Billing

Contents

- 1 Overview

- 2 Initial Billing Setup

- 2.1 Setup Your Chart of Accounts

- 2.2 Setup your Invoice Payment Terms

- 2.3 Setup Your Terms & Conditions

- 2.4 Setup GrowthZone Pay

- 2.5 Setup Taxes

- 2.6 Set Up Your Invoice Template

- 2.7 Configure Invoice & Statement Messages

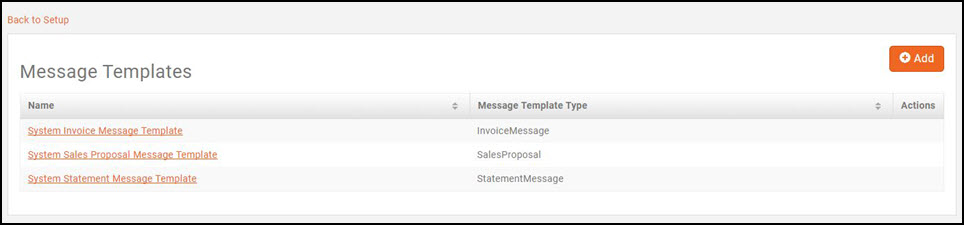

- 2.8 View Default Message Templates

- 2.9 Configure Finance Defaults & Logo for Invoices & Statements

- 2.10 Setup Goods/Services

- 3 Billing Functions

- 4 Accounting Transaction Export (Coming Soon)

- 5 Billing Reporting

- 6 Reconciling your Accounting Records in GrowthZone

- 7 Recorded Billing Tutorials

- 8 FAQ's

Overview

With your GrowthZone software, we have integrated the entire invoicing process into the software to ensure no double entry and save you time. An Accounting Summary report allows you to post summary from GrowthZone to keep QuickBooks, PeachTree and other accounting systems in sync.

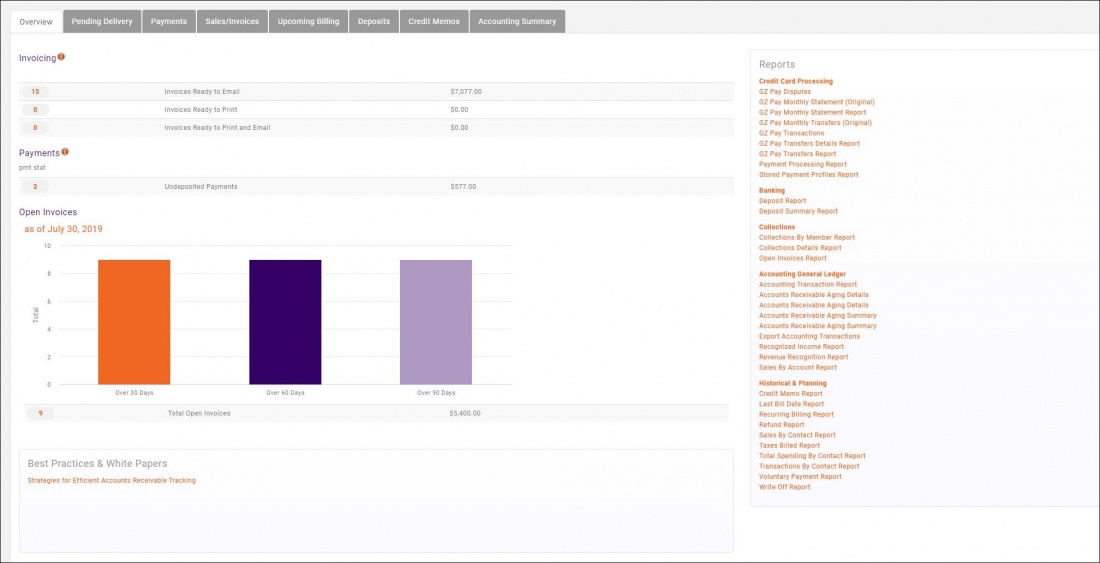

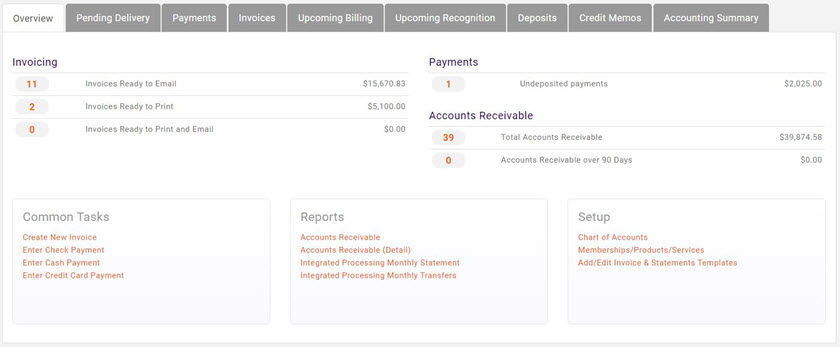

Billing Overview Tab

Within the Billing Module, an Overview tab is provided for a quick at a glance view of your finances, provides a graphical view of your open invoices, and easy access to various billing reports.

- The Invoices section, provides an at a glance view of the number of invoices to be emailed, printed or both. Click a numbered link to open the Pending Delivery tab to deliver the invoices. See Deliver Invoices for further instructions.

- The Payments section provides an at a glance view of the number of payments that need to be deposited. Click the numbered link to create the deposit. See Deposits for further instructions.

- The Open Invoices section provides a graphical view of invoices that are open as of the current date, and the total number and value of invoices. By dwelling your mouse over the graph, you will see summary information about the invoices. Click into the graph to open the Open Invoices Report. See Open Invoices Report for further details and uses of the report.

- The Reports section provides a list of the various billing reports available to you. The list will also include any custom reports you may have created, identified by a yellow asterisk. See Billing Reports for information on each report.

- The Best Practices & White Papers section will provide you with information on best practices for managing your billing through the GrowthZone software. This list will grow over time, providing you with insight on managing your billing.

Initial Billing Setup

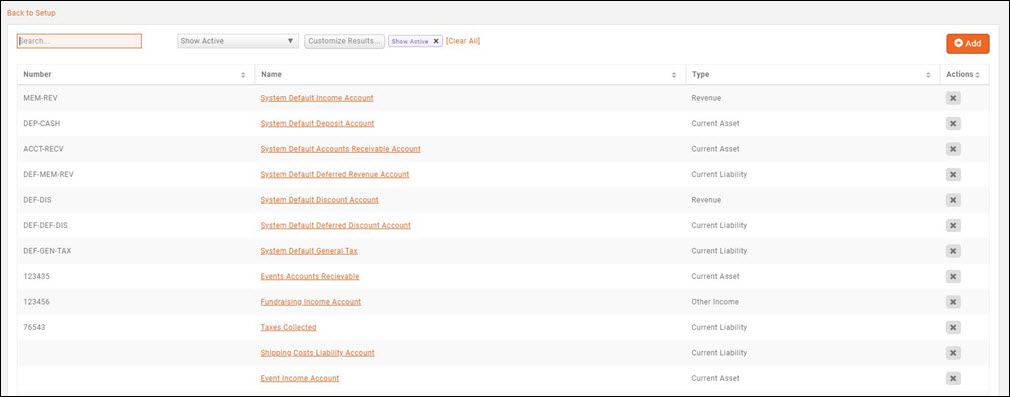

Setup Your Chart of Accounts

The Chart of Accounts ensures that your financial data is aligned to any existing accounting records and processes. On installation of the software, a sample chart of accounts is provided as a starting point. Edit and add to this list to ensure your database chart of accounts matches your current structure.

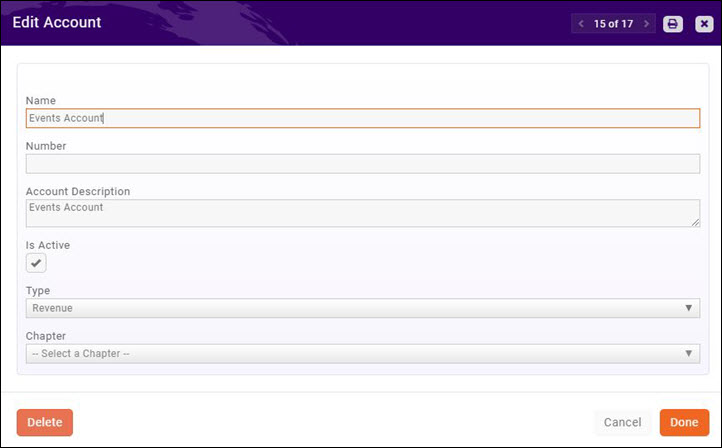

Edit an Account in your Chart of Accounts

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click on the link for the account you wish to edit and make the desired edits.

- Click Done to save the changes.

Add New Account to Your Chart of Accounts

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click the Add button.

- Configure the following settings:

- a. Name - This is the name of the account. This name must match exactly the name of the account in your general accounting software.

- b. Number - This is the number associated with this account.

- c. Account Description - Enter a description of this account. This is for informational purposes only.

- d. Is Active - Select the check-box to activate this account. If the account is not activated, it will not be available for use within the software.

- e. Type - Select the type of account from the drop-down list.

- f. Chapter - If applicable, select the chapter associated with this account.

- Click Done to save the new account.

De-activate an Account in your Chart of Accounts

When you no longer wish to use an account, best practice is to de-activate the account. By de-activating you ensure that all historical financial data associated to this account is maintained in the database. By de-activating, the account is no longer visible when assigning accounts to goods/services.

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click on the link for the account you wish to de-activate.

- Clear the Is Active check-box.

- Click Done.

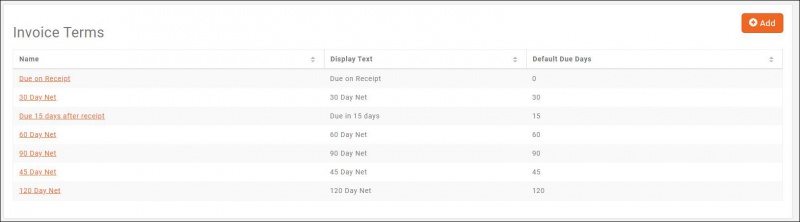

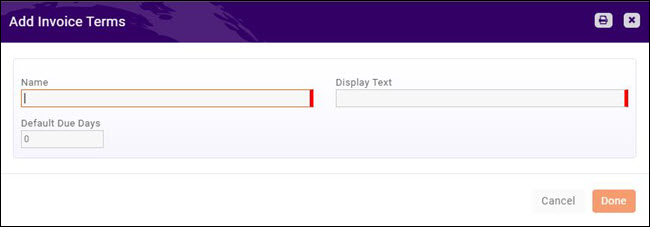

Setup your Invoice Payment Terms

By default, payment terms are set to Due on Receipt. You may modify and add additional payment terms to meet your business needs. You may configure your terms initially through the setup functions, but you will also have the opportunity to create terms "on the fly" when creating invoices.

- Click Setup in the Navigation panel.

- Click Invoice Terms in the Finance section. A list of invoice terms currently configured in your system will be displayed.

- Click the Add button.

- On the Add/Edit Invoice Terms screen, configure the following:

- Name - Enter a name for this invoice term. This name will be displayed in drop-down lists in the software.

- Display Name - Enter the display name. This will be displayed on invoices.

- Default Due Days - Enter the default due days for this invoice term configuration. This is the number of days the system will use to identify past-due invoices.

- Click Done.

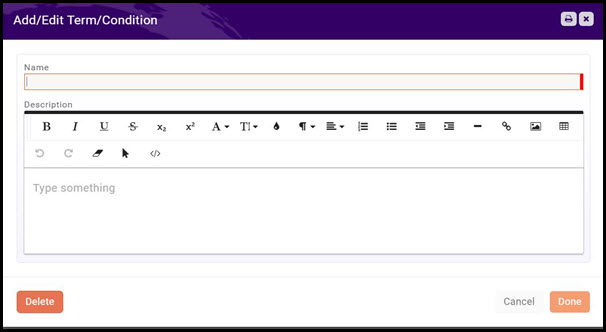

Setup Your Terms & Conditions

- Click Setup in the Navigation Panel.

- Click Terms/Conditions in the Services, Products and Commerce section.

- Click the Add button.

- Enter a Name that easily identifies this terms & condition set. You may create multiple terms & conditions as needed by your business processes.

- Description - Enter your terms & conditions. You may use the standard word-processing functions (bold, italics, etc.) as well as add links and images. If you choose, the terms & conditions may be displayed on the Membership Application Form.

- Click Done.

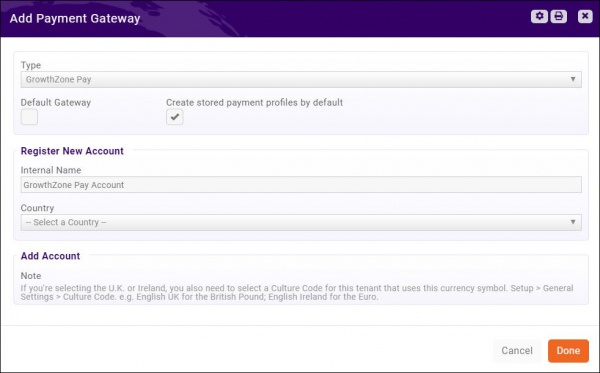

Setup GrowthZone Pay

| NOTE: You may setup and configure your GrowthZone Pay gateway. If you are using a different gateway, contact support@growthzone.comfor assistance. |

GrowthZone Pay allows your contacts to enter their credit card or bank account information into a secured page to pay invoices, event registration, donations, etc. By checking to save this account, users can apply this automatically to recurring fees (e.g. membership) or other one-time purchases. Creating your GrowthZone Pay gateway is a two step process

Step One

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

- Click the Add button.

- On the Add Payment Gateway screen, configure the following:

- Type - Select GrowthZone Pay from the drop-down list.

- Default Gateway - Select this check-box if this will be used as your default gateway.

- Create stored payment profiles by default - Select this check-box if you want the "store payment profile" checkbox on the payment widget through out the software is enabled by default.

- Internal Name - This name is the name you will see internally for this account. You may have multiple processing accounts, perhaps one for your memberships and one for fundraising. In this event, you would add additional GrowthZone Pay gateways for these. This is a way for you to internally recognize with account is used for which transaction.

- Country - (Optional) Select your country from the drop-down list.

- Click Done to save the new GrowthZone Pay account.

Step Two

In step two, your business contact and account information is entered. This will also include personal information about the owner of the account. This information is necessary to verify the authenticity of the account holder.

- For the newly created gateway, click the pencil icon in the 'Actions column.

- On the Edit Payment Gateway screen, configure the following:

- Name - this field will be populated with the name previously assigned to this gateway. You may modify it if needed.

- Default Gateway - this field if populated with your previous choice. You may modify it if needed.

- *Account Number - this field is automatically generated when the gateway is first created.

- Business Name - this field is automatically populated with the name of your business.

- Statement Descriptor (Maximum 22 characters) - The statement descriptor appear on purchasers statements so best practice is to enter a descriptor that allows the purchaser to easily identify your organization. Statement descriptors are limited to 22 characters, cannot use the special characters <, >, ', or ", and must not consist solely of numbers.

- Public Contact Info - Enter the contact information for your organization.

- Decline Charge On:

- CVC Failure - The CVC is the three- or four-digit number printed directly on the credit card, usually either on the signature strip or the front of the card. Selecting this option will block any payments that fail the CVC verification check.

- AVC Failure - AVS is comprised of two checks: one based on the ZIP code and another based on the billing street address. AVS checks determine whether these pieces of information match the billing address on file with the card issuer. Selecting this options will block to block any payments that fail ZIP code verification.

- 'Bank Accounts - Click the Add button to associate the organization's bank account with this gateway. This is the bank account to which the funds will be transferred. Once created, this bank account may not be deleted unless another one is added. Your bank account information is required when activating your account. The type of bank account information required depends on where your bank account is located. A standard bank account with a financial institution must be provided (e.g., checking). Other types of bank accounts (e.g., savings) or those with a virtual bank account provider (e.g., e-wallet or cross-border services) are not supported. NOTE: Accounts are not editable in the gateway setup after entry, if you have entered the wrong account, you would need to add a new account.

- Account Holder Information:

- Select the Type of account from the drop-down list.

- Enter the required account holder information. Enter information about the holder of this account, i.e. the user/business receiving funds from this account. Select Individual or Business account. If selecting Business, the representative for the business is the individual who has been given authorization by their business to set up an account on behalf of the business. This individual is not responsible or liable for any activity that happens on the businesses' account but is required as part of "Know Your Customer" regulations.

- If Business was selected as the account type, a hyper-link Enter/Change Tax ID will be displayed. Click the hyper-link to enter or change the Tax ID.

- Additional Owners - In EU countries, we are required to collect and verify information about anybody that owns at least 25% of the company, in addition to the representative. The address of the additional owner(s) does not need to be in the same country as the account. Click the Add button to add additional owners to this account. This field will NOT be displayed if country is set to United States.

- Identity Document: If required upload identity documentation. Click Here to view the documentation required by country.

- Click Done to save the account information.

As part of the GrowthZone Pay service, GrowthZone is committed to taking reasonable “Know Your Customer” steps to assure that customers applying for a payment gateway account are legitimate and not impersonating as an association or chamber for unlawful or harmful purposes. As part of our validation process, once a payment gateway application is submitted, the account requires an additional verification step by GrowthZone. While this verification due diligence is completed, the payment gateway is not yet fully available for processing. Once GrowthZone has completed the verification, the gateway is enabled and transactions can be processed.

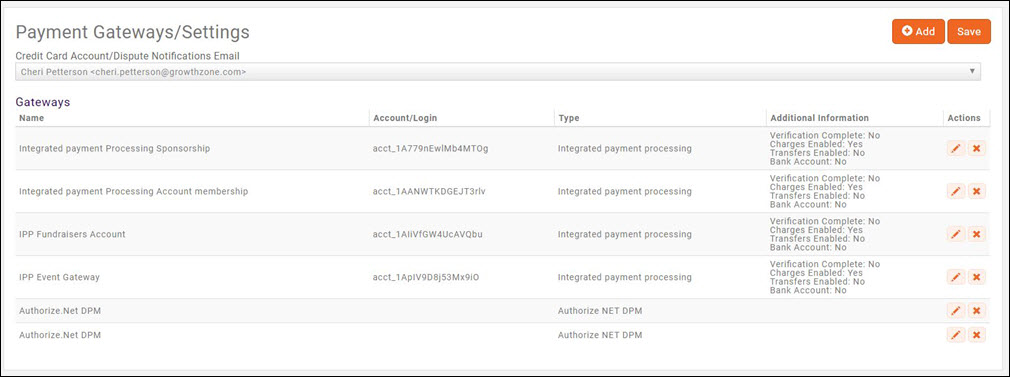

Verify Status of Payment Gateway

Until the payment gateway has been properly verified it may be on hold, preventing you from receiving payouts. To verify the status of the gateway setup:

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

In the Additional Information column you will see the following to indicate the status of the gateway:

- Verification Complete: This will indicate (yes/no) if the required verification by Stripe & GrowthZone have been completed.

- Charges Enabled: This will indicate (yes/no) whether charges may be processed through the gateway.

- Transfers Enabled: This will indicate (yes/no) whether transfers to your bank account have been enabled.

- Bank Account: This will indicate (yes/no) whether your bank account information has been successfully verified.

Configure Gateway Notifications for Disputes/Charge Failures

Automated notification may be sent to your staff when a GrowthZone Pay charge fails or when a charge is disputed.

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

- Select the staff member to whom notifications should be sent from the Credit Card Account/Dispute Notifications Email list. All active staff members will be displayed.

- Click Save.

Setup Taxes

If any of your goods/services are taxable, to setup your taxes you will need to configure:

- Product Tax Categories

- Tax Regions

- Tax Rules

- Tax Rates

- Tax Sets

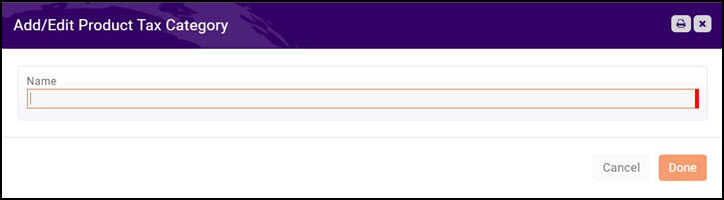

Setup Product Tax Categories

Under Product Tax Categories you will define the categories of products that are taxable. For example, if you are using the store module and are required to collect tax on certain products, you could set up the tax categories based on your store product categories (i.e. apparel, gifts, etc.).

- Click Setup

- Click Taxes in the Finance section.

- On the Product Tax Categories tab, click the Add button.

- Enter a Name for the category.

- Click Done.

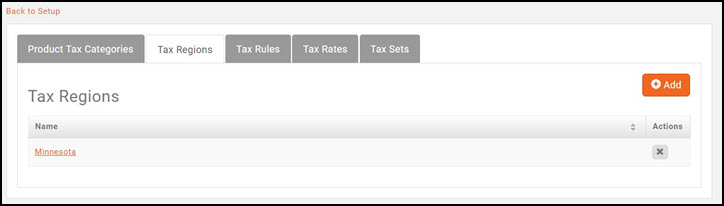

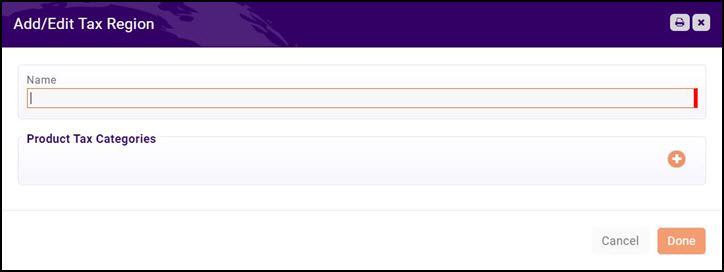

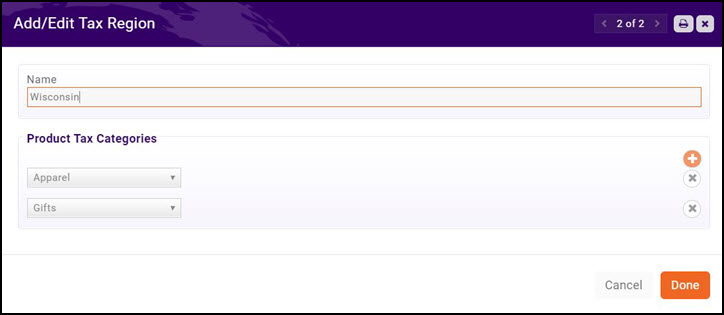

Setup Tax Regions

Tax regions are the region for which you must collect taxes. For example, if you must collect state taxes, you could name the region after the state.

- Click Setup

- Click Taxes in the Finance section.

- On the Tax Regions tab, click the Add button.

- Enter a Name for the new regions.

- Click the

button to associate the product categories that are taxable in this region.

button to associate the product categories that are taxable in this region.

- Repeat the step above to add additional product categories.

- Click Done.

| NOTE: When the product categories are added to the regions, these become the Tax Rules displayed on the Tax Rules tab. |

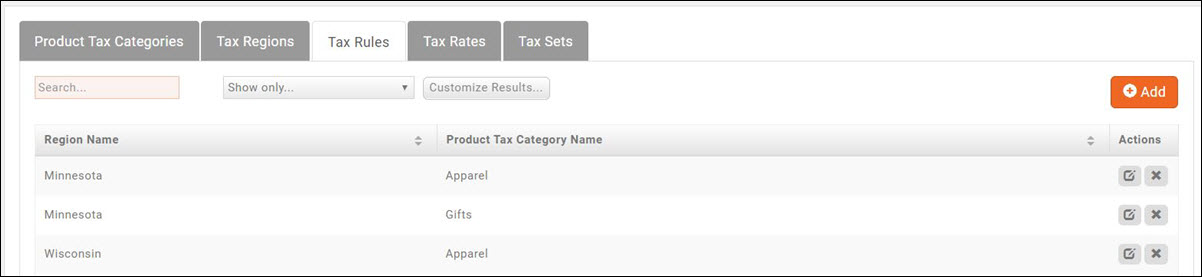

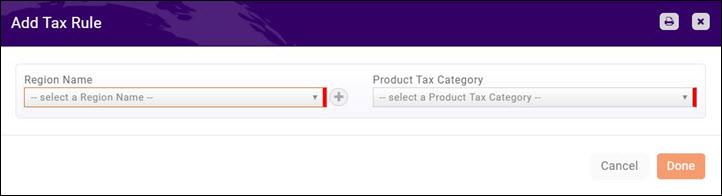

Setup Tax Rules

Tax rules allow you to identify which product tax categories are taxable in which Tax Regions. These tax rules may have been automatically created when you created regions, but you may add additional tax rules on the Tax Rules tab.

- Click Setup

- Click Taxes in the Finance section.

- Click the Tax Rules tab.

- Click the Add button to create a new tax rule.

- Select a Region Name from the drop down box. This is the region in which this rule will apply.

- Select a Product Tax Category from the drop down box. This is the product category that will be taxable in the selected region.

- Click Done.

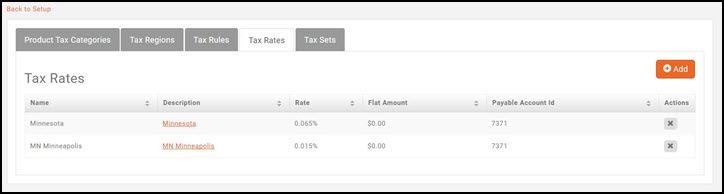

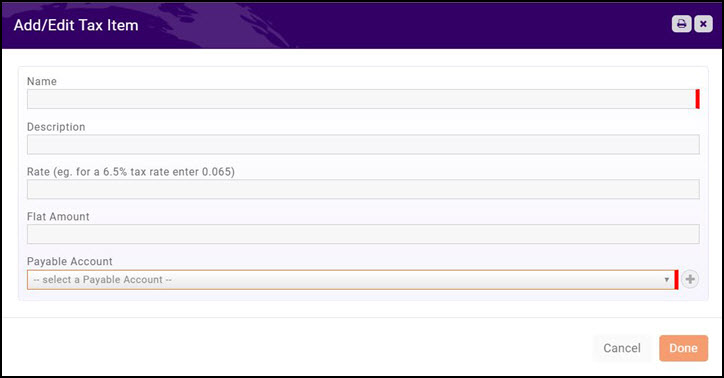

Setup Tax Rates

In most cases, sales tax rates must be configured for the physical location that the chamber/association has a presence (nexus). If you operate in multiple states, you would need to enter the tax rates for each state.

- Click Setup

- Click Taxes in the Finance section.

- On the Tax Rates tab, click the Add button.

- Enter a Name for the tax rate. For Example: Minnesota to identify a Minnesota tax rate.

- Enter an optional Description of the tax rate.

- Enter the rate in decimal format. For Example: 6.5% tax rate enter 0.065.

- If taxing is a Flat Amount enter the flat amount.

- Select the Payable Account that will be used for your taxes payable.

- Click Done.

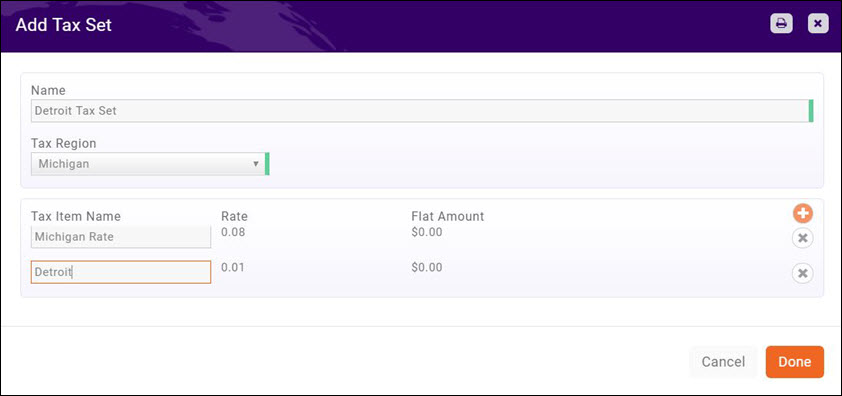

Setup Tax Sets

Tax sets allow you to combine several tax rates together. For Example: If you will have local, state, and county taxes, you can create a set to include each of these tax rates together so you can view the breakdown of the taxes by collecting agency.

| NOTE: Even if you are NOT combining several rates together, sets MUST be created to make the taxes available for selection when creating goods & services. |

- Create individual Tax Rates. Click Here for information on setting up individual tax rates.

- On the Tax Sets tab, click Add.

- Enter a name for the new tax set.

- Select the Tax Region from the drop down box.

- Click the

to select the tax rate to be included in the set.

to select the tax rate to be included in the set. - Repeat step 5 to add additional tax rates to the set. NOTE: If you are simply creating a tax set for an individual tax rate, you need only select the one associated tax rate.

- Click Done.

Set Up Your Invoice Template

A standard invoice template is built into the software. You can use this default template, or modify it to meet your business needs. You may also add a logo to the invoice. Alternately, you may import your existing template into the database.

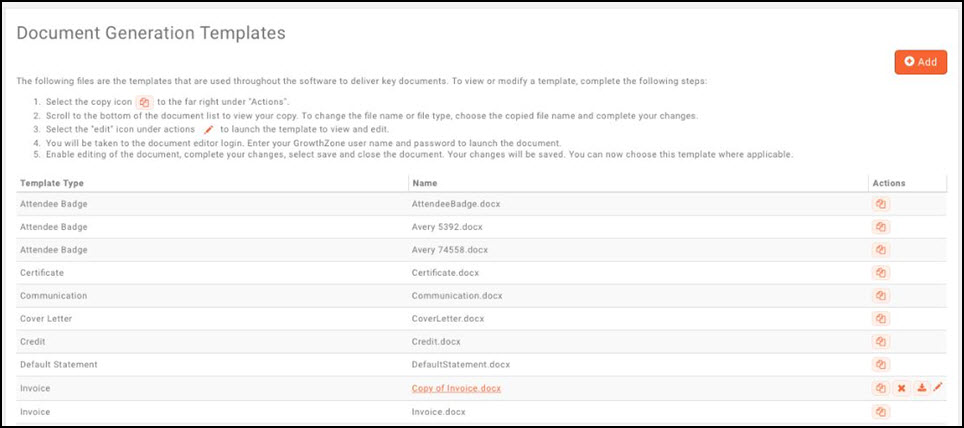

View/Modify Invoice Template (PC Instructions)

- Click Setup in the Navigation Panel.

- Click Document Generation Templates in the Document Generation section. A list of existing templates will be displayed.

- Click the copy icon

for the Invoice template.

for the Invoice template. - Click OK in the confirmation dialog box. A copy of the invoice template will be available in the list of templates.

- To view the template, click the pencil icon (Edit Template Document). The Open URL:Word Protocol dialog box will be displayed.

- Click Open URL:Word Protocol. You will be taken to the document editor login. Enter your GrowthZone user name and password to launch the document.

- Enable editing of the document.

- Complete your changes.

- Save your document.

Your changes will be saved. You can now choose this template where applicable.

Note: The default invoice template contains a system message. The message may be viewed and changed under Setup > Message Templates > System Invoice Message Template.

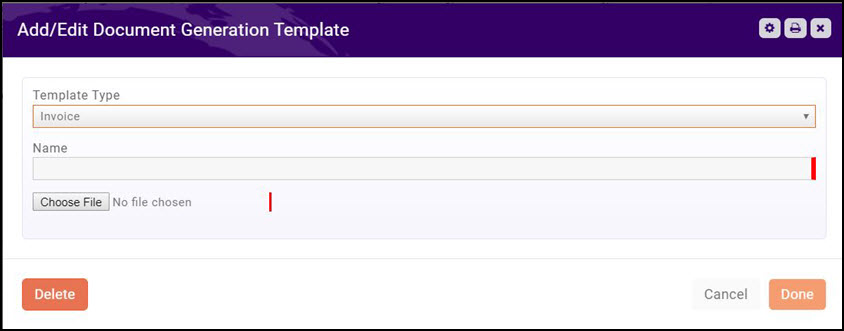

View/Modify Invoice Template (MAC Instructions)

- Click Setup in the Navigation Panel.

- Click Document Generation Templates in the Document Generation section. A list of existing templates will be displayed.

- Click the copy icon

for the Invoice template.

for the Invoice template. - Click OK in the confirmation dialog box. A copy of the invoice template will be available in the list of templates.

- To edit the copy, click the download icon

in the Actions column.

in the Actions column. - Open the downloaded file and make desired edits.

- Save the downloaded file.

- On the Document Generations Template screen, click the Add

button.

button.

- Enter a Name for the new template.

- Click Choose File to navigate to your saved copy and upload.

- Click Done. You will now be able to choose this template where applicable.

Configure Invoice & Statement Messages

Automatic messages may be included on your invoices and statements.

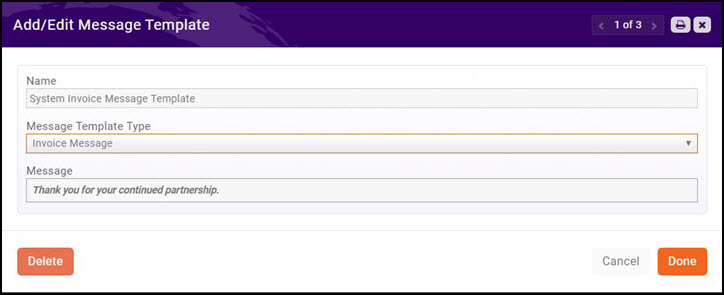

View Default Message Templates

- Click Setup in the Navigation Panel.

- Click Message Templates in the Finance section.

- Click the hyper-link for the message you wish to view.

| NOTE: You may edit an existing message template. However, if edited, a duplicate message template will be created. If you wish to edit, best practice is to enter a new Name for the template to avoid confusion. |

Configure Finance Defaults & Logo for Invoices & Statements

- Click Setup in the Navigation panel.

- Click General Settings in the Finance section.

- Click the pencil icon below Logo for Invoices and Statements. NOTE: the icon is visible when you dwell the mouse below Logo for Invoices and Statements.

- Click Upload to browse to the location of your logo.

- Click Open.

- Crop the image as needed, then click Crop & Save. The logo will now be displayed on all of your invoices and statements.

- For each of the listed accounts, select your default. This default will automatically be applied when you create goods & services, but you will be able to over-ride if needed.

- Select your Default Invoice Template. This is the template that will be used for all of your invoicing, but may be over-ridden. Refer to Setting Up Your Invoice Template for details on setting up a template.

- Select your Default Invoice Terms. Select the terms you wish to use by default.

- Transaction Deletion - This setting determines the number of days in which an invoice or payment may be deleted. Best practice is to limit the transaction window, as once an invoice is deleted, it is completed removed from your view which could cause issues with audits and/or reconciling. Additionally, there is risk that an invoice deleted from the database may already have been posted to your general accounting software. This would cause the two systems to become out of sync. The system provides a Void option that can be used instead of deleting. A void will create a counter entry.

- Automated Scheduled Billing The settings below allow you to automate the process of of generating invoices and processing payments (if a member has a stored profile).

- Click Use Automated Billing to enable the process.

- Enter Lead Time Days: Lead time days is the number of days ahead of Next Bill Date that invoices are created. You will go to the Pending Delivery tab under Billing to actually send the invoices. This lead time gives you time to review invoices, apply credits, and apply un-applied payments, etc. before sending out the invoices. NOTE: Billings that have stored payment profiles will be charged on the actual Next Bill Date. At that time both the invoice and payment are automatically created.

- My Association typically tracks and records information under the: This setting allows you to configure whether event registrations invoices should be tracked on the business (member) account tab, or the individual account tab.

- Invoice Editing:

- Click the Allow Invoice Numbers To Be Edited check-box if you wish to allow for invoices numbers to be edited after an invoice has been created. If this option is enabled, a warning message that will be displayed if an invoice number is duplicated. This setting is disabled by default.

- Next Invoice Number: This field displayed the next sequential invoice number, and would allow you to set the starting number for invoices. It will increase each time a new invoice is created.

- Click Save.

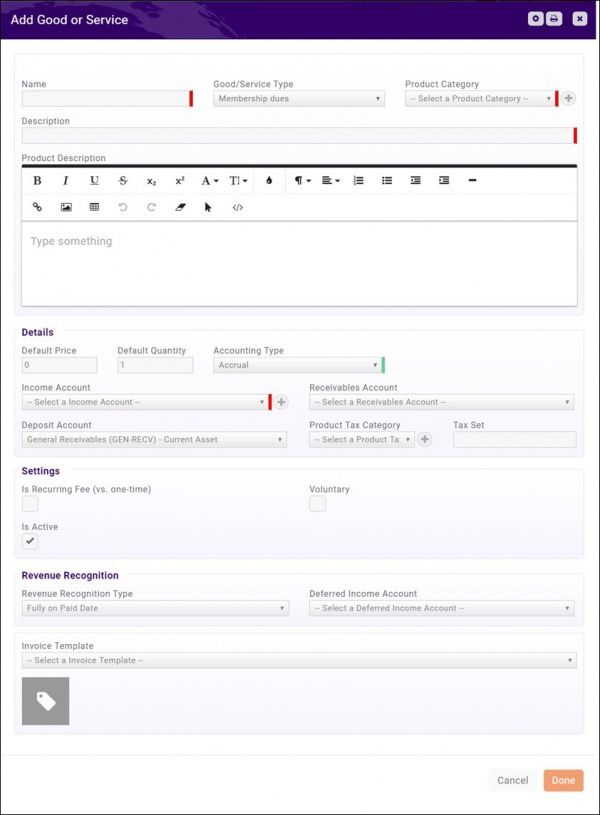

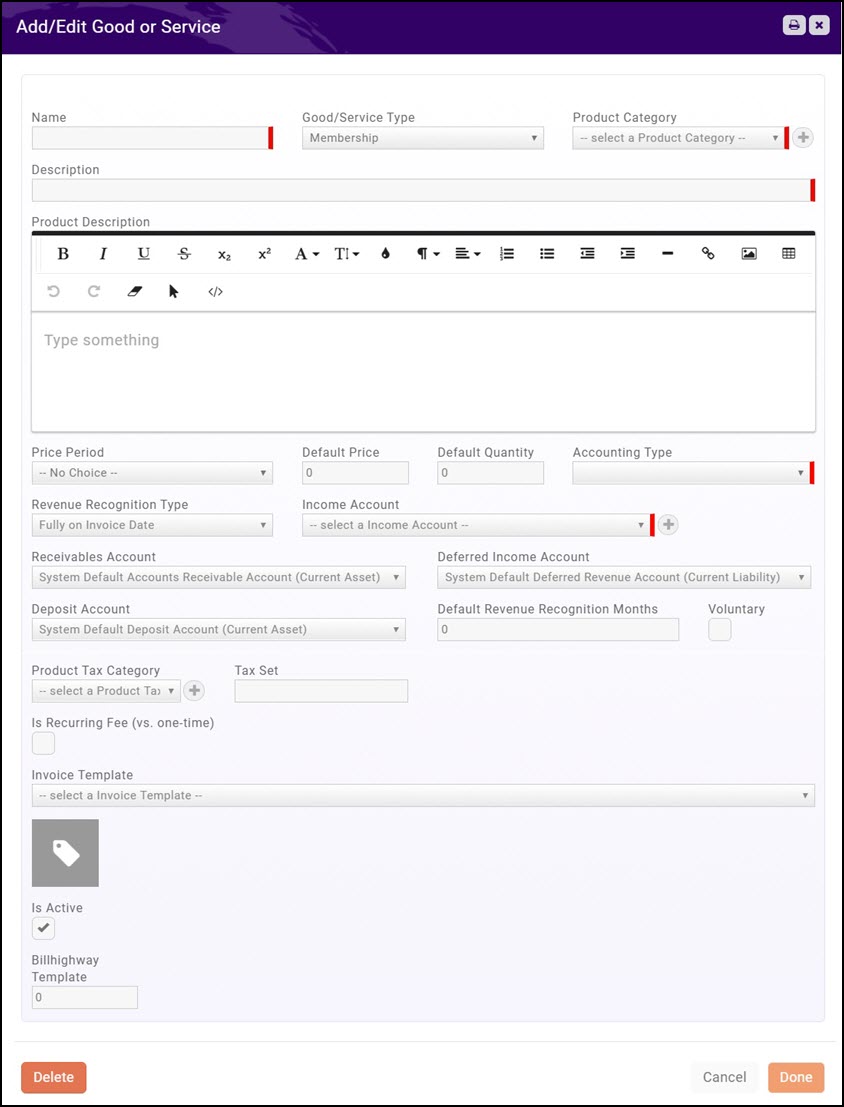

Setup Goods/Services

Goods and Services allow you to define the “products” for the memberships, services and products you provide. Upon initial setup of the system you will add high level categories of the items that you offer. Additional good/services may be added as your business requires.

- Click Setup in the Navigation panel.

- Click Goods/Services in the Services, Products and Commerce section. A list of Goods/Services currently configured in your system will be displayed.

- Click the New button.

- On the Add/Edit Good or Service screen, configure the following:

- Name - Provide a name for the good/service. This will be displayed when you are selecting goods or services.

- Good/Service Type - Select a type from the drop-down list. Type is used for filtering and reporting.

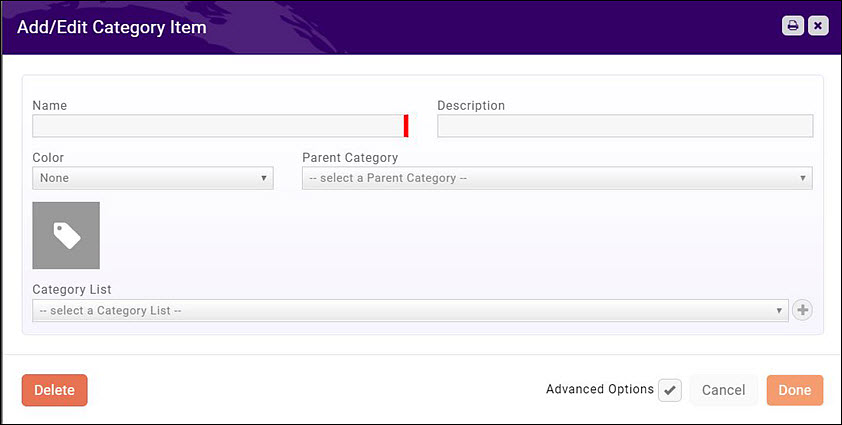

- Product Category - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the + sign.

-

- Enter a Name for the new product category.

- Enter a Description of the new product category.

- Select a Category List from the drop-down, or, to add a new category list, click the + sign.

- Click Done.

- Description - Enter a description of the good/service. This description is displayed in the Goods/Services list.

- Product Description - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description.

- Default Price - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service.

- Default Quantity - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service.

- Accounting Type - Select either Cash or Accrual. If Accrual is selected, the Revenue Recognition Type drop-down list will be displayed at the bottom of the screen. This is the account that is used to "hold" revenue throughout the recognition period.

- Income Account - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the + sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements. This is the account the will be credited when this goods & service is invoiced.

- Receivables Account - Select the accounts receivable account for this good/service.The drop-down list will be populated with the receivables account configured in your Chart of Accounts. This is the account that will be debited when this goods & service is invoiced.

- Deferred Income Account - Select the deferred income account for this good/service. The drop-down list will be populated with the deferred income accounts configured in you Chart of Accounts. If you have chosen to defer the revenue for this event to a specific point in time, the revenue will be held in the deferred income account until that point in time.

- Deposit Account - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts.

- Default Revenue Recognition Months - If the revenue for this good/service will be recognized over a period of time, enter the default number of months over which the revenue will be recognized.

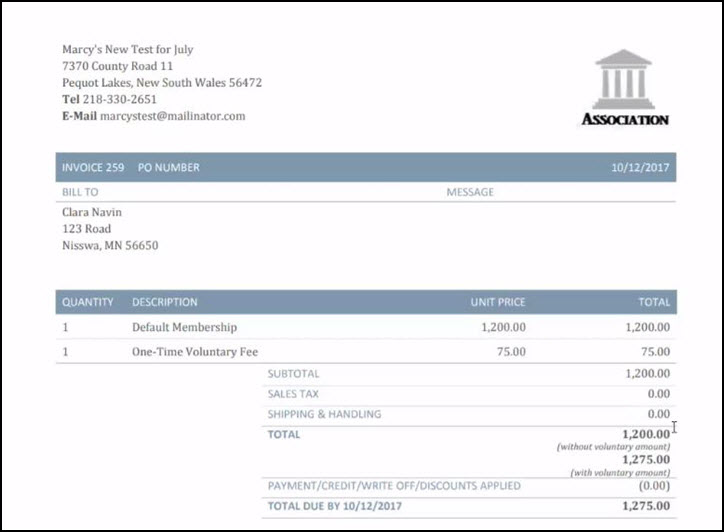

- Voluntary - Select this check-box if the fees for this good/service are voluntary. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount).

- Note: When creating a voluntary fee, you must select Membership as the Goods/Services type. Additionally, when the Voluntary check box is selected, the Accounting Type will automatically be set to Cash and the Revenue Recognition Type will be set to Fully on Paid Date.

- Product Tax Category - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the + button.

- Tax Set - If this good/service is taxable, select the appropriate tax set.

- Is Recurring Fee (vs. one-time) - Select this check-box if this is a recurring fee. Your membership dues, for example, are recurring fees.

- Revenue Recognition - From the Revenue Recognition Type select how you will recognize the revenue for this good/service. For example, if this is an event related fee, and you wish to defer revenue recognition until the start date of the event, you would select Fully on Event Start Date. NOTE: This option is only displayed if you have selected Accrual as Accounting Type for this goods/service.

- Invoice Template - Select the invoice template to be used for this good/service.

- Is Active - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service.

- Click Done to save the new good/service.

Setting up Voluntary Fees

Voluntary fees may be added to your member invoices and membership applications. With a simple set up you can easily ask for, collect and track voluntary amounts. You may wish to use voluntary fees to ask for extra funds for special projects, such as technology improvements, or fundraising to support specific committee. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, shown below, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount).

- Click Setup in the Navigation panel.

- Click Goods/Services in the Services, Products and Commerce section. A list of Goods/Services currently configured in your system will be displayed.

- Click the New button.

- On the Add/Edit Good or Service screen, configure the following:

- Name - Provide a name for the good/service. This will be displayed when you are selecting goods or services.

- Good/Service Type - Select Membership as the Goods/Services type.

- Product Category - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the + sign.

-

- Enter a Name for the new product category.

- Enter a Description of the new product category.

- Select a Category List from the drop-down, or, to add a new category list, click the + sign.

- Click Done.

- Description - Enter a description of the good/service. This description is displayed in the Goods/Services list.

- Product Description - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description.

- Price Period - Select how this good/service is billed. You may select: Annually, Monthly, One-time, Semi-annually, or Quarterly. An event good/service would be a one time fee.

- Default Price - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service.

- Default Quantity - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service.

- Voluntary - Select the Voluntary check box.

- Accounting Type - Select Cash.

- Revenue Recognition Type - Select Fully on Paid Date.

- Income Account - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the + sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements.

- Receivables Account - Select the accounts receivable account for this good/service.The drop-down list will be populated with the receivables account configured in your Chart of Accounts.

- Deferred Income Account - Select the deferred income account for this good/service. The drop-down list will be populated with the deferred income accounts configured in you Chart of Accounts. If you have chosen to defer the revenue for this event to a specific point in time, the revenue will be held in the deferred income account until that point in time.

- Deposit Account - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts.

- Default Revenue Recognition Months - Leave this set to 0.

- Note: When creating a voluntary fee, you must select Membership as the Goods/Services type. Additionally, when the Voluntary check box is selected, the Accounting Type will automatically be set to Cash and the Revenue Recognition Type will be set to Fully on Paid Date.

- Product Tax Category - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the + button.

- Tax Set - If this good/service is taxable, select the appropriate tax set.

- Is Recurring Fee (vs. one-time) - Select the recurring fee check box.

- Invoice Template - Select the invoice template to be used for this good/service.

- Is Active - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service.

- Click Done to save the new voluntary good/service.

Voluntary fees can be easily tracked by running the Voluntary Payment Report. Click here for more details.

Billing Functions

The Billing module provides the functions to review invoices, view overdue invoices, accept payments, as well as review reports on accounts receivables, and generate the reports needed to reconcile to your general accounting software.

| NOTE: Via the Billing module you can manage billing for multiple members simultaneously. You may also perform many of these functions individually on a member's Billing tab. |

The Billing module displays nine separate tabs to allow you to manage your billing processes:

- Overview - This tab provides a summary view into the present status of your billing.

- Pending Delivery - This tab will display a list of invoices that are currently waiting to be sent.

- Payments - This tab displays a list of all payments you have received.

- Invoices - This tab will display list of all invoices that have not yet been sent out.

- Upcoming Billing - This tab displays a list of all future billing.

- Upcoming Recognition - This tab will display a list of all revenue to be recognized in the future.

- Deposits - This tab will display a list of all previous deposits.

- Credit Memos - This tab will display a list of all previous credit memos.

- Accounting Summary - This tab will display your accounting summary.

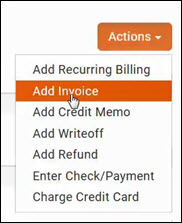

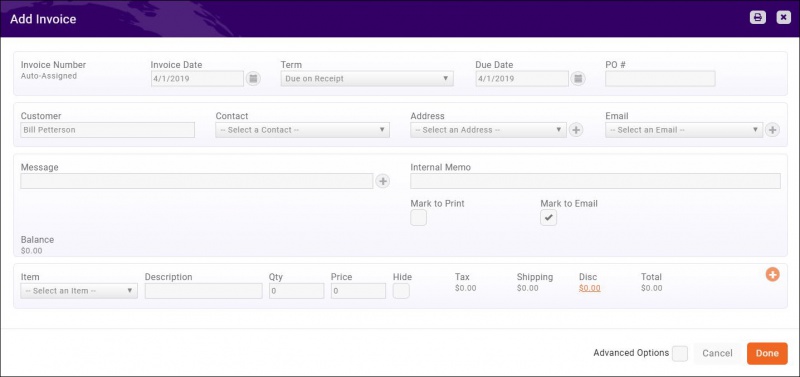

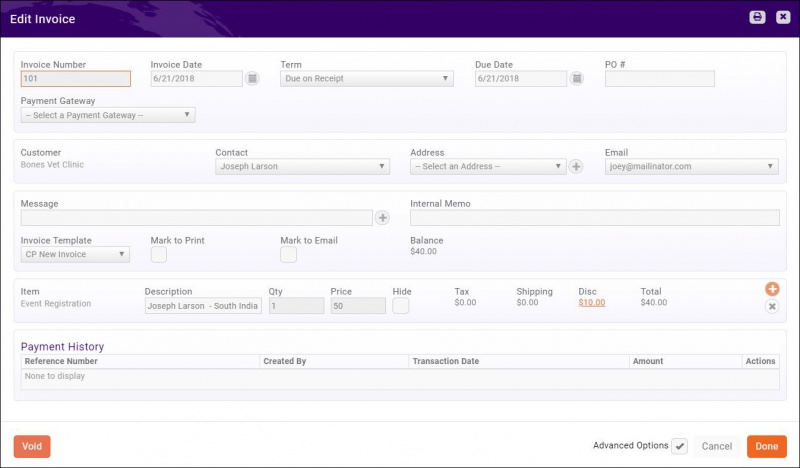

Create a Single Invoice

Single invoices may be created directly on a contact or individual's Billing tab, or from the Billing module. Click Here to view a brief tutorial on creating a single invoice.

- On a Contact's Billing tab, click the down arrow on the Actions button.

- Click Add Invoice.

- Configure the following as needed:

- The Invoice Number will default to Auto Assigned, however clicking the Auto Assigned link will allow you to enter your own invoice number. Best practice is to allow the system to auto-assign, however, if you choose to enter an invoice number, the system will trigger an error if you have entered a duplicate number.

- The Invoice Date will default to the current date. You may change this by entering a new date, or clicking the calendar icon and selecting a date.

- The Term will default to the terms you defined in the Finance General Settings. You may select different terms from the drop-down list, or select Select a Term from the list and click the

to add a new term. Click Here for more information on setting up your terms and conditions.

to add a new term. Click Here for more information on setting up your terms and conditions. - The Due Date will automatically be populated with a date derived from the Terms you have selected. For Example: If you have selected Due on Receipt the due date will be the current date. You may over-ride this date by entering a date, or clicking the calendar icon to choose a date.

- PO # - If you have been provided with a PO # you may entered it here. NOTE: If provided with a PO # after an invoice is sent, you may add this by editing the invoice.

- The Purchase Date will default to the current date. You may change this by entering a date, or clicking the calendar and selecting a date.

- Customer will be automatically populated.

- Contact: Select a contact from the drop-down list. If no contact is selected, the contact chosen as the billing contact will be included on the invoice.

- Address: Select an address from the drop-down list. This is optional, however, if you wish to print and mail this invoice, the address is required. Addresses in the drop-down will be those associated to the organization. If no address is available in the drop-down, or if you wish to add an additional address, click Select an Address in the drop-down, and click the

to open the Address dialog box.

to open the Address dialog box. - Email: Select an email from the drop-down list. This is optional, however, if you wish to email this invoice, email is required. Emails in the drop-down will be those associated to the organization. If no email is available in the drop-down, or if you wish to add an additional address, click Select an Email in the drop-down, and click the

to open the Email Address dialog box.

to open the Email Address dialog box. - Message: Enter a message that you would like to appear on the invoice. This is optional. If entered, it will display under the address on the invoice.

- Internal Memo: Enter a memo that will viewed in the back office only (optional).

- Choose how you would like to deliver this invoice. By making this selection, the invoice will be added to your list of Pending Delivery in the Billing module. Mark to Print, Mark to Email. You may select both options.

- Select a goods/service from the Item drop-down list. The list will be populated with all goods/services that have been configured in your system. Click Here for further information on setting up goods/services. You may add additional items by clicking the

icon.

icon. - Description: The description will be populated with the default description associated to the item, you may over-ride.

- Price: The price will be populated with the default price associated to the item. You can over-ride.

- Quantity: Enter the quantity of this item you wish to include on the invoice.

- Hide: If adding multiple goods/services to this invoice, and you wish to roll all items into the first item, click the Hide check-box.

- If the item has been configured as taxable, the Tax field will automatically be populated.

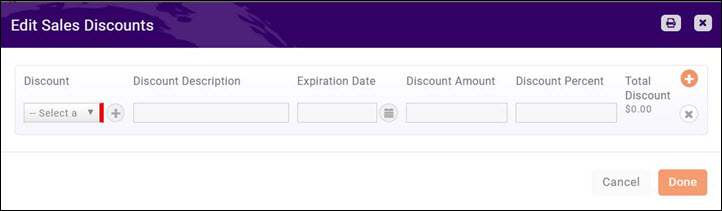

- Disc: (Optional) If you wish to add a discount to this item, click the Disc hyper link.

-

- Select an option from the Discount drop-down, or click the

to add a new discount. The details of the discount (description, expiration date, discount amount, discount percent) will automatically be populated. You can make changes as needed. The Total Discount field will be updated based on your settings. Click Done when discount setup is completed.

to add a new discount. The details of the discount (description, expiration date, discount amount, discount percent) will automatically be populated. You can make changes as needed. The Total Discount field will be updated based on your settings. Click Done when discount setup is completed.

- Select an option from the Discount drop-down, or click the

- Mark to Print and/or Mark to Email: If you wish to mark this invoice for future printing or emailing, select desired option. This will place the invoice on the Pending Delivery list in the Billing Module.

-

- Advanced Options: By default, the system will use the default payment gateway and invoice template configured in your general finance settings. If you wish to over-ride the defaults, slick the Advanced Options check-box, and select desired gateway and template.

- Click Done. The invoice is now created.

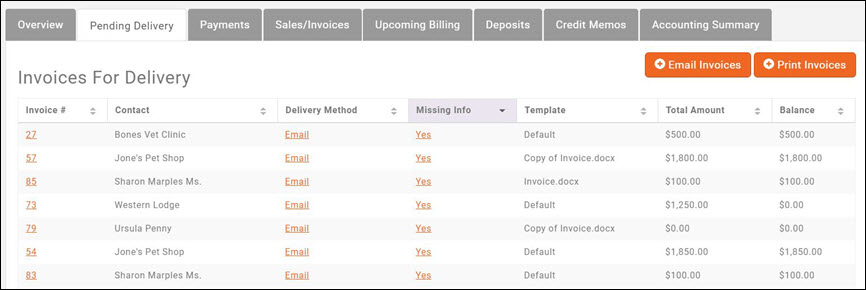

Deliver Invoices

The Pending Delivery tab in the Billing Module will provide a list of invoices that have not been sent out. These invoices include invoices created when you run your recurring billing, when an invoice is created through the back-office, or invoices created when a member requested to be invoiced, for example for an event or membership application.

You may process and send out the invoices in the following manner:

- Select Billing in the Navigation Panel.

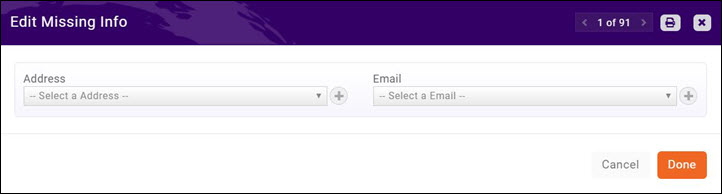

- Click the Pending Delivery tab. A list of all invoices that have not been sent will be displayed. When an invoice is created, you select whether the invoice is to be emailed, printed or both. This choice is displayed in the Delivery Method column. If the database does not have the information needed (address and/or email address) this will be noted by Yes in the Missing Info column. You may click the Yes hyper-link to add the missing information if available.

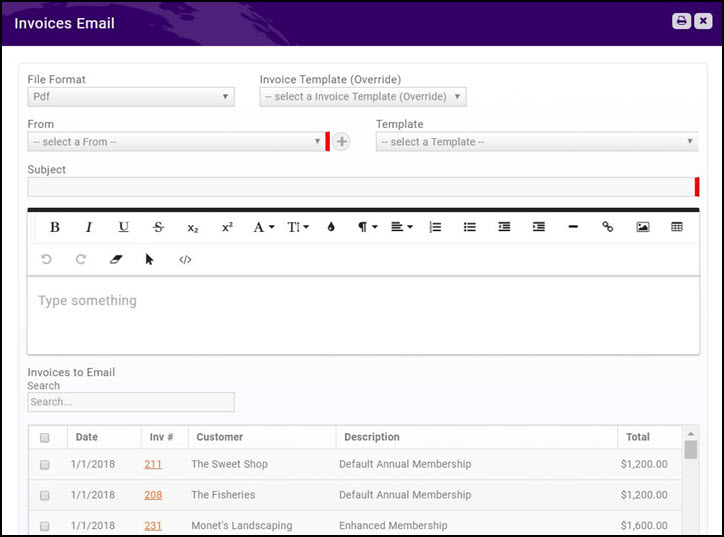

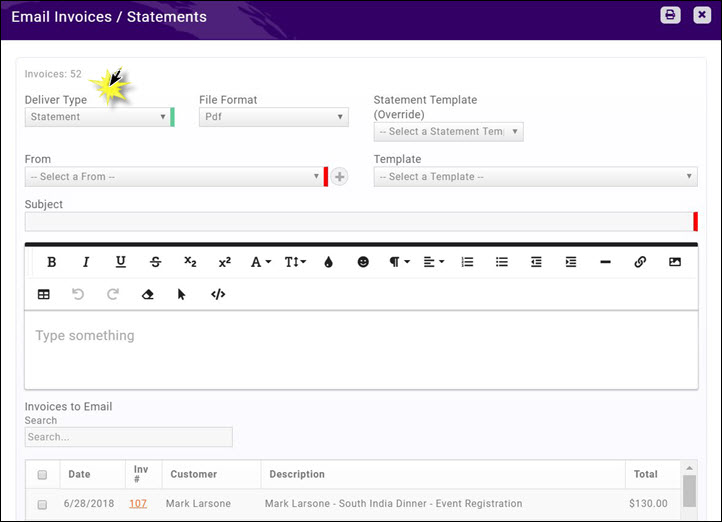

Deliver Invoices via E-mail

- Click Billing in the left-hand navigation panel.

- Click the Pending Delivery tab. A list of all invoices pending delivery will be displayed. NOTE: Invoices that do not have an email will be indicated by Yes in teh Missing Info column. Click the Yes link to update the email address.

- Click the Email Invoices button. A list of invoices to be emailed will be displayed. NOTE: If an email address is not available, the invoice will NOT be displayed in the list. Correct this as described previously.

- Configure the following email settings:

- File Format - Select either PDF or Word Format.

- Invoice Template (Override). This option allows you to over-ride the invoice template that is associated to the fee items included in the invoices you are sending out. You may, for example, wish to select a different invoice template when sending out past due invoices.

- From - Select the from email address.

- Template - If you have created an email template to be used when sending invoices you may select it. If you are not using a template, you will simply be able to type your message.

- Subject - Enter a subject for the email, and type your message into the text box, if you are not using a template.

- Select the Invoices to Email. You may select invoices individually, or click the top check-box to select all invoices in the list. You can search for specific invoice by typing into the Search box.

- Click Done. Your selected invoices have now been emailed.

| NOTE: If an email address is marked as invalid, the email will not be sent out and the Missing Info column on the Pending Delivery tab will be updated to Yes. When you click on pending invoices' "yes" it will open up the dialog to recheck and validate the email address. See Managing Invalid Emails for further instructions. |

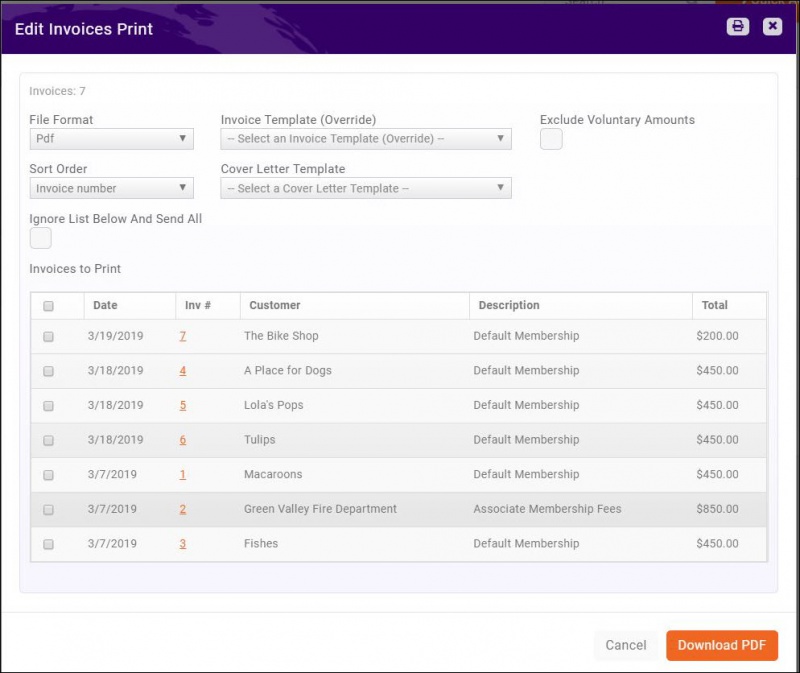

Print Invoices for Delivery

- In the Billing module, select the Pending Delivery tab.

- Click Print Invoices.

- Select the File Format you wish to use.

- Invoice Template (Override). This option allows you to over-ride the invoice template that is associated to the fee items included in the invoices you are sending out. You may, for example, wish to select a different invoice template when sending out past due invoices.

- Select your Cover Letter Template (optional)

- Select desired Sort Order. This will set the order in which the invoices will be printed. You may choose: Customer, Date or Invoice Number.

- Select the Ignore List Below And Send All check-box if you wish to print all invoices. If de-selected, the system will only print the first 500 invoices.

- Select the invoices you wish to print. You may select invoices individually, or click the top check-box to select all the invoices in the list.

- Click Done. The invoices will download and you may proceed with printing.

| NOTE: Only invoices for which you have address information will be available for printing. Correct missing address information as previously described. |

Re-deliver Past Due Invoices

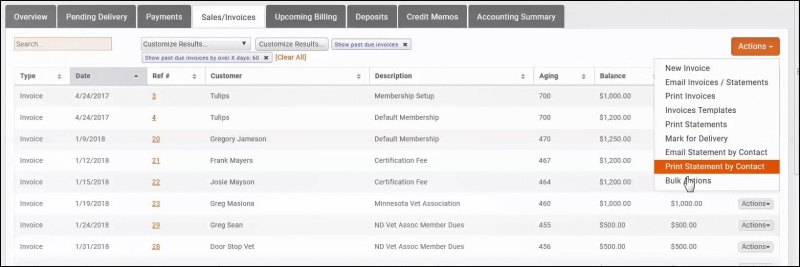

You can view all invoices on the Sales/Invoices tab. To view only over-due invoices select Past Due Invoices from the Show Only drop-down list. The list of invoices will refresh displaying on your past due invoices.

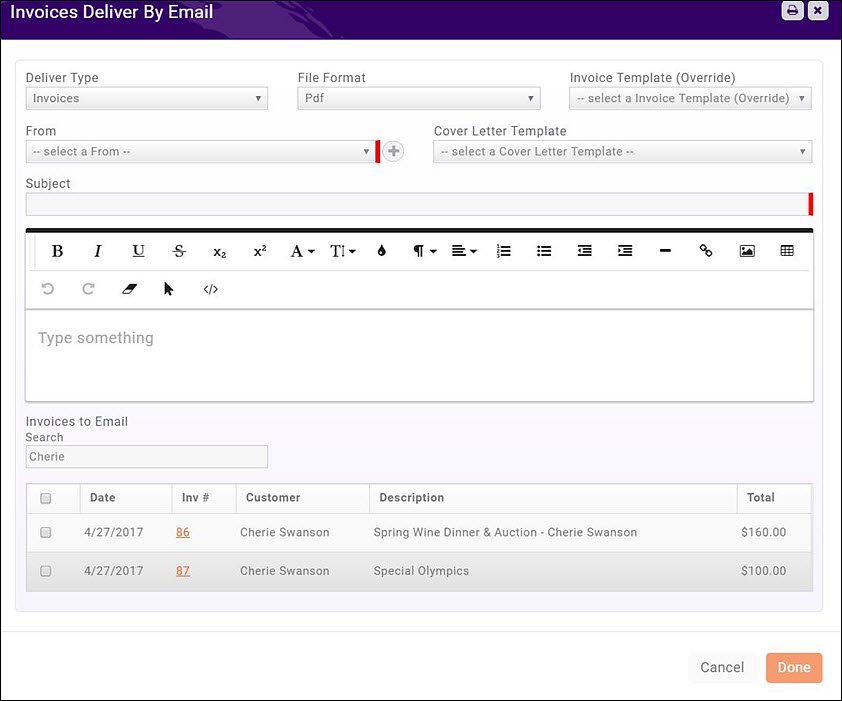

Re-deliver Past Due Invoices via Email

- On the Sales/Invoices tab, filter the list to Past Due Invoices as described previously.

- Click the drop-down arrow on the New Invoice button.

- Click Email Invoices/Statements.

-

- Select Invoice from the Deliver Type drop-down list.

- Select the desired File Format from the drop-down list.

- Select the desired invoice template from thehInvoice Template (Override) drop-down list.

- Select a From address from the list.

- Select a Cover Letter Template from the list.

- Enter a Subject and type in your message if you have not selected a cover letter template.

- Click the check-box for the invoices you want to email, or click the top-most check-box to select all invoices in the list.

-

- Click Done. The Past Due invoices have now been emailed.

Re-deliver Past Due Invoices via Print

- On the Sales/Invoices tab, filter the list to Past Due Invoices as described previously.

- Click the drop-down arrow on the New Invoice button.

- Click Print Invoices.

- Select the desired File Format from the list.

- Select the desired Invoice Template from the list.

- Select the desired Cover Letter Template from the list.

- Click the check-box for the invoices you want to print. Click the top-most check box to select all invoices in the list.

- Click Done to print the invoices.

Deliver Statements

Email Statements

- On the Sales/Invoices tab, filter the list as needed to find the members to whom you wish to deliver statements.

- Click the Actions button.

- Click Email Invoices/Statements.

-

- Select Statement from the Deliver Type drop-down list.

- Select the desired File Format from the drop-down list.

- (Optional) Select the desired statement template from the Statement Template (Override) drop-down list. This option allows you to over-ride the statement template you selected in your general finance settings. If no selection is made, the default will be used.

- Select a From address from the list.

- Select the template that you wish to use for the body of the email from the Template drop-down list.

- Enter a Subject and type in your message, if you have not selected a template.

- Click the check-box for the members to whom you want to send statements, or click the top-most check-box to select all members in the list.

-

- Click Done. Statements are now emailed.

Print Statements for Delivery

- On the Sales/Invoices tab, filter the list as needed to find the members to whom you wish to deliver statements.

- Click the Actions button.

- Click Print Statements.

- Select the desired File Format from the list.

- Select the statement template the you wish to use from the Document Generation Template drop-down list.

- Select the desired Cover Letter Template from the drop-down list.

- Click the check-box for the statements you want to print. Click the top-most check box to select all invoices in the list.

- Click Done to download and print the statements.

Accept Payments

The Invoice tab will display all of your invoices, whether they have been paid or not. You can use this tab to analyze aging and make payments. The list may be filtered to just open invoices to make it easier to manage payments.

You can view the details of an invoice by clicking into the hyper-link for a particular invoice.

- Select Billing in the Navigation Panel.

- Click the Invoices tab. Customize the list to display only unpaid invoices to make it easier to locate the invoices for which you are accepting payment.

- Click the payment type in the Actions list. You may choose: check or credit card.

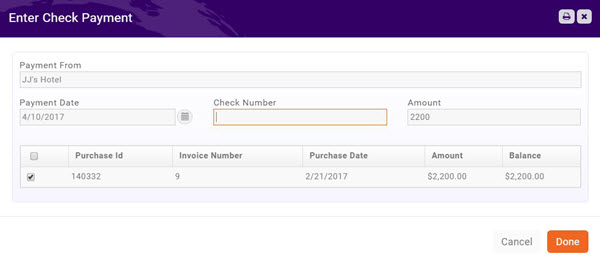

Accept a Check Payment

- Click the Enter Check icon in the Actions list.

- Payment From - This will display the member the invoice was sent to. You may change this if necessary.

- Payment Date This will display today's date. You may change this at initial creation of payment, however, once the payment is saved you will not be able to change the date.

- Check Number - Enter the check number as a reference.

- Amount - The full amount of the invoice will be displayed by default. You may change this if necessary.

- Click Done.

Accept a Credit Card Payment

- Click the Enter Credit Card icon in the Actions list.

- Payment From - This will display the member the invoice was sent to. You may change this if necessary.

- Stored Payment Methods If a credit card has been stored for this member, you will be able to select this payment from the list.

- Card Information - Select the appropriate Payment Gateway.

- Enter Card Information - Enter the required credit card information fields.

- Store Payment Info For Future - if the member wishes you to do so, you may click this check-box to store this credit card number for future use.

- Amount - enter the amount to process in this transaction. The amount due on the invoice will be displayed by default, but you may change this.

- Click Done to process the credit card payment.

| NOTE: If processing credit cards outside of the GrowthZone software, best practice is to enter the payment as a check payment, described above. In the check number field, enter the last four digits of the credit card. |

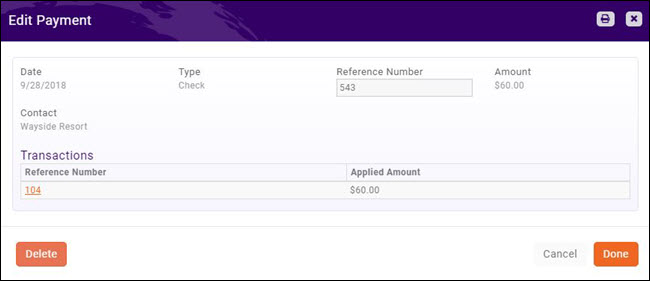

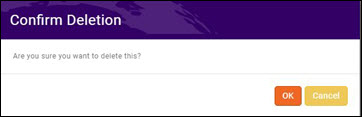

Delete a Payment

You may delete a payment from a member's Billing tab, or from the Payments tab in the Billing Module.

- Select the member's Billing tab.

- Click the hyper-link for the payment that you wish to delete.

- Click the Delete button.

- Click OK to confirm that you wish to delete this payment.

The payment will be deleted, and the balance(s) on the invoice(s) to which the payment was applied will be adjusted.

| NOTE: You may only delete a payment if it has NOT been deposited, or if it is NOT a credit card payment. In these cases, the Delete option will not be displayed. |

View Payments

Within the Billing module, you will be able to search for and view all payments received.

- Click Billing in the left-hand navigation panel.

- Click the Payments tab. A list of all payments will be displayed.

You can search payments by entering the reference number in the search box. Further filtering options are available by selecting Show Only or Customize Results.

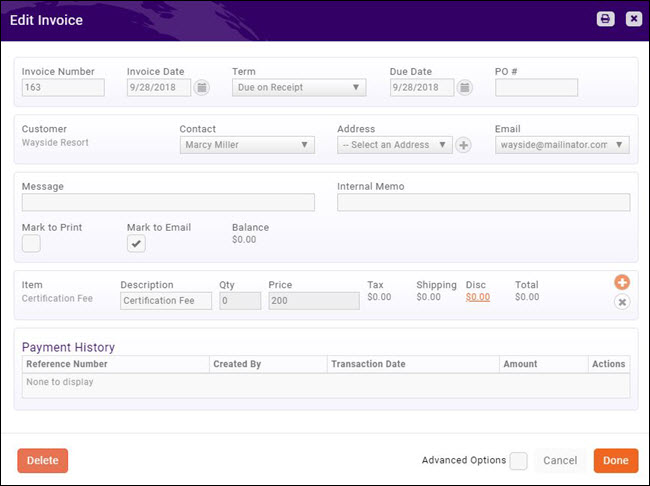

Void an Invoice

You may void an unpaid invoice by selecting it on the Billing module Invoices tab.

| NOTE: The Void button will only be displayed if the invoice date is outside of the Allow Deletion for (days) window established in your finance settings. If the invoice date is within the window, a Delete button will be displayed. For auditing purposes, best practice is to void invoices versus deleting invoices. Refer to Configure Finance Defaults for further details. Additionally, the void options is NOT available if a payment has been made against the invoice. |

- Select Billing in the Navigation Panel.

- Click the Invoices tab. A list of all invoices is displayed, whether open or paid. To easily find the invoice to be voided, filter the results to Open Invoices.

- Click the hyper-link in the Inv # column for the invoice you wish to void.

- Click the Void button.

- Click OK to confirm.

| NOTE: There is no function to restore a voided invoice. If you do need to do this, best practice is to simply recreate the invoice. |

Delete an Invoice

The ability to delete an invoice is available as long as the invoice date is within the window you have configured in your General Finance settings. See Configure Finance Defaults for further information. Additionally, the Delete option will not be available on an invoice that has a zero balance. If you wish to delete and invoice that has a zero balanced, you must first delete the payment, then delete the invoice. See Delete a Payment. NOTE: Invoices may not be deleted if paid.

Invoices may deleted on the member's Billing tab, or on the Sales/Invoices tab in the billing module.

- Click the hyper-link for the invoice you wish to delete.

- Click the Delete. NOTE: If you are not within the window configured in General Finance settings, the delete button will not be displayed. See Configure Finance Defaults for further information.

- Click OK to confirm the deletion.

| NOTE: Best accounting practice is to NOT delete invoices. Best practice is to void an invoice. |

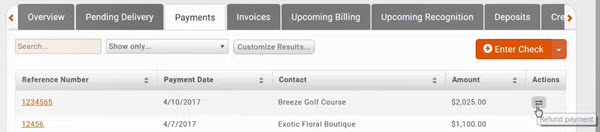

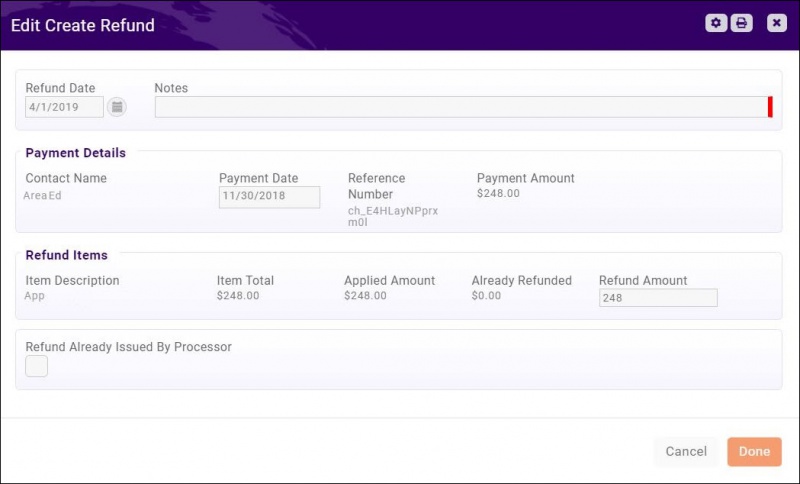

Refund a Payment

The Payments tab will display a list of all payments you have received. From this tab, you will be able to refund a payment.

| NOTE: If your payment processor is GrowthZone Pay, Authorize.net or Bill Highway the refund will be performed by the credit card processor. If you are refunding a cash, check, or credit card payment from an outside processor, you will need to follow up with the appropriate action (i.e. cut a check for the refund, process the refund through the outside processor. |

- Select Billing in the Navigation Panel.

- Click the Payments tab.

- Click the Refund Payments icon in the Actions column. NOTE: If the icon is not displayed, this indicates that a refund has already been created for the item.

- Refund Date - The date will default to today's date. You may change it if necessary.

- Enter Notes. This is a required field.

- In the Refund Items section, the full amount of the fee items will be displayed.

- Refund Already Issued By Processor: If this is a refund that is being issued for a credit card, selecting this option will record the refund in the GrowthZone software, without a refund being issued back to the purchaser on the processor side. This is useful when a credit card dispute is lost and the processor automatically refunds the money back to the purchaser as no refund is automatically reflected on the GrowthZone side and must be done manually. Checking the box “Refund already issued by processor” will allow the transaction to be properly refunded so income is not overstated.

- Click Done.

You can run the Refund Report (Reports > Refund Report) to view a list of all refunds that have been performed. Click Here for information on the Refund Report.

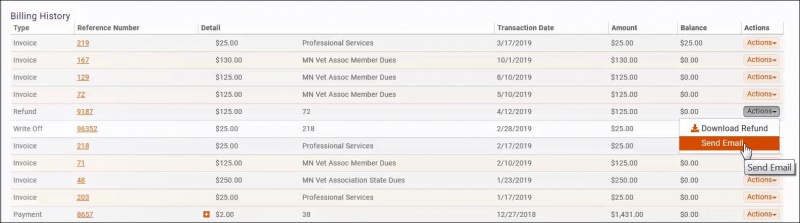

| NOTE: If the member needs a record of the refund, go to the member's Billing tab, and click the Actions button for the desired refund. You can download the refund receipt or email the receipt to the member.

|

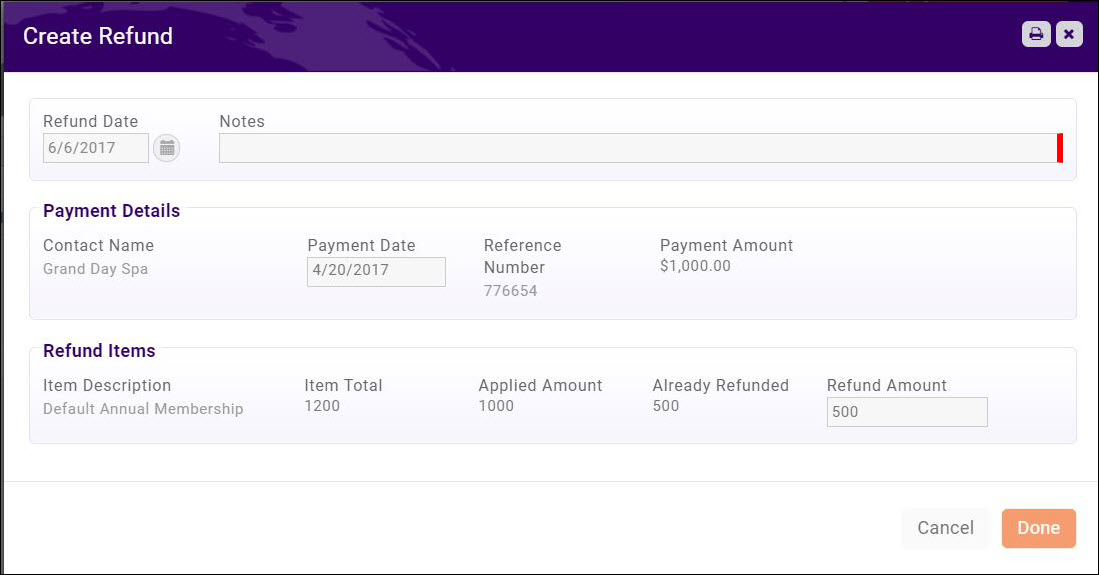

Issue a Partial Refund

The Payments tab will display a list of all payments you have received. From this tab, you will be able to do a partial refund.

- Select Billing in the Navigation Panel.

- Click the Payments tab.

- Click the Refund Payments icon in the Actions column for the payment to which you wish to apply a partial payment. NOTE: If the icon is not displayed, this indicates that a refund has already been created for the item.

- Refund Date - The date will default to today's date. You may change it if necessary.

- Enter Notes. This is a required field.

- In the Refund Items section, the full amount of the fee items will be displayed. To issue a partial refund, enter the amount you wish to refund.

- Refund Already Issued By Processor: If this is a refund that is being issued for a credit card, selecting this option will record the refund in the GrowthZone software, without a refund being issued back to the purchaser on the processor side. This is useful when a credit card dispute is lost and the processor automatically refunds the money back to the purchaser as no refund is automatically reflected on the GrowthZone side and must be done manually. Checking the box “Refund already issued by processor” will allow the transaction to be properly refunded so income is not overstated.

- Click Done.

You can run the Refund Report (Reports > Refund Report) to view a list of all refunds that have been performed. Click Here for information on the Refund Report.

| NOTE: If you are using GrowthZone Pay, a partial refund will appear on the person's statement a little differently than a full refund if the original charge has not yet fully processed. The credit won't appear as a separate line item on the bank statement. Instead, the original charge should post for a lower amount on the customer's statement. This will especially be an issue when a partial refund is issued shortly after the original charge was made. For example, a charge is made for $830.00. A partial refund is issued for $35.00 while the original charge was still listed as pending so the charge was updated to $795.00. There will not be a separate transaction for the refund issued. If the customer has questions on how this shows on their statement, they should contact their bank directly. |

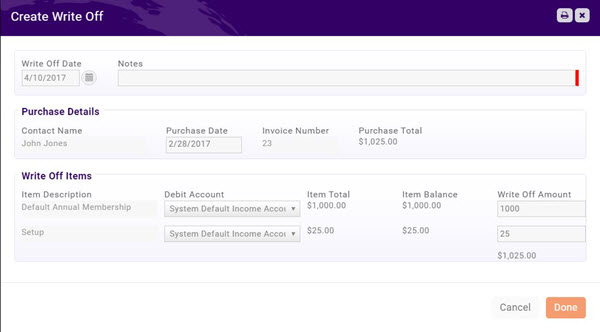

Create a Write Off

When needed, you may create a write-off on the Billing module Invoices tab.

- Select Billing in the Navigation Panel.

- Click the Invoices tab. Customize the list to display only unpaid invoices to make it easier to locate the invoice you wish to write-off.

- Click the Create Write Off icon in the Actions column.

- Configure the following as necessary:

- Write Off Date - The date will default to the current date.

- Notes - This field is for internal use and is a required field.

- Purchase Details - This field displays the invoice details, and may not be edited.

- Write Off Items - This field displays the fee items on the invoice, and the associated account. The Write Off Amount will be populated with the original amount on the invoice.

- Click Done to complete the write-off.

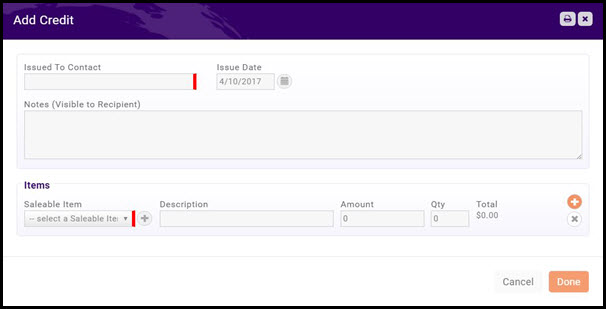

Add a Credit Memo

You may add a Credit Memo on the Credit Memos tab.

- Select Billing in the Navigation Panel.

- Click the Credit Memos tab. A list of current credit memos is displayed.

- Click the New Credit button.

- Configure the following:

- Issued To Contact - Type the name of the contact to which you are issuing the credit. Type ahead functionality will display options that match your input.

- Issue Date - The date will default to the current date. You may change this if needed.

- Notes (Visible to Recipient) - Enter notes describing the credit. These will be visible to the recipient in the Info Hub.

- Items

- Saleable Item - Select the type of goods/service to which this credit will be applied. You may click the + button to dynamically add additional saleable items.

- Description - Enter a description.

- Amount - Enter the dollar value for the credit.

- Quantity - Enter the quantity (this is applied to the credit amount).

- Click Done.

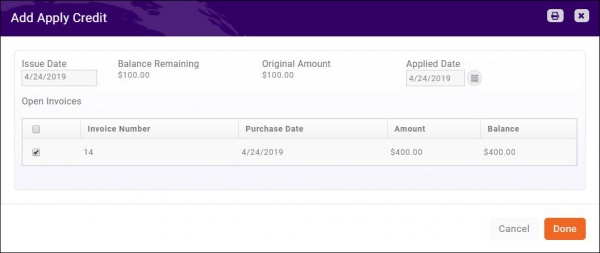

Apply a Credit Memo

- Select the desired contact's Billing tab. Any available credits will be displayed in the Summary section.

- Scroll to the Billing History section.

- Click the Actions button on the Credit you would like to apply.

- Click Apply Credit in the dropdown menu.

- Check the boxes next to the invoice(s) you would like the credit applied to.

- Click Done.

Notice the invoice selected will be paid with the credit applied. If there are additional fees due, the remaining balance will reflect in the Billing History.

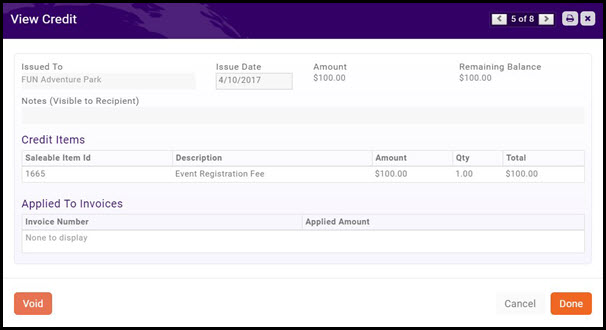

Void a Credit Memo

- Select Billing in the Navigation Panel.

- Click the Credit Memos tab. A list of current credit memos is displayed.

- Click the hyper-link for the Credit Memo you wish to void.

- Click the Void button.

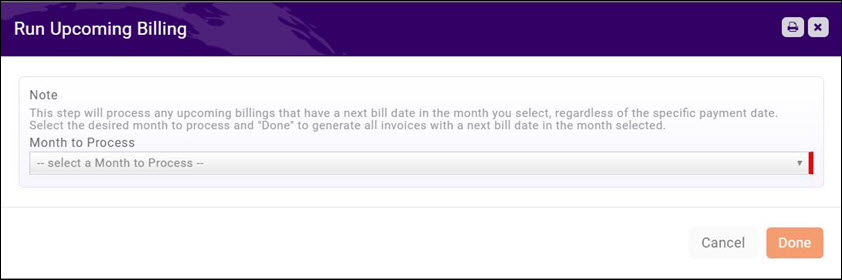

Generating Invoices for Upcoming (Recurring) Billing

The Upcoming Billing tab displays a list of all recurring billing (i.e. recurring membership dues). From this tab, you can review/manage your upcoming billing. You can also generate the invoices needed.

To generate invoices for your recurring fees:

- On the Upcoming Billing tab click Run Upcoming Billing.

- Select the month for which you want to generate invoices. This step will process any upcoming billings with a due date in the month that you select.

- Click Done.

Invoices for the month selected will be created, and will be available for processing on the Pending Delivery tab.

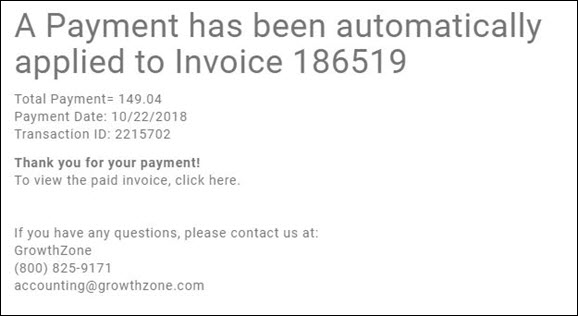

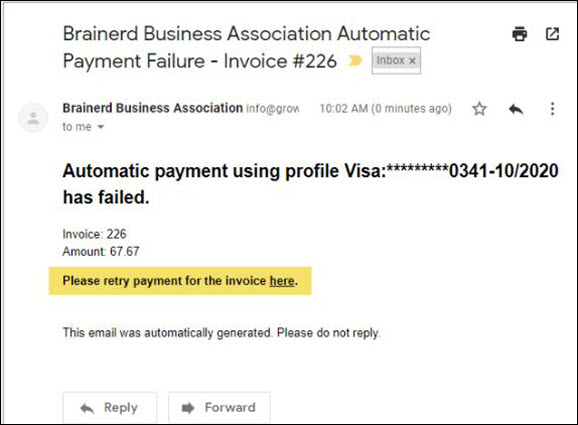

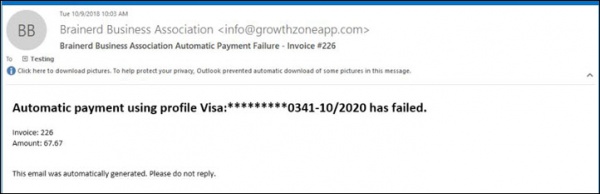

Invoice Processing for Stored Payment Profiles

When invoices are generated for members who have stored payment profiles, and have agreed to automatic charges, the day invoices are generated for upcoming billing, the stored payment profile will be charged. An Automated Message (Auto Payment Receipt) will be sent to the member when the payment is processed.

Additionally, an automated message (Growth Zone Pay Charge Failed) notification will be sent to the member if the charge fails. In this email, there is a link for the contact to go and pay/update their payment information.

Staff members who have subscribed to the Auto-payment Failed notification will also receive an email.

| NOTE: An attempt will be made to charge the account again every 24 hours for five days when a card or bank account has failed. |

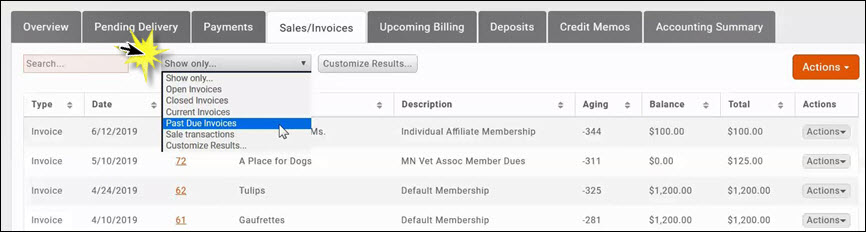

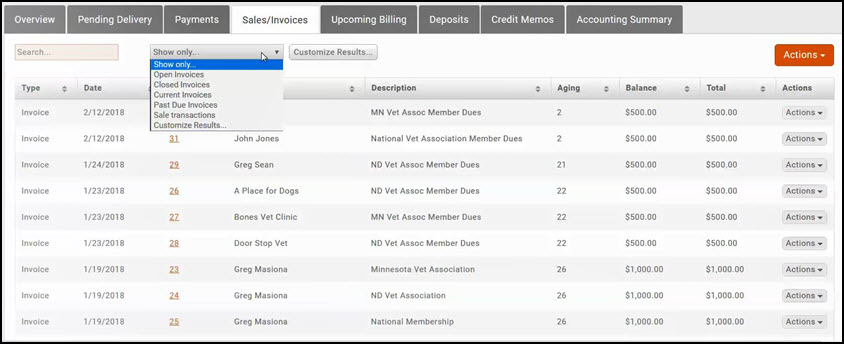

Reviewing Invoices

The Sales/Invoices tab in the Billing module provides a listing of all invoices you have created.

Click the drop-down arrow in the Show Only box, to filter the list by:

- Open Invoices

- Closed Invoices

- Current Invoices

- Past Due Invoices

- Sales Transactions

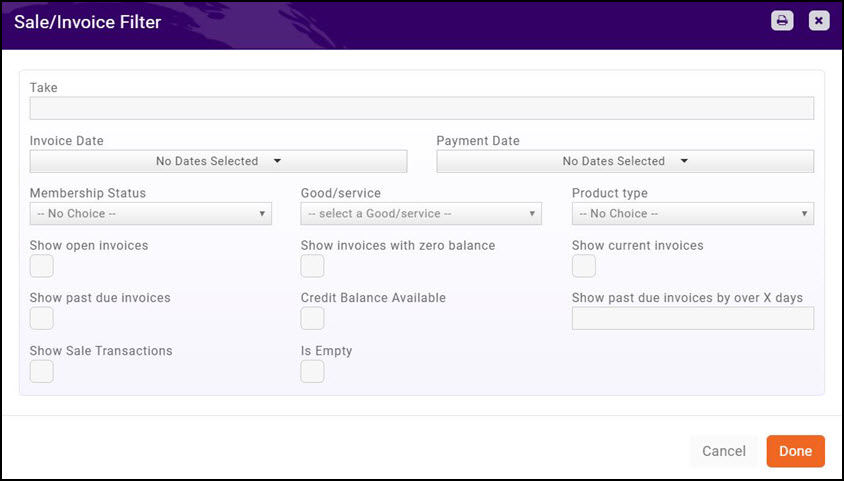

Additional filtering criteria can be added by clicking the Customize Results button.

The list of invoices may be filtered by:

- Invoice date range (by selecting a date range from the Invoice Date

- Payment date range (by selecting a date range from the Payment Date)

- Membership Status

- Goods/Service

- Product Type

- Invoices with Zero Balance

- Past Due Invoices

- Current Invoices

- Credit Balance Available

- Past due invoices by over X days

- Sales Transactions

- Is Empty

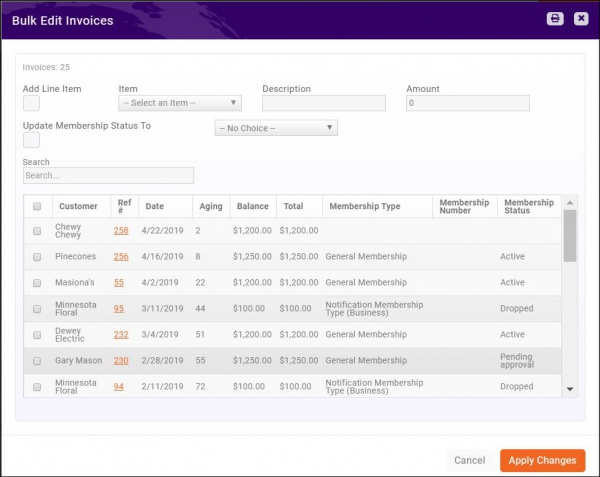

Bulk Edit (Add Additional Fee Item) Invoices

From the Sales/Invoices tab, you can bulk edit existing invoices. This function will allow you to add a fee item to invoices you have selected, and/or change the membership status for the members you select. For example: If you wish to add a late fee to over-due invoices.

- Select Billing in the left-hand navigation panel.

- Click the Sales/Invoices tab.

- Click the orange Actions button.

- Click Bulk Edit.

- Tick the Add Line Item check-box.

- Select the fee item you wish to add to the invoice from the Item list. The Description and Amount will be populated with the data entered when the fee item was setup. You may change this if needed.

- You may also update membership status if needed. See Bulk Update Membership Status for instructions.

- Select the invoices to which you wish to add the fee item.

- Click Apply Changes.

Bulk Update Membership Status

From the Sales/Invoices tab, you can bulk update Membership Status. For Example: You can filter the invoices on this tab to those members who have overdue invoices, and change their status to Dropped.

- Select Billing in the left-hand navigation panel.

- Click the Sales/Invoices tab.

- Click the orange Actions button.

- Click Bulk Edit.

- Tick the Bulk Update Membership Status check-box. NOTE: Membership status updates will only be applied to those members in the list that have invoices that contain membership dues fees. The Membership Type column will display the type, if the invoice contains dues.

- Select the desired status from the drop-down list.

- Select the members for whom you wish to update the status.

- Click Apply Changes.

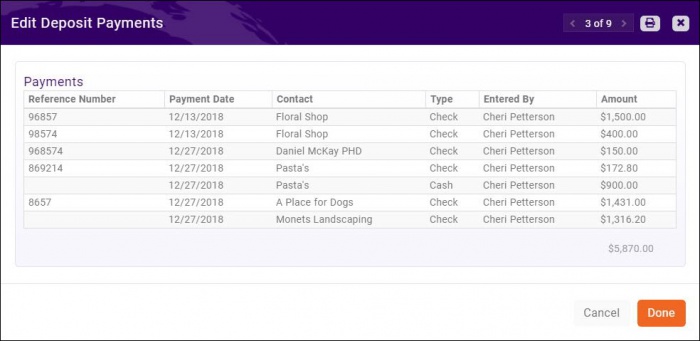

Deposits

View Previous Deposits

You may view previous deposits, and the payments associated to those deposits on the Billing module Deposits tab.

- Select Billing in the Navigation Panel.

- Click the Deposits tab. A list of your previous deposits will be displayed.

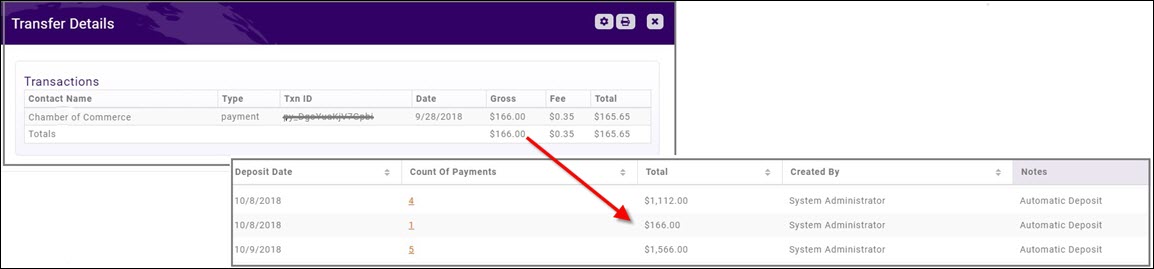

- Click the hyper-link in the Count of Payments column to view the payments associated with the deposit.

| NOTE: The Deposit Summary Report can be used to generate a list of all deposits. Click Here for information on generating the report. |

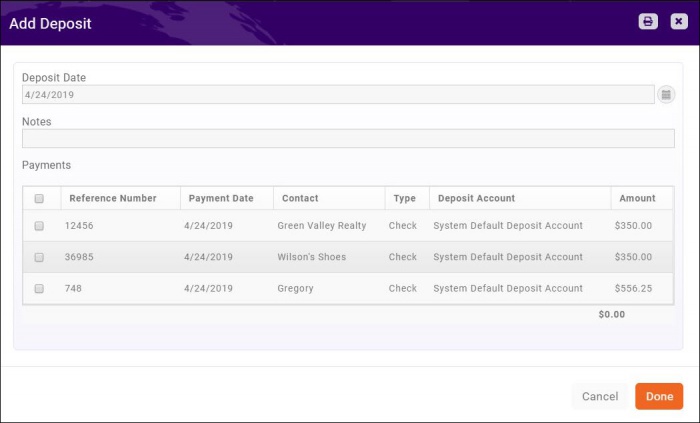

Prepare Deposits

The Overview tab in the Billing module will display the quantity of Undeposited Paymentss. Prepare your deposits by clicking the link on the Overview tab, or on the Deposits tab.

| NOTE: If you are using GrowthZone Pay, deposits for the credit card transactions are automatically created. These deposits will match the transfers made to your bank account. |

- Select Billing in the Navigation Panel.

- Click the Deposits tab. A list of your previous deposits will be displayed.

- Click the Create Deposit button.

- Deposit Date - The date will default to the current date, and may be changed if needed.

- Notes - You may add optional notes as needed.

- If you would like to search for a particular payment, enter criteria in the Search box. NOTE: The Search box is only displayed if there are more than 10 undeposited payments.

- Payments - Select the payments you wish to include in this deposit. You may select all by clicking the uppermost check-box, or click individual payments.

- Click Close.

| NOTE: If needed, you can print the deposit before saving. It may be useful to have a printout to take to the bank when you make the actual deposit. |

GrowthZone Pay Deposits

If you are using GrowthZone Pay, an automated process will create deposits for each Transfer. These deposits will be listed as Created by - System Administrator and Notes will display Automatic Deposit. This automated process makes it easy for you to manage your credit card deposits.

Accounting Transaction Export (Coming Soon)

The Accounting Transaction Export makes it easy for you to export the journal entries created in GrowthZone for import into your accounting software. Currently an IIF export file is available for import to QuickBooks.

Pre-requisites

- Verify that all Account Numbers in your Chart of Accounts match, exactly, the Accounts in QuickBooks.

- Verify that all of your Goods/Services items have a Deposit Account set to Undeposited Funds.

- The “Deposit Account” selection should not be to a bank account. Why? The selected account is where payments are recorded (debited) when a payment transaction is created in GrowthZone. In the case of Cash/Check, if you do not deposit the amounts in the bank on the same day as the transaction was created, then the bank account entry will not be on the correct date. In the case of credit card payments, the payment amount does not actually get deposited in the bank until several days later and is not controlled by you. At the time of actual deposit, then a manual journal entry can be created to record the deposit to the bank and the associated credit card fees. This allows you to have an entry in your books that will match the deposit amount that actually is being deposited into your bank and on the correct day. See Setup Goods/Services for further information on configuring your Goods/Services. NOTE: If you need to update existing Goods/Services account, this will only affect new transactions going forward. Transactions completed prior to making this change will not be updated to a different account. Payments made prior to this change will come thru the export as being deposited in the account that was selected at that time.

- Verify that all Accounting Types for your Goods/Services are set to the proper recognition types.

- Verify that all Goods/Services are set to the proper income and A/R account.

- Verify that balances in your QuickBooks Undeposited Funds Account and Accounts Receivable Account match the balances in the GrowthZone Accounts.

- Before imports into your accounting software will ever tie out and balance, the current balances in GrowthZone must match the balance you have in your accounting software for that same date.

- For Example: If you wish to start using the summary export method in GrowthZone on July 1st, you would run the reports for Accounts Receivable, Undeposited Funds (outstanding deposits), and Accounts Payable (typically only applicable if you have sales tax payable) for June 30. The amounts that you show in GrowthZone for those accounts on 6/30 should match the amount that you show in your current accounting software for that date.

- Accounts Receivable: Generate the Accounts Receivable Summary Report, and compare the balance to the Accounts Receivable in your accounting software. Fix any discrepancies.

- Undeposited Funds: If this is a new account for you in your accounting software, you’ll want to create a beginning balance entry into this new Undeposited Funds asset account. See your software instructions for entering the beginning balance. This would typically be a debit balance account.

In GrowthZone, make sure all deposits have been created and are current up to the date that you want to begin your exporting. Then view the deposits that are still outstanding under Billing > Deposits tab, Create Deposit. The total of the amounts here can be entered as the beginning debit balance for the Undeposited Funds in your accounting software.

Accounting Export Process/Best Practices

Daily - Create Deposits & Refunds

Deposits will be manually entered into your accounting software, therefore, best practice is to complete this task daily. Deposits should include your Credit Card deposits, as well as your cash/check deposits.

GrowthZone Pay Deposits

With GrowthZone Pay, Credit Card/ACH payments begin processing on the day they are entered but the money is not deposited in the bank until a day to two later or sometimes longer. That is why our best practice (see Prerequisites above) is to have your fee items be setup to go first into an account called Undeposited Funds, a holding account until the money is deposited into the bank. At that time, a journal entry can be made that takes the money from Undeposited Funds and records it as a deposit in your bank account. This also gives opportunity to record the processing fees that are immediately subtracted from the amount collected. With GrowthZone pay, you will use the GrowthZone Pay Transfer Details report to view the deposit and associated fees. You will create your journal entry for each deposit. Best Practice: We recommend checking for deposits every day and creating the appropriate journal entry accordingly.

Billing Reporting

Your software provides a wide range of reports that can be used to monitor your billing and update your general accounting software. See Billing Reports.

Reconciling your Accounting Records in GrowthZone

The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer billings to the accounts receivables. GrowthZone provides a variety of reports to assist you in this reconciliation. You may choose to reconcile as frequently as your business processes dictate.

In it's simplest form to reconcile:

(A/R Previous Month End) + (Sales Current Month) - (Deposits) = Ending Balance

The Ending Balance should be equal to the current Accounts Receivable. Use the following reports to find the data needed to perform the calculation:

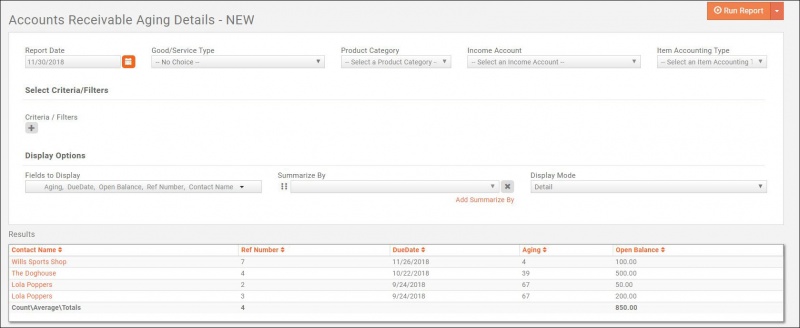

A/R Previous Month End

You can find the A/R Previous Month End by generating the Accounts Receivable (Detail) Report on the Billing Overview tab. Generate the report for the last day or the month/year for which you wish to reconcile.

A/R Previous Month End = $850.00

Sales Current Month

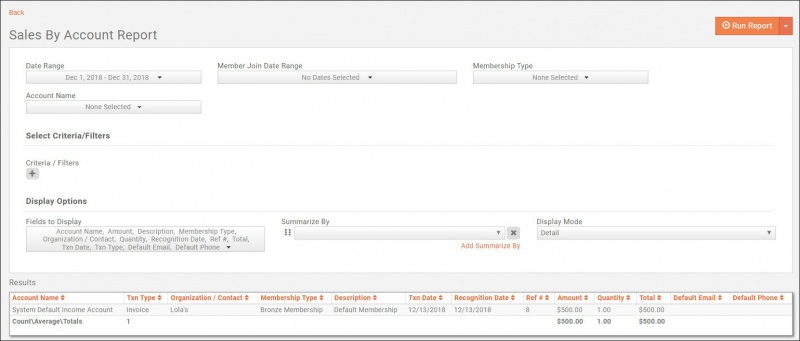

The Sales by Account Report will provide the Sales Current Month value. Generate the report for the first day through the last day of the current month. In the example below, the report is generated for Dec 1 - Dec 31.

Sales Current Month = $500.00

Deposits

Deposits are calculated by generating the Deposit Summary for the current month less Undeposited Fund + Undeposited Funds from the previous month.

Recorded Billing Tutorials

Entering a Credit Card Payment

FAQ's

How do I change a members preferred invoice delivery method?

You may change a members preferred invoice delivery method on the members Billing tab. Click the membership link, under Billing Fees and Schedule and make the desired change.

How can I change the invoice template after an invoice has already been created?

- Click into the hyper-link for the invoice.

- Select the desired template from the Invoice Template drop-down.

- Click Save.