If you have chosen to defer the revenue for this event to a specific point in time, the revenue will be held in the deferred income account until that point in time. |

| − | #:*'''Receivables Account''' | ||

| − | #:*'''Deferred Income Account''' | ||

#:*'''Deposit Account''' - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts. | #:*'''Deposit Account''' - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts. | ||

| − | #:*'''Default Revenue Recognition Months''' - | + | #:*'''Default Revenue Recognition Months''' - If the revenue for this good/service will be recognized over a period of time, enter the default number of months over which the revenue will be recognized. |

| + | #:*'''Voluntary''' - Select this check-box if the fees for this good/service are voluntary. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount). | ||

#::'''Note:''' When creating a voluntary fee, you must select '''Membership''' as the '''Goods/Services''' type. Additionally, when the '''Voluntary''' check box is selected, the '''Accounting Type''' will automatically be set to '''Cash''' and the '''Revenue Recognition Type''' will be set to '''Fully on Paid Date'''. | #::'''Note:''' When creating a voluntary fee, you must select '''Membership''' as the '''Goods/Services''' type. Additionally, when the '''Voluntary''' check box is selected, the '''Accounting Type''' will automatically be set to '''Cash''' and the '''Revenue Recognition Type''' will be set to '''Fully on Paid Date'''. | ||

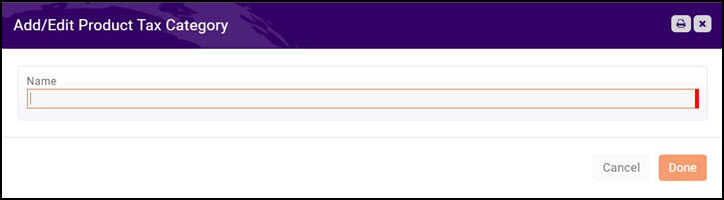

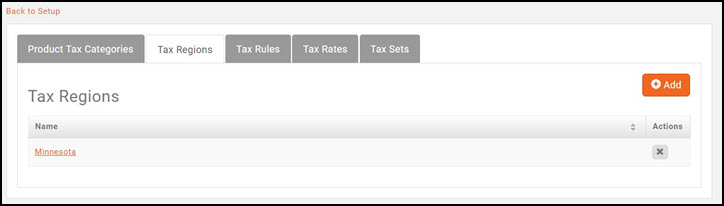

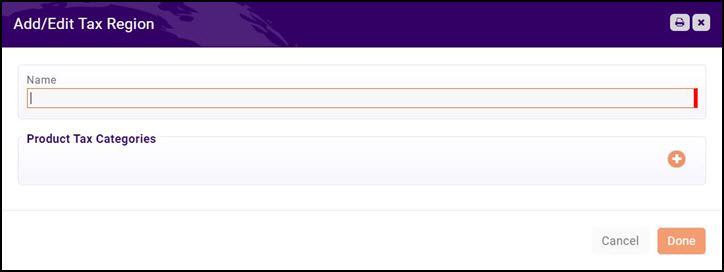

#:*'''Product Tax Category''' - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the '''+''' button. | #:*'''Product Tax Category''' - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the '''+''' button. | ||

#:*'''Tax Set''' - If this good/service is taxable, select the appropriate tax set. | #:*'''Tax Set''' - If this good/service is taxable, select the appropriate tax set. | ||

| − | #:*'''Is Recurring Fee (vs. one-time)''' - Select the | + | #:*'''Is Recurring Fee (vs. one-time)''' - Select this check-box if this is a recurring fee. Your membership dues, for example, are recurring fees. |

| + | #:*'''Revenue Recognition''' - From the '''Revenue Recognition Type''' select how you will recognize the revenue for this good/service. For example, if this is an event related fee, and you wish to defer revenue recognition until the start date of the event, you would select '''Fully on Event Start Date'''. '''NOTE:''' This option is only displayed if you have selected '''Accrual''' as '''Accounting Type''' for this goods/service. | ||

#:*'''Invoice Template''' - Select the invoice template to be used for this good/service. | #:*'''Invoice Template''' - Select the invoice template to be used for this good/service. | ||

#:*'''Is Active''' - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service. | #:*'''Is Active''' - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service. | ||

| − | # Click '''Done''' to save the new | + | # Click '''Done''' to save the new good/service. |

| − | + | ===='''<span style="color:#800080">Accrual Accounting in GrowthZone'''</span>==== | |

| − | + | ---- | |

| − | + | When setting up your goods/services you can elect to use accrual accounting. If you are not certain which accounting methodology you are using, discuss with your accountant. | |

| − | ='''<span style="color:#800080"> | + | Using Accrual Basis, at the goods/service level, you will define, the various accounts to be used: |

| + | *'''Income (Revenue) Account''': This is the revenue account that will be credited based on your revenue recognition settings. | ||

| + | *'''A/R Account''': This is the asset account that represents money due to your organization and will be credited when an invoice is created. When payment is received, this account is debited. The timing of this debit is depended on the Recognition Option set for the goods/service. | ||

| + | *'''Deferred Revenue Account''': This is a liability account to “hold” the revenue until it is to be recognized. Based on the recognition option configured for the goods/service, the account will be credited when the invoice is created and debited on the appropriate recognition day. | ||

| + | *'''Deposit Account''': This current asset account is debited when payment is received for invoices. | ||

| + | <br>These accounts will be debited and credited based on the revenue recognition type you choose. A debit is an accounting entry that either increases an asset or expense account or decreases a liability or equity account. ... A credit is an accounting entry that either increases a liability or equity account or decreases an asset or expense account. It is positioned to the right in an accounting entry.</br> | ||

| + | <br>Following are the recognition types that may be configured for your goods/services.</br> | ||

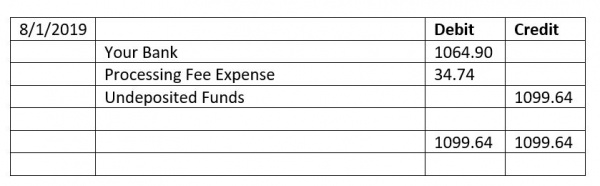

| + | ====='''<span style="color:#800080">Fully on Invoice Date'''</span>===== | ||

| + | ---- | ||

| + | If this option is selected, when invoiced, your revenue account is credited the sale immediately and the A/R account is debited. When the invoice is paid, the A/R account is credited, and your deposit account is debited. | ||

| + | <br>'''Example''':</br> | ||

| + | $1200.00 Membership Dues invoice created on 8/3 | ||

| + | *Revenue account is credited $1200.00 | ||

| + | *A/R account is debited $1200.00 | ||

| + | [[File:Fully on Invoice Date.jpg|1000px|center]] | ||

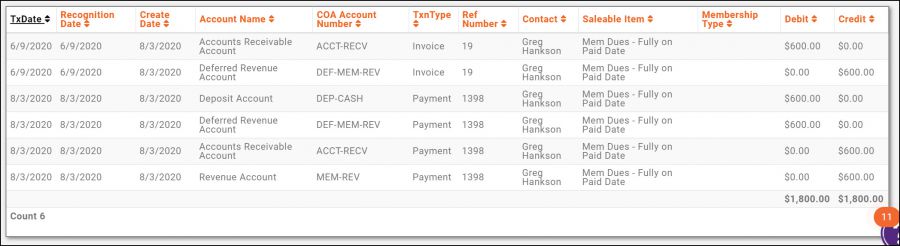

| + | ====='''<span style="color:#800080">Fully on Paid Date'''</span>===== | ||

| + | ---- | ||

| + | If '''Fully on Paid Date''' is selected, revenue will be credited to your income account when the invoice is paid. The Deferred A/R account will be credited to “hold” the funds until the paid date and the A/R account will be debited. On the day the invoice is paid, the Deferred A/R account will be debited, and the income account will be credited. | ||

| + | <br>'''Example''':</br> | ||

| + | An invoice, for $600.00, was created on 7/7. The invoice is paid on 8/3. | ||

| + | *On 7/7: | ||

| + | **Deferred Revenue account is credited $600.00 | ||

| + | **A/R account is debited $600.00 | ||

| + | *On Paid Date 8/3: | ||

| + | **Deferred Revenue account is debited $600.00 | ||

| + | **A/R account is credited $600.00 | ||

| + | **Revenue account is credited $600.00 | ||

| + | **Deposit account is debited $600.00 | ||

| + | [[File:Fully on Paid Date 2020.jpg|900px|center]] | ||

| + | ====='''<span style="color:#800080">Fully on Invoice Due Date'''</span>===== | ||

| + | ---- | ||

| + | If '''Fully on Invoice Due Date''' is selected, revenue will not be credited to the assigned revenue account until the due date. The Deferred A/R account will be credited to “hold” the funds until the due date and the A/R account will be debited. On the day the invoice is paid, the Deferred A/R account will be debited, and the income account will be credited to the revenue account. | ||

| + | <br> | ||

| + | '''Example''':</br> | ||

| + | Invoice for $400.00 is dated 7/27. The due date is 8/1. | ||

| + | *On 7/27: | ||

| + | **Accounts Receivable debited $400.00 | ||

| + | **Deferred Revenue credited $400.00 | ||

| + | *On Due Date (8/1) | ||

| + | **Accounts Receivable is credited $400.00 | ||

| + | **Deferred Revenue is debited $400.00 | ||

| + | *A payment at any time will debit Accounts Receivable and credit the Deposit account | ||

| + | [[File:Fully on Invoice Due Date 2020.jpg|800px|center]] | ||

| + | ====='''<span style="color:#800080">Fully on Event Start Date'''</span>===== | ||

| + | ---- | ||

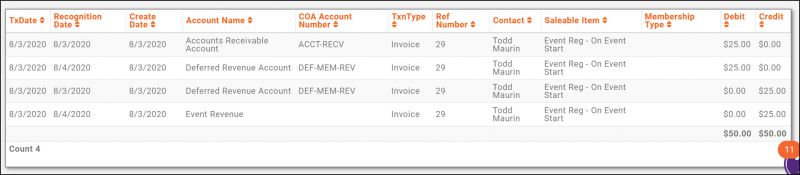

| + | If '''Fully on Event Start Date''' is selected, revenue will not be credited to the assigned revenue account until the day of the event. The Deferred Revenue account will be credited to “hold” the funds until the event start date and the A/R account will be debited. On the day the event starts, the Deferred A/R account will be debited, and the income will be credited to the event revenue account. | ||

| + | <br>'''Example'''</br> | ||

| + | Event registration invoice for $25.00 is created on 8/3. Event begins on 8/4 | ||

| + | *On 8/3 | ||

| + | **Deferred Revenue Account is credited $25.00 | ||

| + | **Accounts Receivable is debited $25.00 | ||

| + | **Revenue account is credited $25.00 | ||

| + | *A payment at any time will debit Accounts Receivable and credit the Deposit account | ||

| + | [[File:Fully on Event Start Date 2020.jpg|800px|center]] | ||

| + | ====='''<span style="color:#800080">Spread Monthly on Invoice Date'''</span>===== | ||

| + | ---- | ||

| + | For membership dues, even though a payment may be received, up front for the entire year, you may wish to recognize revenue equally across a specific period (generally 12 months). '''Spread Monthly on Invoice Date''' allows you to spread equal portions of a payment, across a selected time frame, starting from the invoice date. | ||

| + | <br>'''Example''':</br> | ||

| + | $600 Membership purchased on May 1st. Spread is set to 12 months. | ||

| + | *On May 1st | ||

| + | **A/R account is debited $600.00 | ||

| + | **Deferred Revenue account is credited $600.00 | ||

| + | **Revenue Account is credited $50 (1/12 of $600.00) | ||

| + | **Deferred revenue is debited $50.00 (1/12 of $600.00) | ||

| + | *Each month there after (for a total of 12 months) | ||

| + | **Revenue account is credited $50.00 (1/12 of the $600.00) | ||

| + | **Deferred Revenue account is debited $50.00 (1/12 of the $600.00) | ||

| + | *A payment at any time will debit Accounts Receivable and credit the Deposit account | ||

| + | [[File:Spread on invoice date 2020.jpg|800px|center]] | ||

| + | ====='''<span style="color:#800080">Spread Monthly on Payment Date'''</span>===== | ||

| + | ---- | ||

| + | Spread Monthly on Invoice Payment Date allows you to spread equal portions of a payment across a selected time frame beginning from the date the invoice was paid. | ||

| + | <br>'''Example'''</br> | ||

| + | Invoice dated 6/1 for $600.00 Goods/Services set for a 12-month spread | ||

| + | *On 6/1 | ||

| + | **Deferred Revenue account is credited $600.00 | ||

| + | **Accounts Receivable account is debited $600.00 | ||

| + | *Invoice paid on 8/4. | ||

| + | **Deferred revenue is debited 1/12 of $600.00 = $50 | ||

| + | **Revenue is credited 1/12 of $600.00 = $50.00 | ||

| + | **A/R is credited $600.00 | ||

| + | **Deposit Account is debited $600.00 | ||

| + | *Each month, on the day of the month the payment was initially received: | ||

| + | **Revenue is credited $50.00 | ||

| + | **Deferred Revenue is debited $50.00 | ||

| + | [[File:Spread on payment date 2020.jpg|800px|center]] | ||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | | | ||

| + | [[File:One Row.png|25px]] | ||

| + | | style="width: 100%"| '''IMPORTANT''': This option does NOT “catch up”. It will spread forward from the payment date. | ||

| + | |} | ||

| + | ====='''<span style="color:#800080">Spread Monthly on Invoice Due Date'''</span>===== | ||

---- | ---- | ||

| − | + | '''Spread Monthly on Invoice Due Date''' allows you to spread equal portions of the revenue from the invoice due date forward. | |

| − | + | <br>Example:</br> | |

| − | + | *On 8/4 | |

| + | **Deferred Revenue account is credited $300.00 | ||

| + | **Accounts Receivable account is debited $300.00 | ||

| + | *On the invoice due date (9/3), each month $25.00 will be recognized: | ||

| + | **Deferred Revenue account is debited $25.00 | ||

| + | **Revenue Account is credited $25.00 | ||

| + | *A payment at any time will debit Accounts Receivable and credit the Deposit account | ||

| + | [[File:Spread on invoice due date 2020.jpg|800px|center]] | ||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| | | | ||

| − | [[File:Smallest.png|50px]] | + | [[File:One Row.png|25px]] |

| − | || '''NOTE:''' Via the '''Billing''' module you can manage billing for multiple members simultaneously. You may also perform many of these functions individually on a member's '''Billing''' tab. | + | | style="width: 100%"| '''IMPORTANT''': This option does NOT “catch up”. It will spread forward from the invoice due date. |

| + | |} | ||

| + | |||

| + | ===='''<span style="color:#800080">Set up Voluntary Fees'''</span>==== | ||

| + | ---- | ||

| + | |||

| + | Voluntary fees may be added to your member invoices and membership applications. With a simple set up you can easily ask for, collect and track voluntary amounts. You may wish to use voluntary fees to ask for extra funds for special projects, such as technology improvements, or fundraising to support specific committee. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, shown below, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount). | ||

| + | |||

| + | #Click '''Setup''' in the Navigation panel. | ||

| + | #Click '''Goods/Services''' in the '''Services, Products and Commerce''' section. A list of Goods/Services currently configured in your system will be displayed. | ||

| + | #Click the '''New''' button. | ||

| + | #:[[File:Voluntary fee 2021.jpg|700px|center]] | ||

| + | #On the '''Add/Edit Good or Service''' screen, configure the following: | ||

| + | #:*'''Name''': Provide a name for the good/service. This will be displayed when you are selecting goods or services, and is the name that you will report on in the software. | ||

| + | #:*'''Good/Service Type''': Select the desired type. Only Membership Dues, Miscellaneous and PAC will allow for setting up a voluntary fee. | ||

| + | #:*'''Product Category''': Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the '''+''' sign to create a new product category. | ||

| + | #:*'''Description''' - Enter a description of the good/service. This description is what will display as the line item on invoices. | ||

| + | #:*'''Product Description''': Optional - you can provide further details about the product. | ||

| + | #:*'''Default Price''': Optional - Enter a default price for this good/service. The default price will automatically be populated when adding the item to an invoice, however, this price may be over-ridden when you are assigning the good/service. | ||

| + | #:*'''Default Quantity''': Optional - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and automatically entered when adding the goods/service to an invoice. This may be overridden when you are assigning the good/service. | ||

| + | #:*'''Voluntary''': Select the '''Voluntary''' check box. | ||

| + | #:*'''Accounting Type''': Select ''''Cash'''. This ensures that the voluntary fee is not recognized until it has been paid. Cash is the only accounting option possible for a voluntary fee. | ||

| + | #:*'''Income Account''': Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the '''+''' sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements. | ||

| + | #:*'''Deposit Account''': Select the deposit account that should be used when a payment is received for this goods/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts. | ||

| + | #:*'''Product Tax Category''': If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the '''+''' button. | ||

| + | #:*'''Tax Set''': If this good/service is taxable, select the appropriate tax set. | ||

| + | #:*'''Is Recurring Fee (vs. one-time)''': If you wish to include this fee as a recurring fee item (for example tied to a membership) set as a recurring fee. | ||

| + | #:*'''Invoice Template''': Select the invoice template to be used for this good/service. If no selection is made, the default you have setup under Setup > Finance > General Settings will be used. | ||

| + | #:*'''Is Active''': Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service. | ||

| + | # Click '''Done''' to save the new voluntary good/service. | ||

| + | |||

| + | Voluntary fees can be easily tracked by running the '''Voluntary Payment Report'''. '''[[Billing#Voluntary_Payment_Report|Click here]]''' for more details. | ||

| + | |||

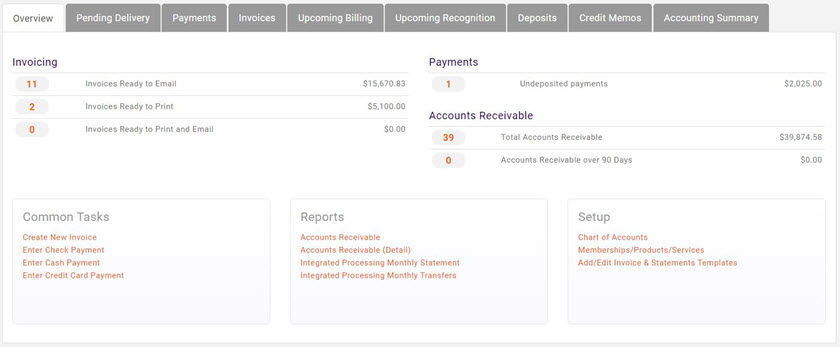

| + | ='''<span style="color:#800080">Billing Functions'''</span>= | ||

| + | ---- | ||

| + | |||

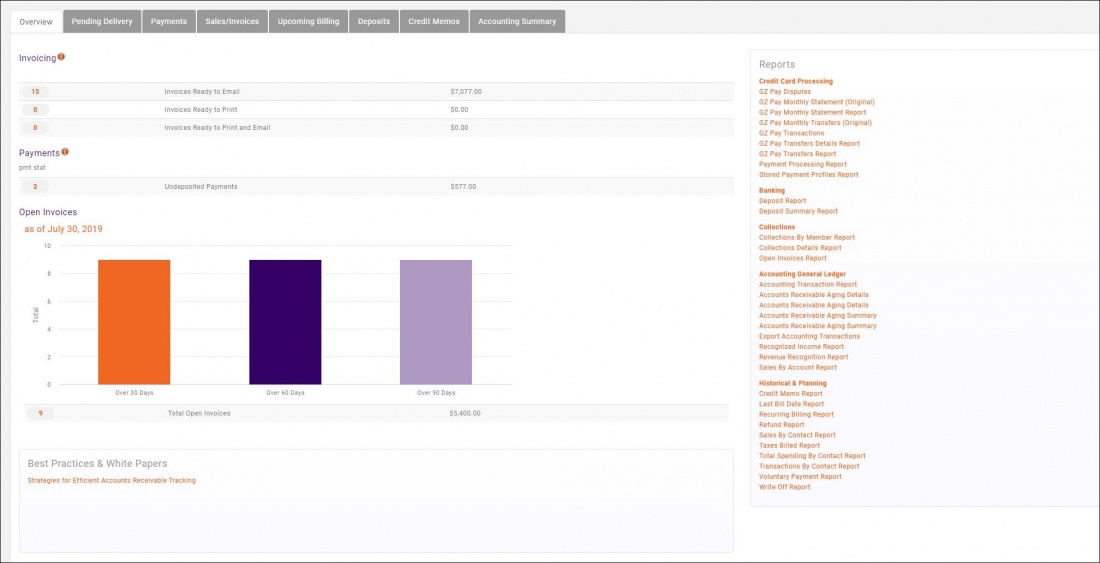

| + | The '''Billing''' module provides the functions to review invoices, view overdue invoices, accept payments, as well as review reports on accounts receivables, and generate the reports needed to reconcile to your general accounting software. | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | | | ||

| + | [[File:Smallest.png|50px]] | ||

| + | || '''NOTE:''' Via the '''Billing''' module you can manage billing for multiple members simultaneously. You may also perform many of these functions individually on a member's '''Billing''' tab. | ||

|} | |} | ||

| Line 597: | Line 893: | ||

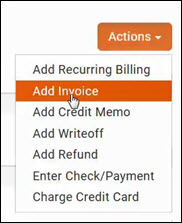

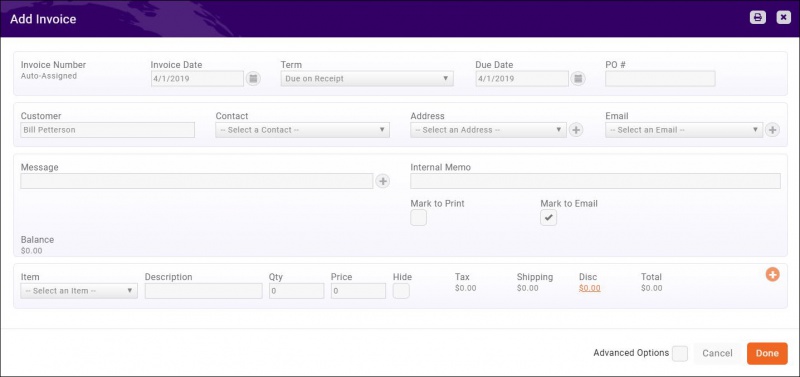

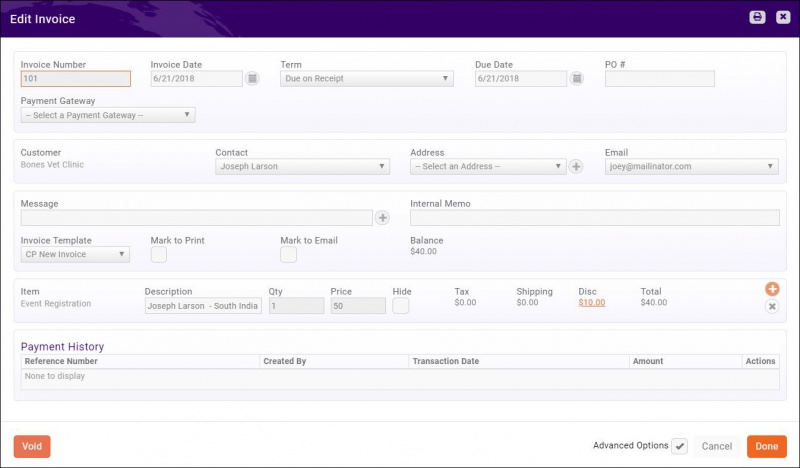

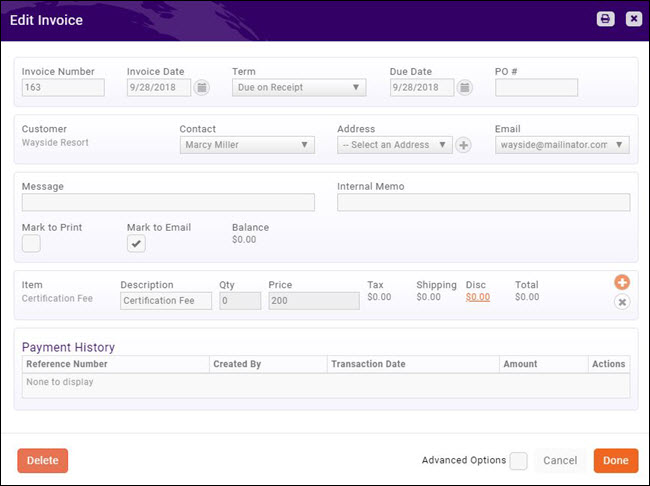

---- | ---- | ||

| − | Single invoices may be created directly on a contact or individual's '''Billing''' tab, or from the '''Billing module''' | + | Single invoices may be created directly on a contact or individual's '''Billing''' tab, or from the '''Billing module'''. |

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| − | | | + | | |

| − | [[File:One Row.png|25px]] | + | [[File:Video-call-24.jpg|link=https://www.screencast.com/t/hFCxokPh4p]] |

| − | | style="width: 100%"| '''NOTE:''' It should be very rare that you would need to manually create an invoice within GrowthZone, there should be an action taken (adding a membership, registering an attendee) which will trigger an invoice to be created for you. | + | | style="width: 100%"| '''See Creating a Single Invoice in Action!''' |

| + | |} | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | | | ||

| + | [[File:One Row.png|25px]] | ||

| + | | style="width: 100%"| '''NOTE:''' It should be very rare that you would need to manually create an invoice within GrowthZone, there should be an action taken (adding a membership, registering an attendee) which will trigger an invoice to be created for you. | ||

|} | |} | ||

| Line 648: | Line 951: | ||

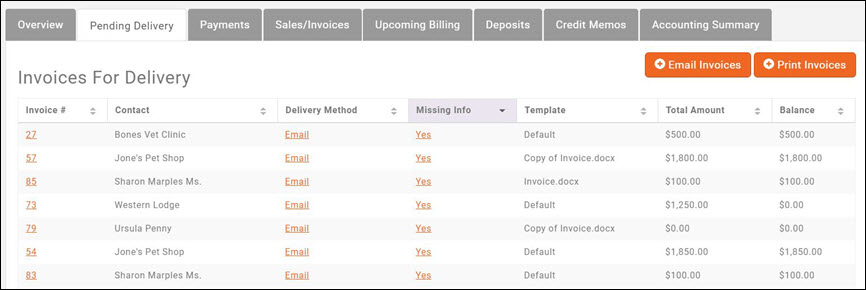

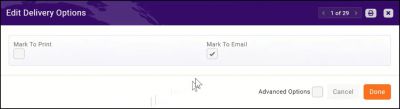

---- | ---- | ||

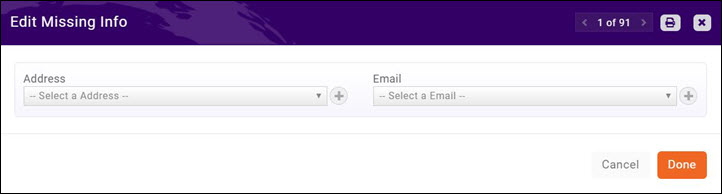

The '''Pending Delivery''' tab in the Billing Module will provide a list of invoices that have not been sent out. | The '''Pending Delivery''' tab in the Billing Module will provide a list of invoices that have not been sent out. | ||

| − | '''How do Invoices Get Place on the Pending Delivery Tab?''': | + | <br>'''How do Invoices Get Place on the Pending Delivery Tab?''': |

*Invoices created when you run your recurring billing on the '''Upcoming Billing''' tab. | *Invoices created when you run your recurring billing on the '''Upcoming Billing''' tab. | ||

*If '''Automated Scheduled Billing''' is enabled under '''Setup > Finance > General Settings'''. | *If '''Automated Scheduled Billing''' is enabled under '''Setup > Finance > General Settings'''. | ||

| Line 655: | Line 958: | ||

*When membership applications are submitted, and you have allowed the applicant to request to be invoiced. | *When membership applications are submitted, and you have allowed the applicant to request to be invoiced. | ||

[[File:Pending Delivery CP.jpg|center]] | [[File:Pending Delivery CP.jpg|center]] | ||

| + | </br> | ||

You may process and send out the invoices in the following manner: | You may process and send out the invoices in the following manner: | ||

#Select '''Billing''' in the Navigation Panel. | #Select '''Billing''' in the Navigation Panel. | ||

| Line 668: | Line 972: | ||

==='''<span style="color:#800080">Deliver Invoices via E-mail'''</span>=== | ==='''<span style="color:#800080">Deliver Invoices via E-mail'''</span>=== | ||

---- | ---- | ||

| − | + | See our '''[https://helpdesk.chambermaster.com/kb/article/650-deliver-invoices-marked-to-be-emailed/ Knowledge Base article]''' | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

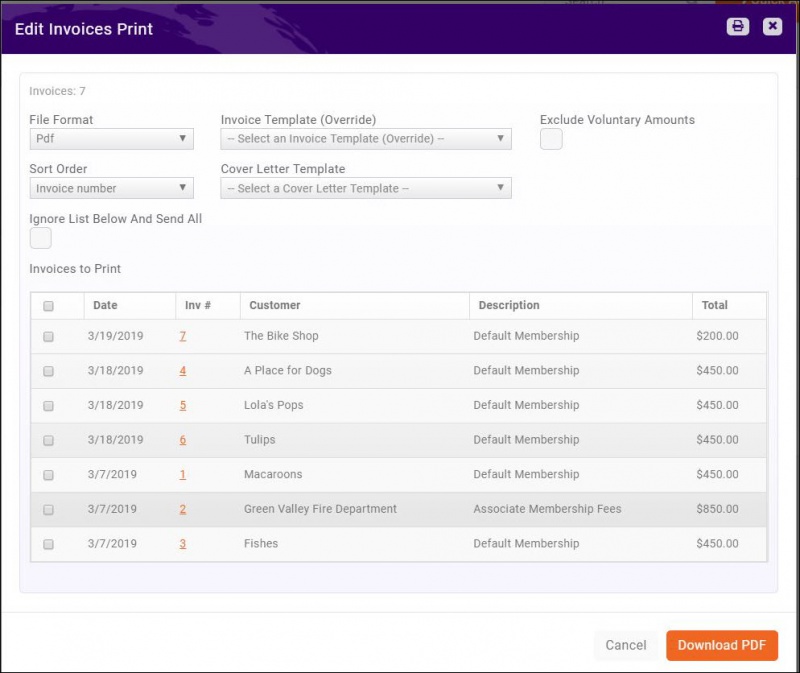

==='''<span style="color:#800080">Print Invoices for Delivery'''</span>=== | ==='''<span style="color:#800080">Print Invoices for Delivery'''</span>=== | ||

---- | ---- | ||

| Line 728: | Line 1,015: | ||

#From the '''Invoice Template (Over-ride)''' list, select the desired template. | #From the '''Invoice Template (Over-ride)''' list, select the desired template. | ||

#Proceed to deliver your invoices as described above. | #Proceed to deliver your invoices as described above. | ||

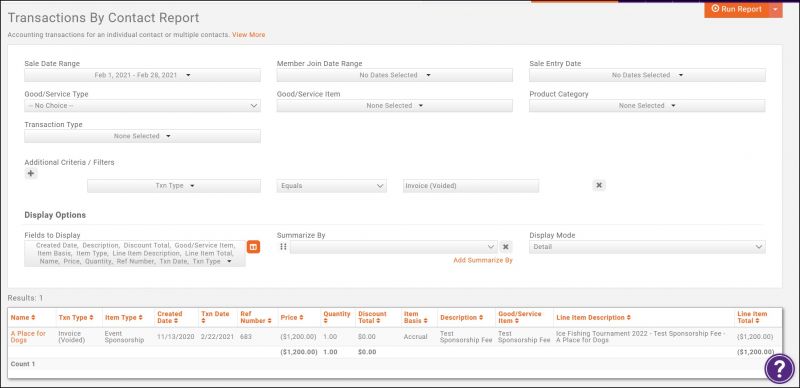

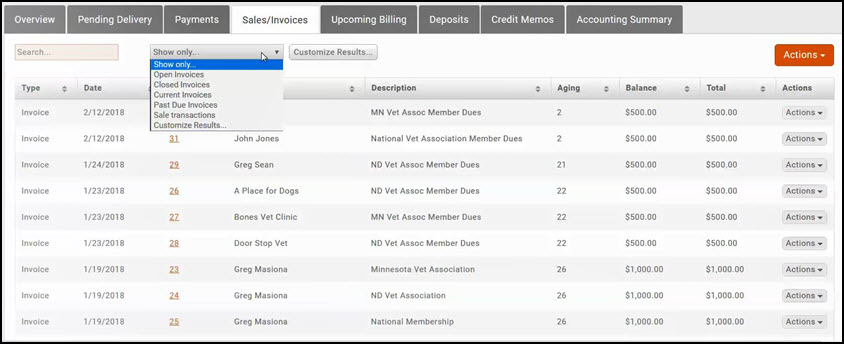

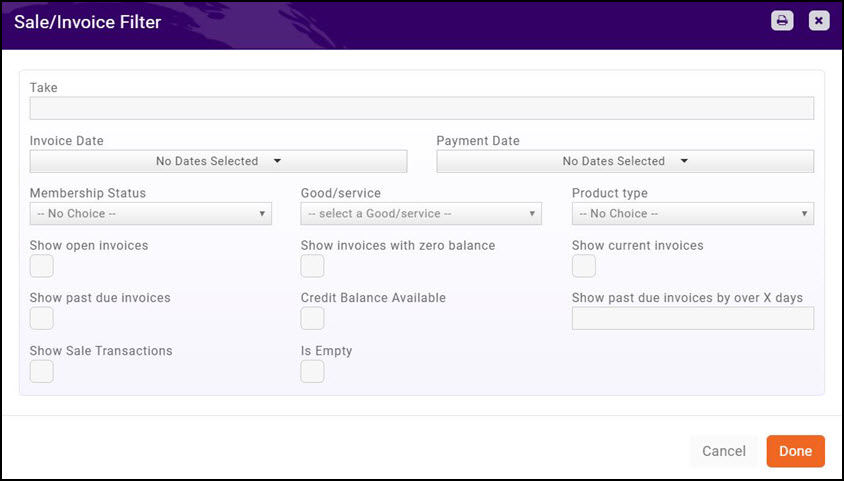

| − | + | =='''<span style="color:#800080">View Past Due Invoices'''</span>== | |

---- | ---- | ||

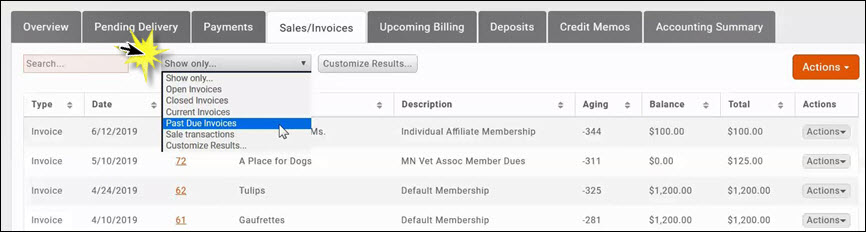

You can view all invoices on the '''Sales/Invoices''' tab. To view only over-due invoices select '''Past Due Invoices''' from the '''Show Only''' drop-down list. The list of invoices will refresh displaying on your past due invoices. | You can view all invoices on the '''Sales/Invoices''' tab. To view only over-due invoices select '''Past Due Invoices''' from the '''Show Only''' drop-down list. The list of invoices will refresh displaying on your past due invoices. | ||

| Line 736: | Line 1,023: | ||

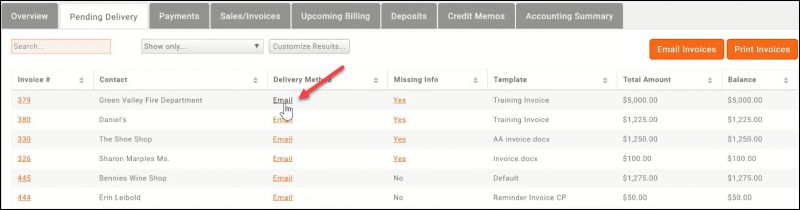

==='''<span style="color:#800080">Re-deliver Past Due Invoices via Email'''</span>=== | ==='''<span style="color:#800080">Re-deliver Past Due Invoices via Email'''</span>=== | ||

---- | ---- | ||

| − | #On the '''Sales/Invoices''' tab, filter the list to '''Past Due Invoices''' as described previously. | + | #On the '''Sales/Invoices''' tab, filter the list to '''Past Due Invoices''' as described previously. You can also add any additional filtering options needed. Your final list of filtered invoices will be those included to be emailed. |

#Click the drop-down arrow on the '''New Invoice''' button. | #Click the drop-down arrow on the '''New Invoice''' button. | ||

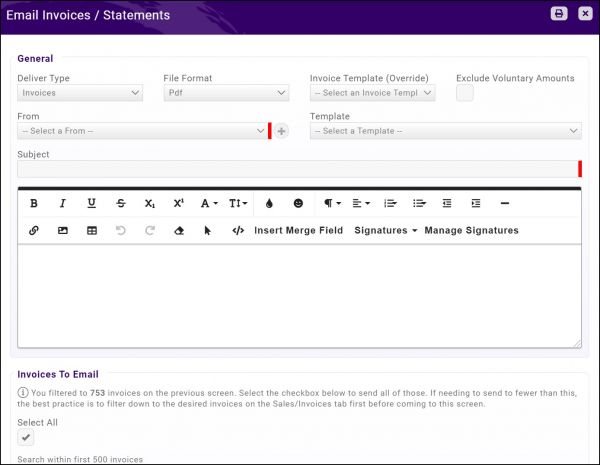

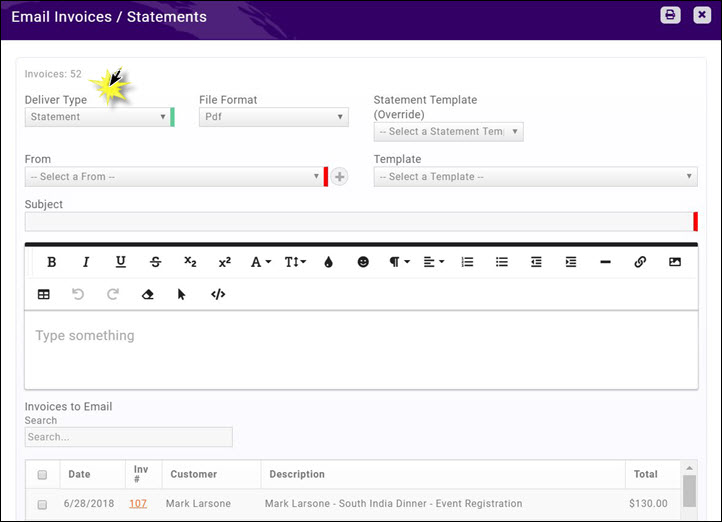

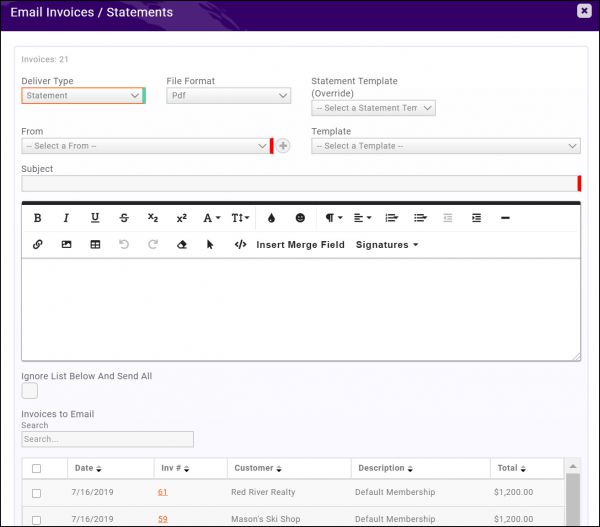

#Click '''Email Invoices/Statements'''. | #Click '''Email Invoices/Statements'''. | ||

| − | #:[[File: | + | #:[[File:EMAIL INVOICES.jpg|600px|center]] |

#:*Select Invoice from the '''Deliver Type''' drop-down list. | #:*Select Invoice from the '''Deliver Type''' drop-down list. | ||

#:*Select the desired '''File Format''' from the drop-down list. | #:*Select the desired '''File Format''' from the drop-down list. | ||

| − | #:*Select the desired invoice template from | + | #:*Select the desired invoice template from the '''Invoice Template (Override)''' drop-down list. This will allow you to select an invoice template to apply to the selected invoices, either by selecting the checkbox at the top to select all or by selecting individual invoices. |

#:*Select a '''From''' address from the list. | #:*Select a '''From''' address from the list. | ||

#:*Select a '''Cover Letter Template''' from the list. | #:*Select a '''Cover Letter Template''' from the list. | ||

#:*Enter a '''Subject''' and type in your message if you have not selected a cover letter template. | #:*Enter a '''Subject''' and type in your message if you have not selected a cover letter template. | ||

| − | #:*Click the check-box for the invoices you want to email, or click the top-most check-box to select all invoices in the list. | + | #:*Click the check-box for the invoices you want to email, or click the top-most check-box to select all invoices in the list. '''IMPORTANT''': The list of invoices will only display the first 500 invoices, and would therefore only deliver the first 500. If you wish to email ALL invoices, click the '''Select All''' check-box. This option will only be displayed if there are more than 500 invoices to be emailed. When choosing the '''Select All''' option, the invoices in the list will not be checked, but they will be included in your email. |

#Click '''Done'''. The Past Due invoices have now been emailed. | #Click '''Done'''. The Past Due invoices have now been emailed. | ||

| + | |||

==='''<span style="color:#800080">Re-deliver Past Due Invoices via Print'''</span>=== | ==='''<span style="color:#800080">Re-deliver Past Due Invoices via Print'''</span>=== | ||

---- | ---- | ||

| Line 754: | Line 1,042: | ||

#Click '''Print Invoices'''. | #Click '''Print Invoices'''. | ||

#Select the desired '''File Format''' from the list. | #Select the desired '''File Format''' from the list. | ||

| − | #Select the desired '''Invoice Template''' | + | #Select the desired invoice template from the '''Invoice Template (Override)''' drop-down list. This will allow you to select an invoice template to apply to the selected invoices, either by selecting the checkbox at the top to select all or by selecting individual invoices. |

#Select the desired '''Cover Letter Template''' from the list. | #Select the desired '''Cover Letter Template''' from the list. | ||

#Click the check-box for the invoices you want to print. Click the top-most check box to select all invoices in the list. | #Click the check-box for the invoices you want to print. Click the top-most check box to select all invoices in the list. | ||

| Line 793: | Line 1,081: | ||

See '''[[Contact_Management#Print_an_Individual_Statement|Print an Individual Statement]]'''. | See '''[[Contact_Management#Print_an_Individual_Statement|Print an Individual Statement]]'''. | ||

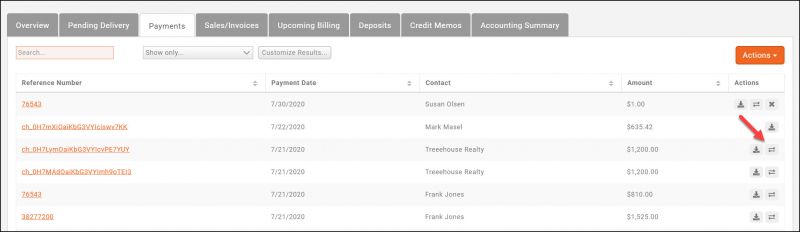

| − | ==Accept Payments== | + | =='''<span style="color:#800080">Accept Payments'''</span>== |

| − | + | ---- | |

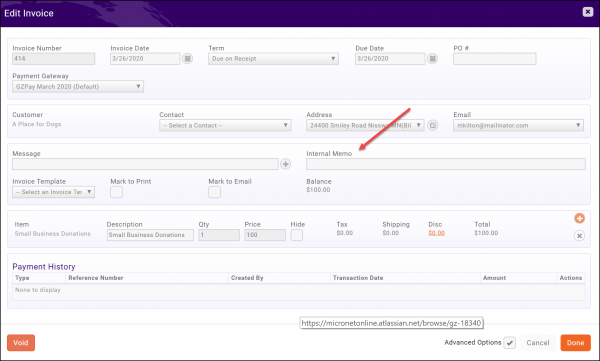

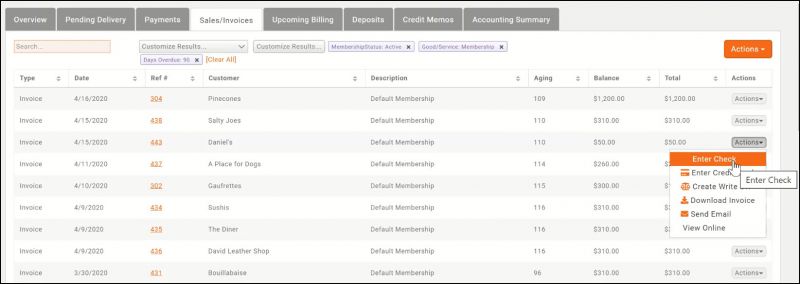

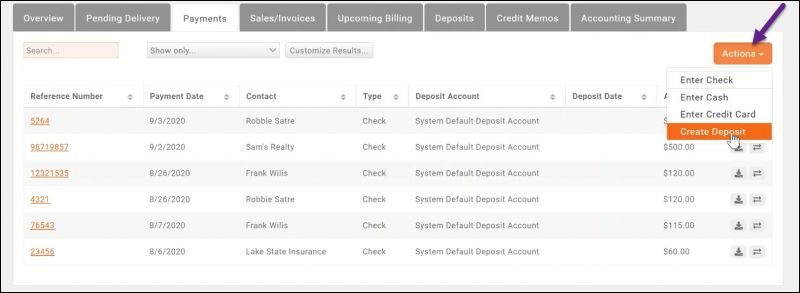

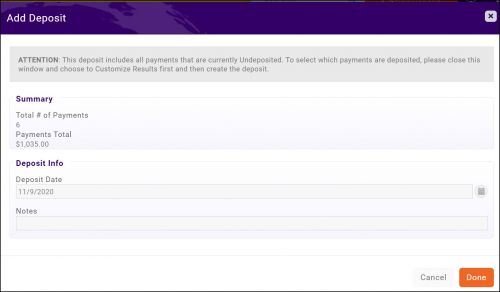

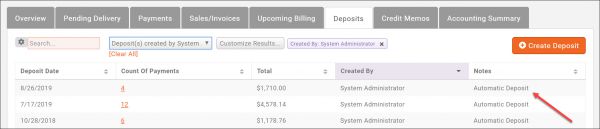

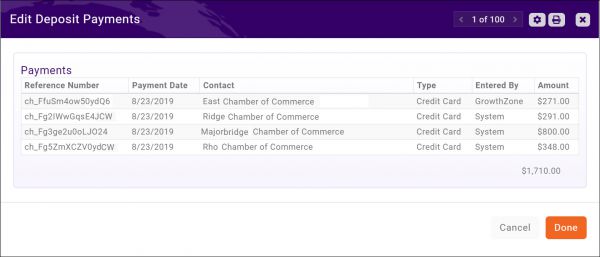

| − | The '''Invoice''' tab will display all of your invoices, whether they have been paid or not. You can use this tab to analyze aging and make payments. The list may be filtered to just open invoices to make it easier to manage payments. | + | The '''Invoice''' tab will display all of your invoices, whether they have been paid or not. You can use this tab to analyze aging and make payments. The list may be filtered to just open invoices to make it easier to manage payments. '''NOTE:''' You may also make payments on the individual members' '''Account''' tab. |

| − | |||

You can view the details of an invoice by clicking into the hyper-link for a particular invoice. | You can view the details of an invoice by clicking into the hyper-link for a particular invoice. | ||

| − | |||

#Select '''Billing''' in the Navigation Panel. | #Select '''Billing''' in the Navigation Panel. | ||

#Click the '''Invoices''' tab. Customize the list to display only unpaid invoices to make it easier to locate the invoices for which you are accepting payment. | #Click the '''Invoices''' tab. Customize the list to display only unpaid invoices to make it easier to locate the invoices for which you are accepting payment. | ||

#Click the payment type in the '''Actions''' list. You may choose: check or credit card. | #Click the payment type in the '''Actions''' list. You may choose: check or credit card. | ||

| − | + | {| class="wikitable" | |

| − | ====Accept a Check Payment | + | |- |

| − | + | | [[File:Smallest.png|25px]] | |

| − | # | + | | style="width: 100%"| '''IMPORTANT''': Partial Payments may be accepted. When a partial payment is received, if there are multiple items on the invoice, the payment will be applied to the smallest items first. If you do not wish to allow partial payments, you can disable this option under '''Setup > Finance > General Settings'''. |

| − | #:[[File:Enter Check Payment. | + | |} |

| − | #'''Payment From''' | + | ==='''<span style="color:#800080">Accept a Check Payment'''</span>=== |

| − | #'''Payment Date''' This will display | + | ---- |

| − | #'''Check Number''' | + | Check payments may be accepted via the '''Billing''' module, or on an individual contact '''Billing''' tab. |

| − | #'''Amount''' | + | #From the '''Billing''' '''Sales/Invoices''' tab, click the '''Enter Check''' icon in the '''Actions''' list. |

| + | #:[[File:Enter check 2020.jpg|800px|center]] | ||

| + | #In the '''Edit Check Payment''' window, complete the following: | ||

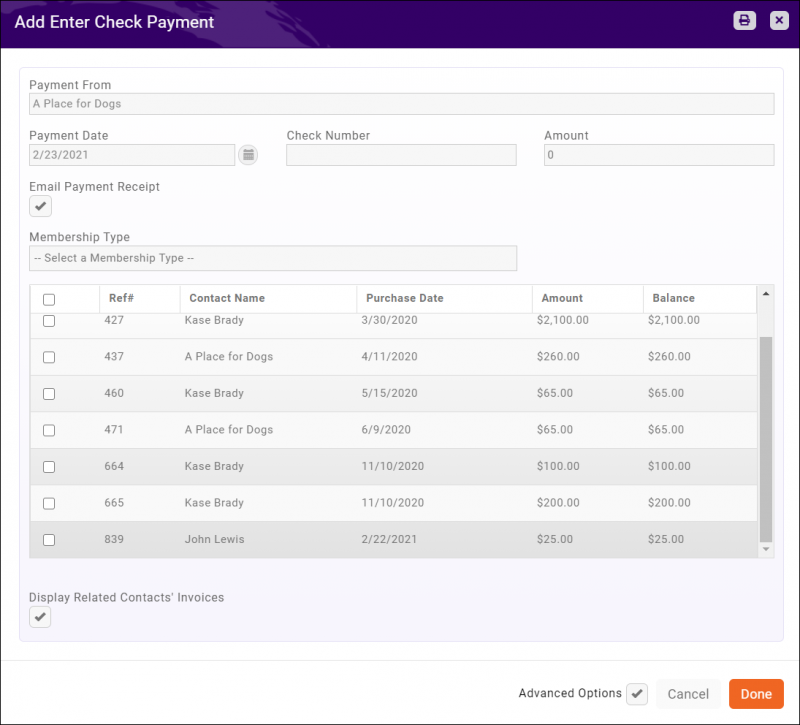

| + | #:[[File:DisplayRelContInv 2021.png|800px|center]] | ||

| + | #'''Payment From''': This will display the name of the contact to whom the invoice was sent. You may change this if necessary. | ||

| + | #'''Payment Date''': This will display the current date. You may change this at initial creation of payment, however, once the payment is saved you will not be able to change the date. | ||

| + | #'''Check Number''': Enter the check number as a reference. | ||

| + | #'''Amount''': The invoice against which you wish to apply payment is automatically selected and the full amount of the invoice will be displayed by default. You can select additional invoices, and the system will total those invoices. You may also change the amount if needed. | ||

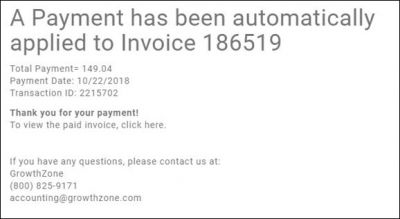

| + | #'''Email Payment Receipt''': This option is selected by default, and will send the automated '''Invoice Payment Received''' email to the contact. This is only sent if the payment is applied an invoice, it will not be sent for an overpayment. | ||

| + | #'''Advanced Options/Display Related Contacts Invoices''': If you are paying for additional invoices that may be associated to your organization's related contacts, you can enable this option to see those additional invoices in the list above. | ||

#Click '''Done'''. | #Click '''Done'''. | ||

| + | {| class="wikitable" | ||

| + | |- | ||

| + | | | ||

| + | [[File:One Row.png|25px]] | ||

| + | | style="width: 100%"| '''NOTE:''' If you have inadvertently entered the wrong check number, click on the payment hyper-link to update the number. | ||

| + | |} | ||

| − | + | ==='''<span style="color:#800080">Enter a Cash Payment'''</span>=== | |

| − | |||

| − | |||

| − | ==='''<span style="color:#800080"> | ||

---- | ---- | ||

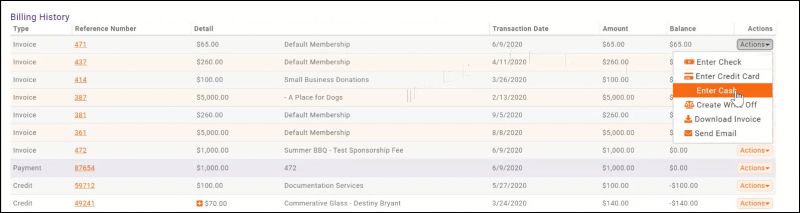

| + | Cash payments may be entered from a contact's '''Billing''' tab. | ||

| + | #Click '''Contacts''' in the left-hand navigation panel. | ||

| + | #Select the desired contact. | ||

| + | #Click the '''Billing''' tab. | ||

| + | #:[[File:Enter cash 2020.jpg|800px|center]] | ||

| + | #Click '''Enter Cash'''. All open invoices will be displayed. | ||

| + | #'''Payment From''': This will display the name of the contact to whom the invoice was sent. You may change this if necessary. | ||

| + | #'''Payment Date''': This will display the current date. You may change this at initial creation of payment, however, once the payment is saved you will not be able to change the date. | ||

| + | #'''Amount''': Select the invoices to which the cash payment is to be applied; the amount will automatically total. You may change this if necessary. | ||

| + | #'''Advanced Options/Display Related Contacts Invoices''': If you are paying for additional invoices that may be associated to your organization's related contacts, you can enable this option to see those additional invoices in the list above. | ||

| + | #Click '''Done'''. | ||

| + | ==='''<span style="color:#800080">Accept a Credit Card Payment - Integrated'''</span>=== | ||

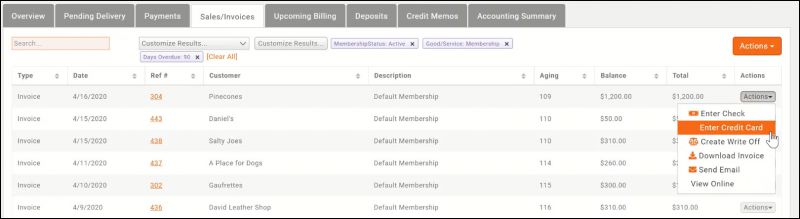

| + | ---- | ||

| + | #Select '''Billing > Sales/Invoices''' tab. | ||

| + | #:[[File:Enter credit card 2020.jpg|800px|center]] | ||

#Click the '''Enter Credit Card''' icon in the '''Actions''' list. | #Click the '''Enter Credit Card''' icon in the '''Actions''' list. | ||

| − | #'''Payment From''' | + | #'''Payment From''': This will display the member to which the invoice was sent. You may change this if necessary. |

| − | #'''Stored Payment Methods''' If a credit card has been stored for this member, you will be able to select this payment from the list. | + | #'''Stored Payment Methods''': If a credit card has been stored for this member, you will be able to select this payment from the list. |

| − | #'''Card Information''' | + | #'''Card Information''': Select the appropriate '''Payment Gateway'''. If no gateway is selected, the system default will be used. |