Difference between revisions of "Billing"

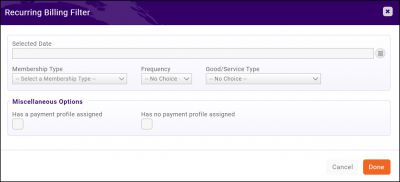

| Line 506: | Line 506: | ||

#In the '''Automated Scheduled Billing''' section, deselect the check-box for '''Use Automated Billing'''. | #In the '''Automated Scheduled Billing''' section, deselect the check-box for '''Use Automated Billing'''. | ||

#:[[File:Auto billing.jpg|800px|center]] | #:[[File:Auto billing.jpg|800px|center]] | ||

| + | #Click '''Done'''. | ||

| + | ===='''<span style="color:#800080">Prevent Members from Making Partial Payments'''</span>==== | ||

| + | ---- | ||

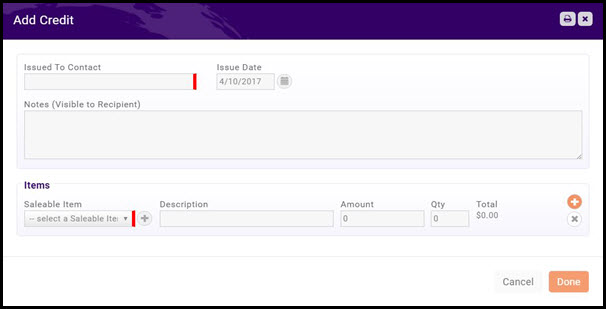

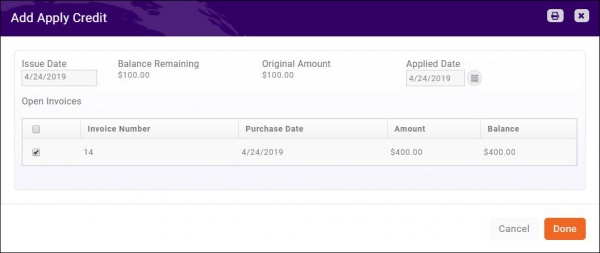

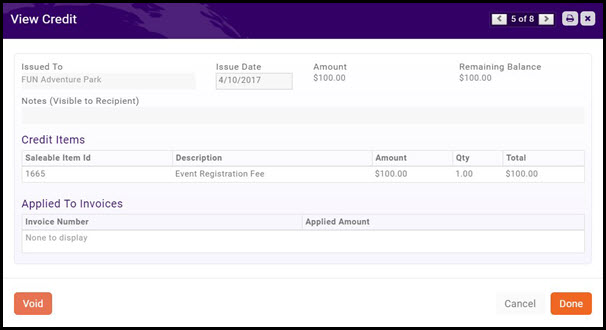

| + | At times, you members may wish to "cherry pick" the items they are paying for on an invoice, and make a partial payment. If you do not wish to allow partial payments: | ||

| + | #Click '''Setup''' in the left-hand navigation panel. | ||

| + | #Click '''General Settings''' in the '''Finance''' section. | ||

| + | #:[[File:Allow partial payments 2020.jpg|600px|center]] | ||

| + | #In the '''Invoice Editing''' section, deselect the '''Allow Partial Payments''' check-box. | ||

#Click '''Done'''. | #Click '''Done'''. | ||

Revision as of 18:32, 26 August 2020

Contents

- 1 Overview

- 2 Initial Billing Setup

- 2.1 Setup Your Chart of Accounts

- 2.2 Setup your Invoice Payment Terms

- 2.3 Setup Your Terms & Conditions

- 2.4 Setup GrowthZone Pay

- 2.4.1 Verify Status of Payment Gateway

- 2.4.2 Configure Gateway Notifications for Disputes/Charge Failures

- 2.4.3 Change GrowthZone Pay Deposit Account

- 2.4.4 Payouts from GrowthZone Pay Credit Card Transactions

- 2.4.5 Is Storing Cards and Bank Accounts with GrowthZone Pay Safe?

- 2.4.6 If using the ACH and bank account storage feature, what countries are supported for where the bank account can be located?

- 2.5 Setup Discounting

- 2.6 Setup Taxes

- 2.7 Set Up Your Billing Templates

- 2.8 Configure Invoice & Statement Messages

- 2.9 View Default Message Templates

- 2.10 Configure Finance Defaults & Logo for Invoices & Statements

- 2.11 Setting Goods/Services

- 2.12 Setup Standard Goods/Services

- 3 Billing Functions

- 3.1 Create a Single Invoice

- 3.2 Add an Internal Memo to an Invoice

- 3.3 Deliver Invoices Pending Delivery

- 3.4 View Past Due Invoices

- 3.5 Deliver Statements

- 3.6 Accept Payments

- 3.7 Void an Invoice

- 3.8 Delete an Invoice

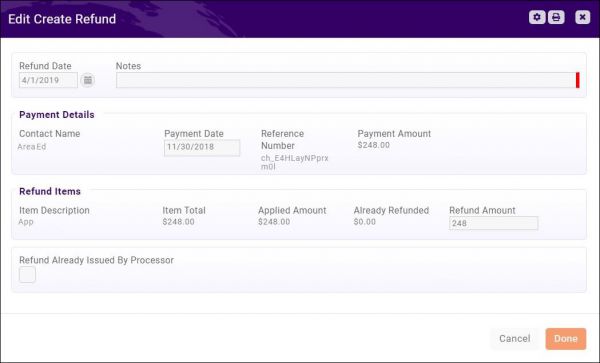

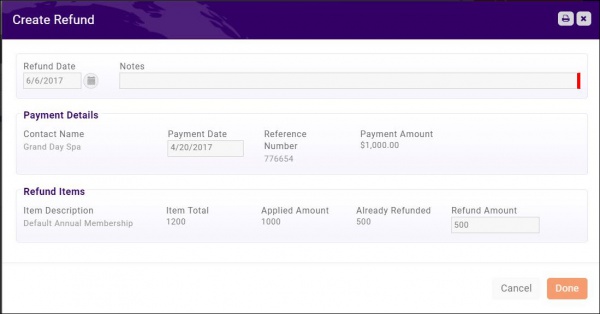

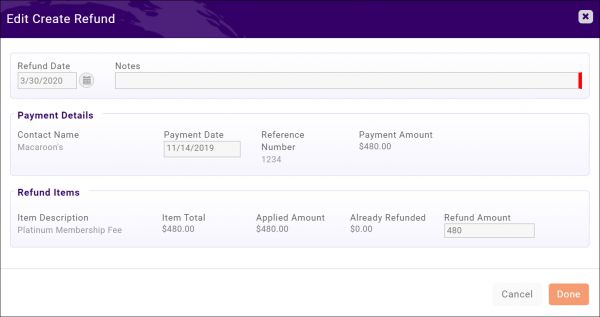

- 3.9 Manage Refunds

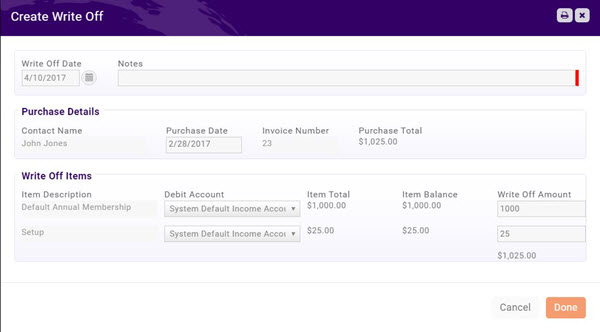

- 3.10 Create a Write Off

- 3.11 Credit Memos

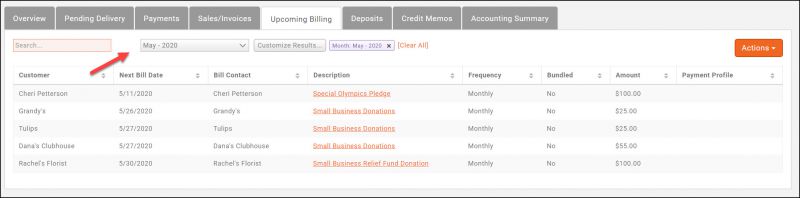

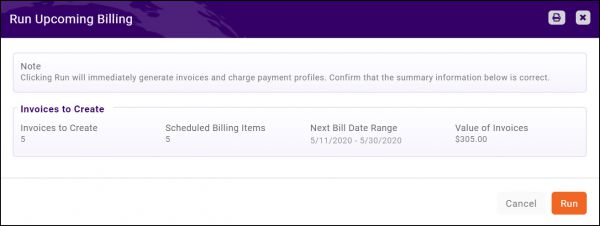

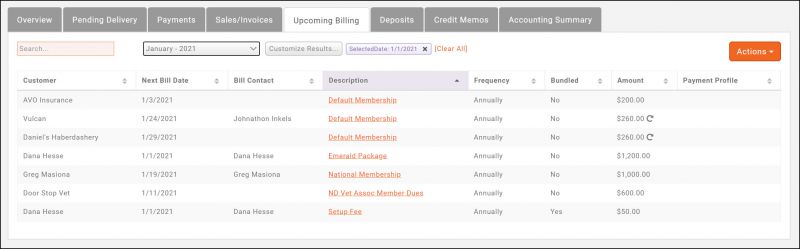

- 3.12 Manage Invoices for Upcoming (Recurring) Billing

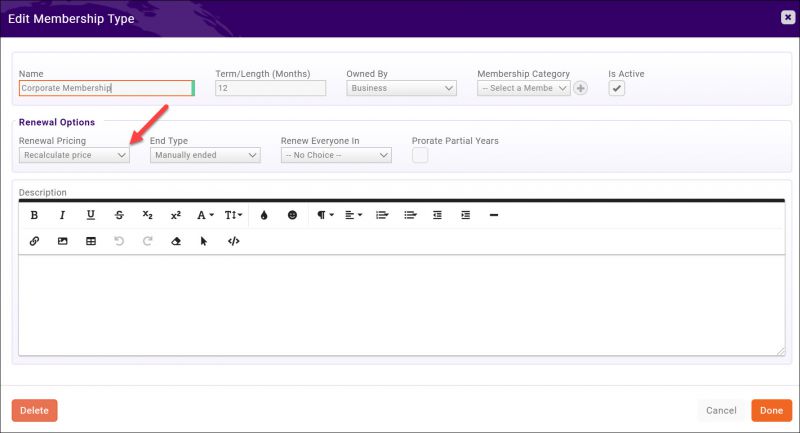

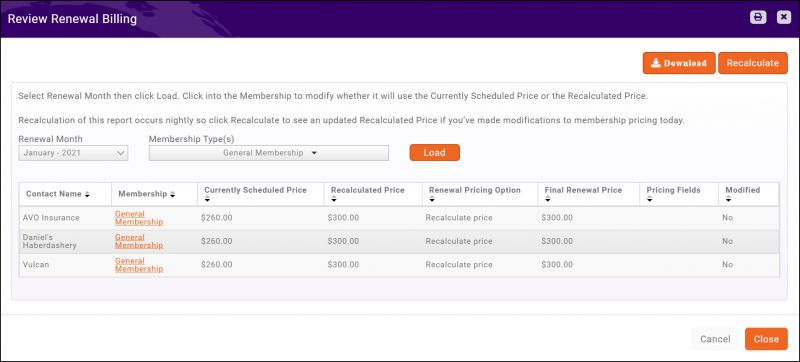

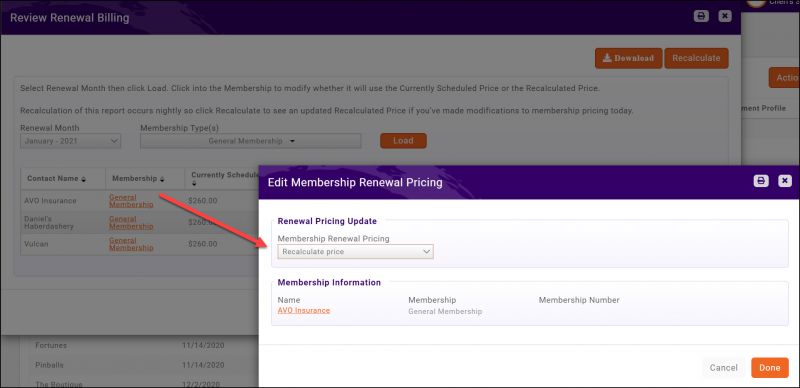

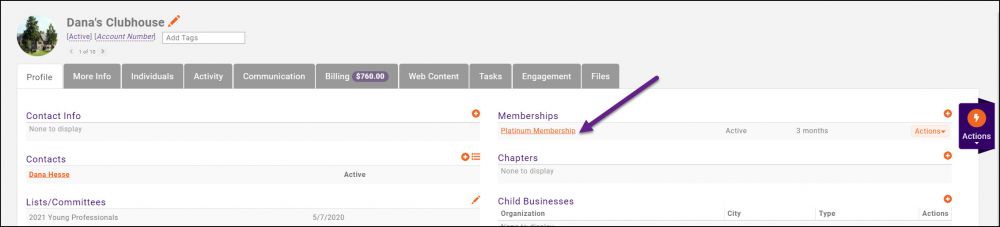

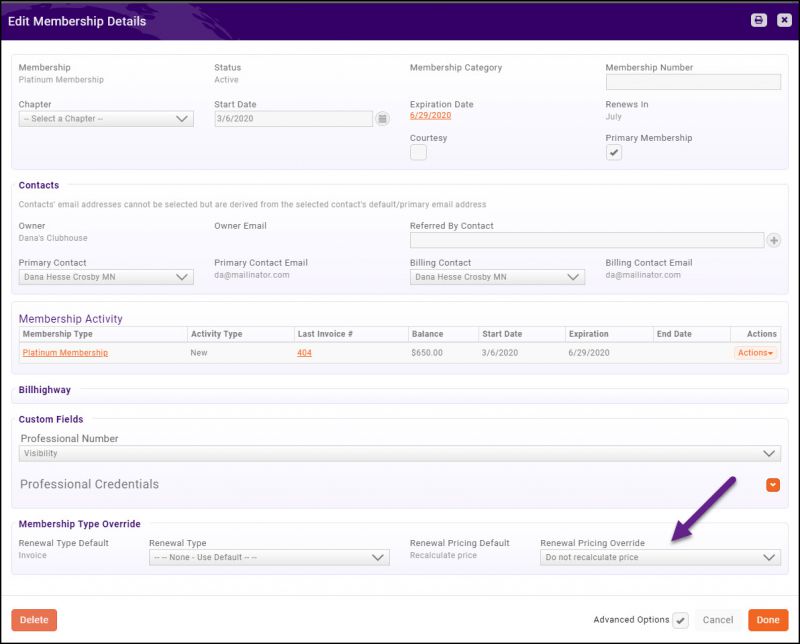

- 3.13 Manage Membership Renewal Pricing

- 3.14 Enable Auto-switch from Annual to Monthly

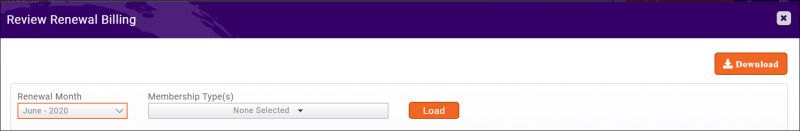

- 3.15 Review Invoices

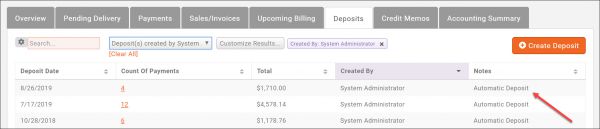

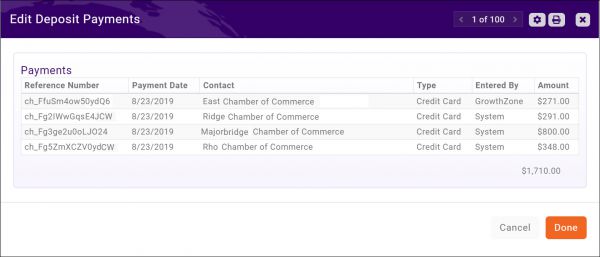

- 3.16 Manage Deposits

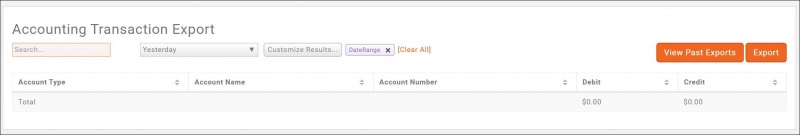

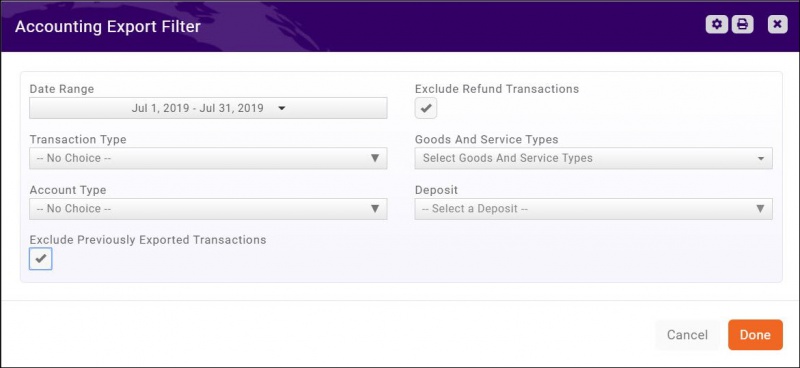

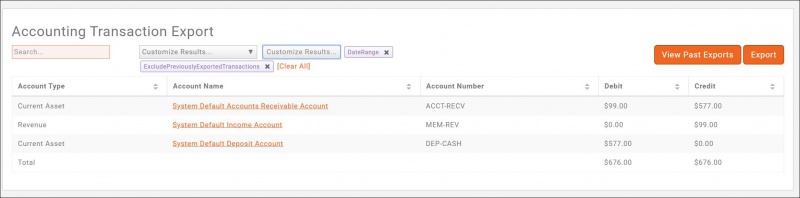

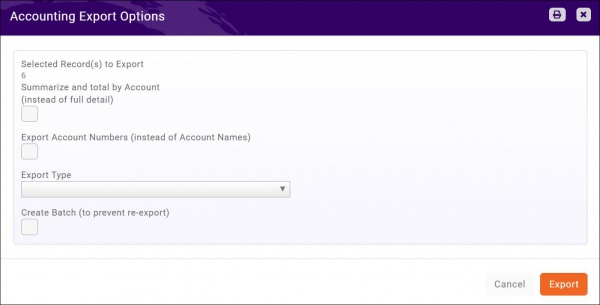

- 4 Accounting Transaction Export

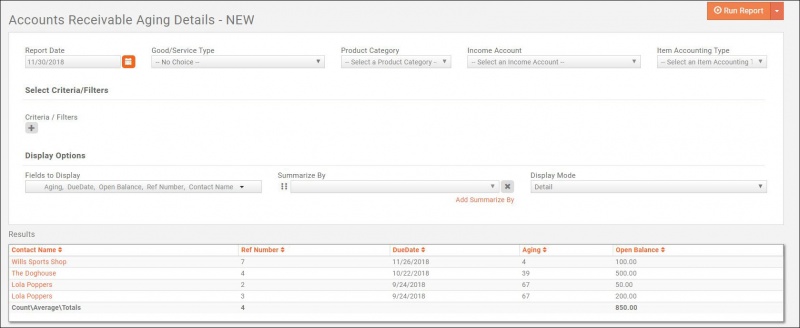

- 5 Billing Reporting

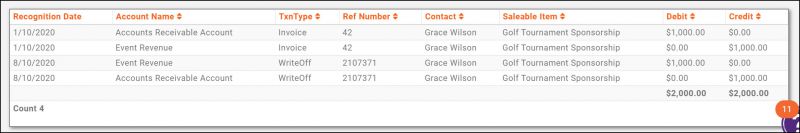

- 6 Reconciling your Accounting Records in GrowthZone

Overview

With your GrowthZone software, we have integrated the entire invoicing process into the software to ensure no double entry and save you time. An Accounting Summary report allows you to post summary from GrowthZone to keep QuickBooks, PeachTree and other accounting systems in sync.

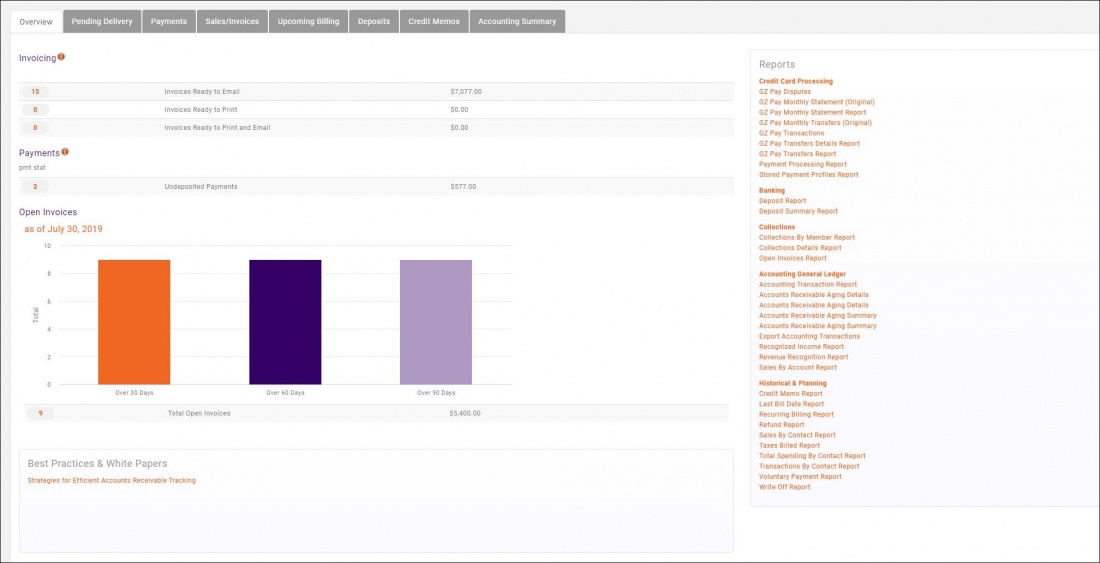

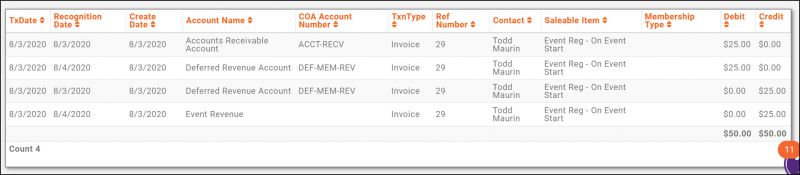

Billing Overview Tab

Within the Billing Module, an Overview tab is provided for a quick at a glance view of your finances, provides a graphical view of your open invoices, and easy access to various billing reports.

- The Invoices section, provides an at a glance view of the number of invoices to be emailed, printed or both. Click a numbered link to open the Pending Delivery tab to deliver the invoices. See Deliver Invoices for further instructions.

- The Payments section provides an at a glance view of the number of payments that need to be deposited. Click the numbered link to create the deposit. See Deposits for further instructions.

- The Open Invoices section provides a graphical view of invoices that are open as of the current date, and the total number and value of invoices. By dwelling your mouse over the graph, you will see summary information about the invoices. Click into the graph to open the Open Invoices Report. See Open Invoices Report for further details and uses of the report.

- The Reports section provides a list of the various billing reports available to you. The list will also include any custom reports you may have created, identified by a yellow asterisk. See Billing Reports for information on each report.

- The Best Practices & White Papers section will provide you with information on best practices for managing your billing through the GrowthZone software. This list will grow over time, providing you with insight on managing your billing.

Initial Billing Setup

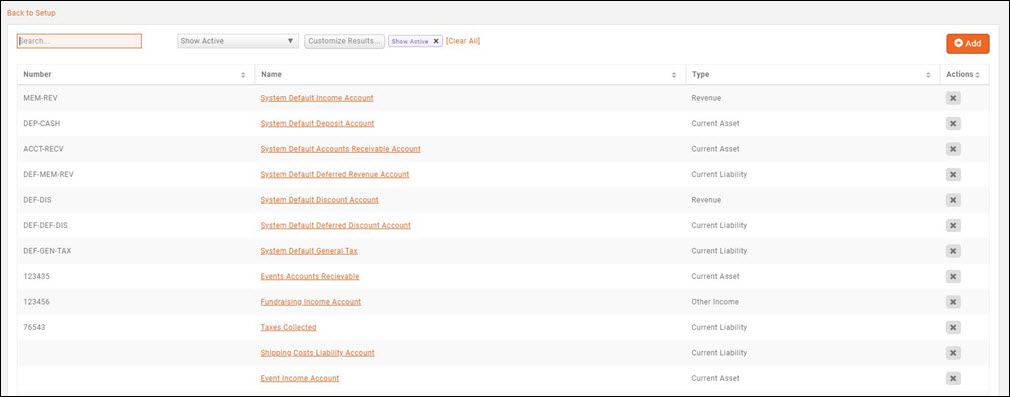

Setup Your Chart of Accounts

The Chart of Accounts ensures that your financial data is aligned to any existing accounting records and processes. On installation of the software, a sample chart of accounts is provided as a starting point. Edit and add to this list to ensure your database chart of accounts matches your current structure.

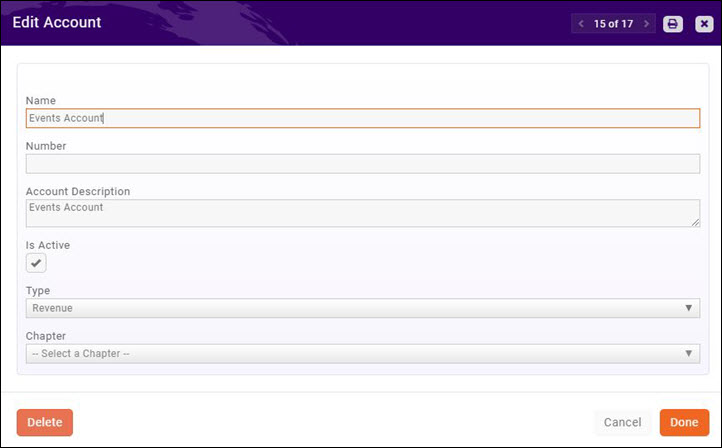

Edit an Account in your Chart of Accounts

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click on the link for the account you wish to edit and make the desired edits.

- Click Done to save the changes.

Add New Account to Your Chart of Accounts

| IMPORTANT: QuickBooks desktop only...If you your QuickBooks Chart of Account contains sub-accounts, and you plan to use the Accounting Transaction Export, you must enter the account numbers in the Chart of Accounts. See more about the Accounting Transaction Export here. |

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click the Add button.

- Configure the following settings:

- a. Name - This is the name of the account. This name must match exactly the name of the account in your general accounting software.

- b. Number - This is the number associated with this account.

- c. Account Description - Enter a description of this account. This is for informational purposes only.

- d. Is Active - Select the check-box to activate this account. If the account is not activated, it will not be available for use within the software.

- e. Type - Select the type of account from the drop-down list.

- f. Chapter - If applicable, select the chapter associated with this account.

- Click Done to save the new account.

De-activate an Account in your Chart of Accounts

When you no longer wish to use an account, best practice is to de-activate the account. By de-activating you ensure that all historical financial data associated to this account is maintained in the database. By de-activating, the account is no longer visible when assigning accounts to goods/services.

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click on the link for the account you wish to de-activate.

- Clear the Is Active check-box.

- Click Done.

Import Chart of Accounts

If you need to add multiple accounts to GrowthZone, this can be done by importing a spreadsheet. The spreadsheet must be an .xlsx or .xls file and 'MUST have these column headers on the first row:

- Name: Required if Number is not populated

- Number: Required if Name is not populated

- Description: Optional

- Type: Type Must be Current Asset, Fixed Asset, Equity, Expense, Current Liability, Liability, Non Current Liability, Other Income, Revenue, Sale, Other Asset or Fund

- Click Setup in the Navigation panel.

- Click Chart of Accounts in the Finance section. A list to the accounts currently configured in your system will be displayed.

- Click the Import Accounts button.

- Click Choose File and navigate to your file.

- Click Done.

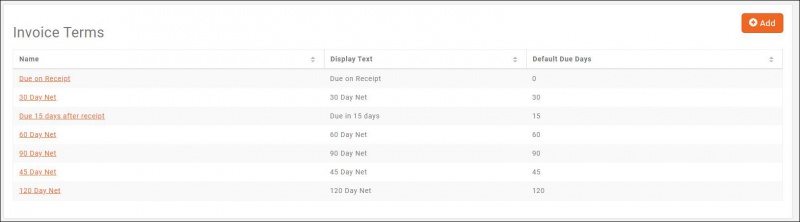

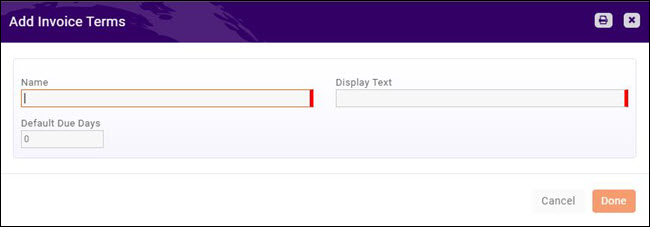

Setup your Invoice Payment Terms

By default, payment terms are set to Due on Receipt. You may modify and add additional payment terms to meet your business needs. You may configure your terms initially through the setup functions, but you will also have the opportunity to create terms "on the fly" when creating invoices.

| See Adding Invoice Terms in Action! |

- Click Setup in the Navigation panel.

- Click Invoice Terms in the Finance section. A list of invoice terms currently configured in your system will be displayed.

- Click the Add button.

- On the Add/Edit Invoice Terms screen, configure the following:

- Name - Enter a name for this invoice term. This name will be displayed in drop-down lists in the software.

- Display Name - Enter the display name. This will be displayed on invoices.

- Default Due Days - Enter the default due days for this invoice term configuration. This is the number of days the system will use to identify past-due invoices.

- Click Done.

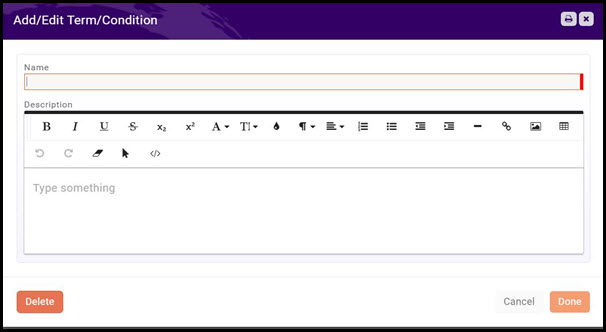

Setup Your Terms & Conditions

- Click Setup in the Navigation Panel.

- Click Terms/Conditions in the Services, Products and Commerce section.

- Click the Add button.

- Enter a Name that easily identifies this terms & condition set. You may create multiple terms & conditions as needed by your business processes.

- Description - Enter your terms & conditions. You may use the standard word-processing functions (bold, italics, etc.) as well as add links and images. If you choose, the terms & conditions may be displayed on the Membership Application Form.

- Click Done.

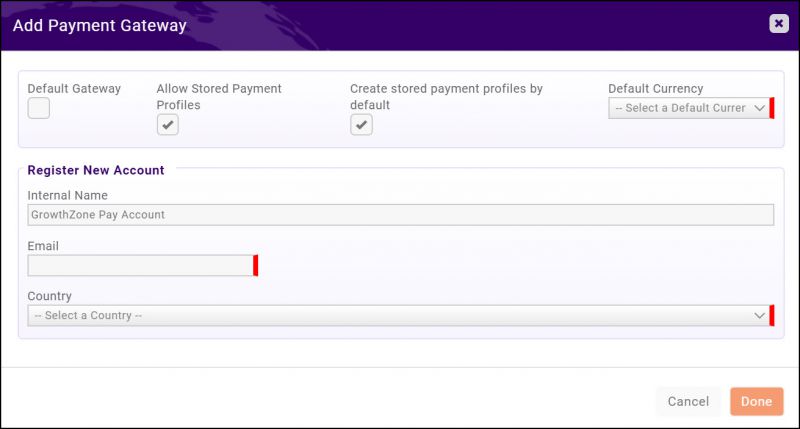

Setup GrowthZone Pay

| NOTE: You may setup and configure your GrowthZone Pay gateway. If you are using a different gateway, contact support@growthzone.comfor assistance. |

GrowthZone Pay allows your contacts to enter their credit card or bank account information into a secured page to pay invoices, event registration, donations, etc. By checking to save this account, users can apply this automatically to recurring fees (e.g. membership) or other one-time purchases. Creating your GrowthZone Pay gateway is a three step process.

Step One

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

- Click the Actions button and select Add GZ Pay Account.

- On the Add Payment Gateway screen, configure the following:

- Default Gateway - Select this check-box if this will be used as your default gateway.

- Allow Stored Payment Profiles: This option is enabled by default. If you do NOT wish to allow members to store credit card, deselect this option. The ability to store credit cards throughout the system (ie. In the Info Hub, when filling out a membership application, etc.) will be hidden.

- Create stored payment profiles by default - Select this check-box if you want the "store payment profile" checkbox on the payment widget through out the software is enabled by default.

- Default Currency - Select the appropriate currency from the option in the menu.

- Internal Name - This name is the name you will see internally for this account. You may have multiple processing accounts, perhaps one for your memberships and one for fundraising. In this event, you would add additional GrowthZone Pay gateways for these. This is a way for you to internally recognize with account is used for which transaction.

- Email - Specify the email of the staff contact responsible for this payment gateway.

- Country - Select your country from the drop-down list.

- Click Done to save and register the new GrowthZone Pay account with the payment processor.

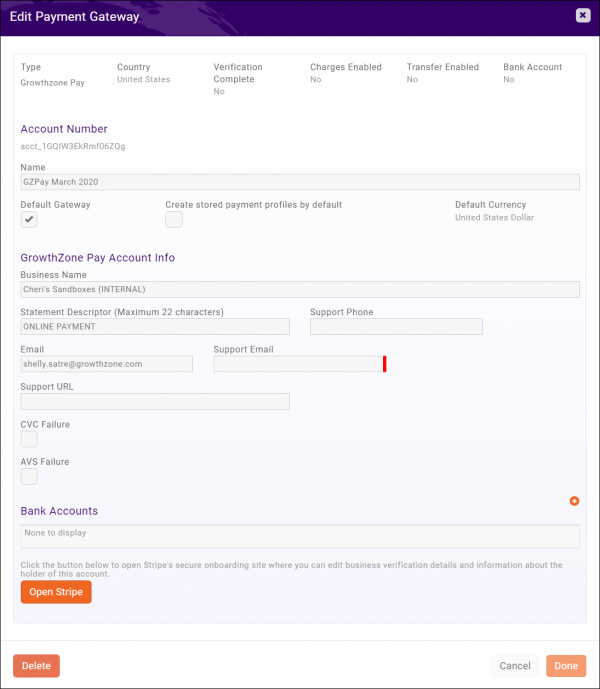

Step Two

In step two, your business contact and account information is entered. This will also include personal information about the owner of the account. This information is necessary to verify the authenticity of the account holder.

- For the newly created gateway, click the pencil icon in the Actions column.

- On the Edit Payment Gateway screen, configure the following:

- Account Number - this field is automatically generated when the gateway is first created. It is not modifiable.

- Name - this field will be populated with the name previously assigned to this gateway. You may modify it if needed.

- Default Gateway - this field is populated with your previous choice. You may modify it if needed.

- Create stored payment profiles by default - this field is populated with your previous choice. You may modify it if needed.

- Default Currency - this field is populated with your previous choice. It is not modifiable.

- Business Name - this field is automatically populated with the name of your business.

- Statement Descriptor (Maximum 22 characters) - The statement descriptor appears on purchasers statements, so best practice is to enter a descriptor that allows the purchaser to easily identify your organization. Statement descriptors are limited to 22 characters, cannot use the special characters <, >, ', or ", and must not consist solely of numbers.

- Support Phone - (Optional) Enter a specific phone number responsible for supporting this gateway.

- Email - this field is populated with your previous choice. You may modify it if needed.

- Support Email - (Optional) Enter a specific email address responsible for supporting this gateway.

- CVC Failure - The CVC is the three- or four-digit number printed directly on the credit card, usually either on the signature strip or the front of the card. Selecting this option will block any payments that fail the CVC verification check.

- AVS Failure - AVS is comprised of two checks: one based on the ZIP code and another based on the billing street address. AVS checks determine whether these pieces of information match the billing address on file with the card issuer. Selecting this options will block to block any payments that fail ZIP code verification.

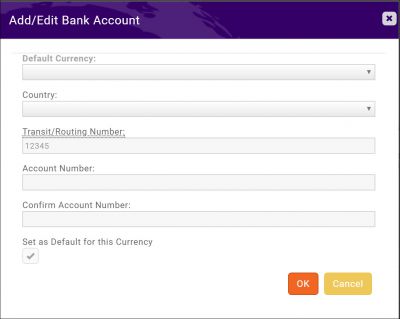

- Bank Accounts - Click the

button to associate the organization's bank account with this gateway. This is the bank account to which the funds will be transferred. Once created, this bank account may not be deleted unless another one is added. Your bank account information is required when activating your account. The type of bank account information required depends on where your bank account is located. A standard bank account with a financial institution must be provided (e.g., checking). Other types of bank accounts (e.g., savings) or those with a virtual bank account provider (e.g., e-wallet or cross-border services) are not supported. NOTE: Accounts are not editable in the gateway setup after entry, if you have entered the wrong account, you would need to add a new account.

button to associate the organization's bank account with this gateway. This is the bank account to which the funds will be transferred. Once created, this bank account may not be deleted unless another one is added. Your bank account information is required when activating your account. The type of bank account information required depends on where your bank account is located. A standard bank account with a financial institution must be provided (e.g., checking). Other types of bank accounts (e.g., savings) or those with a virtual bank account provider (e.g., e-wallet or cross-border services) are not supported. NOTE: Accounts are not editable in the gateway setup after entry, if you have entered the wrong account, you would need to add a new account.

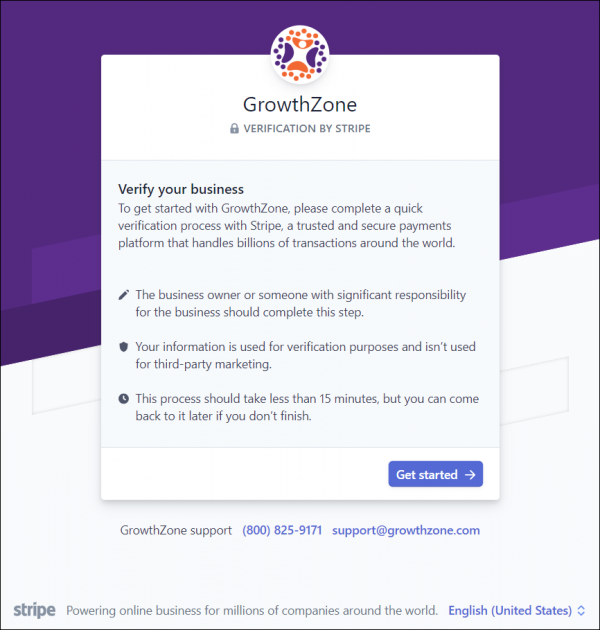

Step Three

At this point, you will need to select the "Open Stripe" button; this will open a new window directly to Stripe (the payment processor) to complete the additional information needed to verify the account, account holder, and representative.

As part of the GrowthZone Pay service, GrowthZone is committed to taking reasonable “Know Your Customer” steps to assure that customers applying for a payment gateway account are legitimate and not impersonating as an association or chamber for unlawful or harmful purposes. As part of our validation process, once a payment gateway application is submitted, the account requires an additional verification step by GrowthZone. While this verification due diligence is completed, the payment gateway is not yet fully available for processing. Once GrowthZone has completed the verification, the gateway is enabled and transactions can be processed.

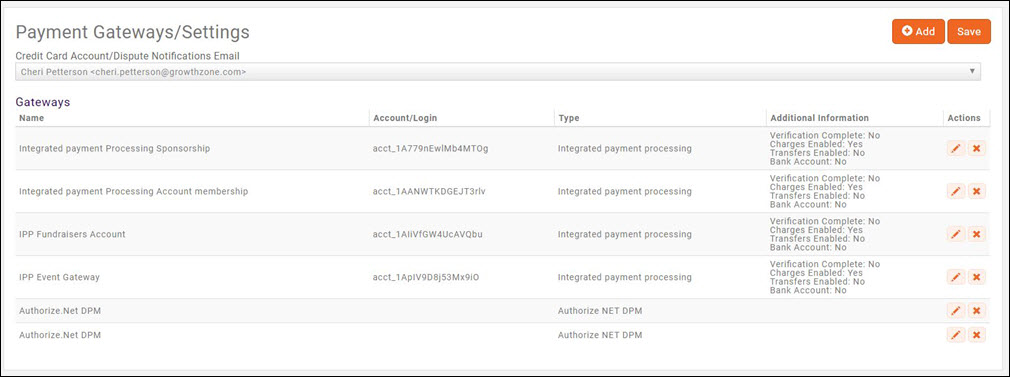

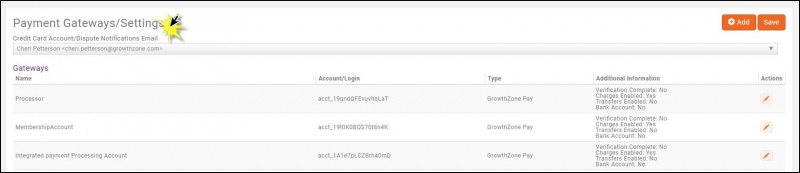

Verify Status of Payment Gateway

Until the payment gateway has been properly verified it may be on hold, preventing you from receiving payouts. To verify the status of the gateway setup:

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

In the Additional Information column you will see the following to indicate the status of the gateway:

- Verification Complete: This will indicate (yes/no) if the required verification by Stripe & GrowthZone have been completed.

- Charges Enabled: This will indicate (yes/no) whether charges may be processed through the gateway.

- Transfers Enabled: This will indicate (yes/no) whether transfers to your bank account have been enabled.

- Bank Account: This will indicate (yes/no) whether your bank account information has been successfully verified.

| NOTE: When the gateway is verified, and email notification will be sent to those staff who have subscribed to the GrowthZone Pay Account Update Completed. |

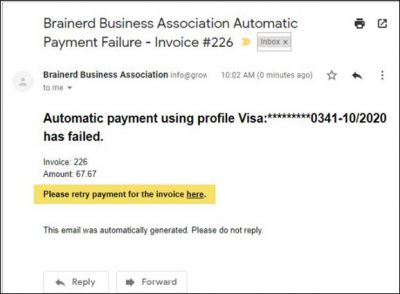

Configure Gateway Notifications for Disputes/Charge Failures

Automated notification may be sent to your staff when a GrowthZone Pay charge fails or when a charge is disputed.

- Click Setup in the Navigation panel.

- Click Payment Gateways in the Finance section.

- Select the staff member to whom notifications should be sent from the Credit Card Account/Dispute Notifications Email list. All active staff members will be displayed.

- Click Save.

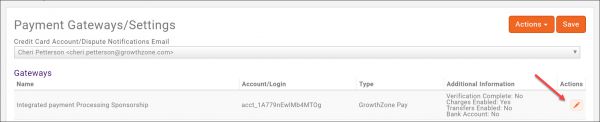

Change GrowthZone Pay Deposit Account

- Select Setup in the left-hand navigation panel.

- Click Payment Gateways in the Finance section.

- Click the

icon Actions column for the desired gateway.

icon Actions column for the desired gateway.

- Click the

icon in the Bank Accounts section to update the bank account number.

icon in the Bank Accounts section to update the bank account number.

- Complete the Add/Edit Bank Account screen.

- Click OK.

- Click Done on the Edit Payment Gateway screen.

- Click the

icon Actions column and verify that the new account has saved.

icon Actions column and verify that the new account has saved.

Payouts from GrowthZone Pay Credit Card Transactions

Deposits into the specified bank account from the credit card transactions are typically done on a daily basis. The process may take 2-4 business days to be completed. Stripe will be depositing the net amount of the transaction, which means, you will receive the full transaction amount minus the fees charged by the processor. If you prefer to have deposits made weekly or monthly, please contact GrowthZone Support. Please keep in mind that fees will be taken at the same frequency the deposits are made. If deposits are selected to be made weekly, fees will be taken on a weekly basis.

The frequency at which payouts are made is dependent on your country. See full payout details at this link.

Is Storing Cards and Bank Accounts with GrowthZone Pay Safe?

Yes! GrowthZone Pay uses Stripe as the credit card processor. Cards are NOT stored in your GrowthZone database.

Stripe exceeds the most stringent security standards:

- SSL Protection: All transactions are SSL (Secure Socket Layer) protected. Your information and your members information are securely transmitted during the processing of all payments.

- PCI Compliant: Stripe is a PCI Service Provider Level 1 which is the highest grade of payment processing security. You can rest assured that your members information is safe and secure.

- Encrypted: All credit card numbers are encrypted and safely stored in Stripe's state of the art data-center. This ensures both the security and integrity of your donors information.

Click here for further information on Stripe Security.

If using the ACH and bank account storage feature, what countries are supported for where the bank account can be located?

United States banks only.

Setup Discounting

Discounts may be used for new memberships, renewal memberships, event registrations and universally. Setting up discounts is a two step process, first you will setup Discount Types, then you will configure the actual discounts.

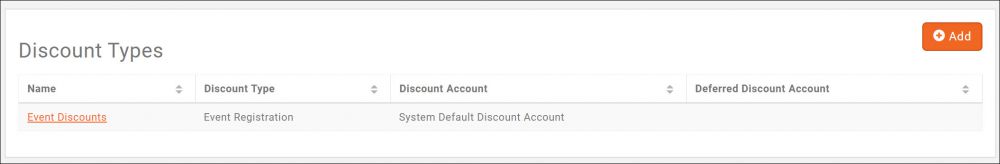

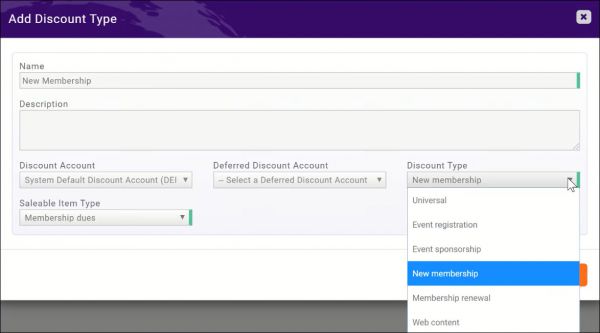

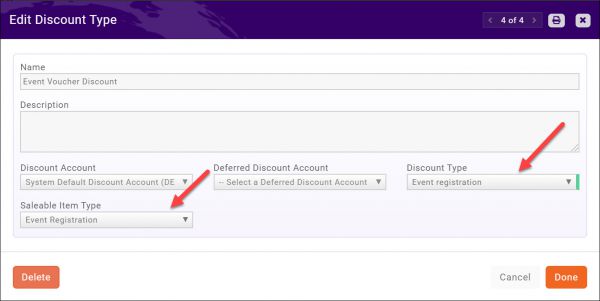

Setup Discount Types

Discount types are used as a way of categorizing, filtering and reporting on discounts that you may offer towards memberships, events, etc. You can pro-actively create your discount types, or you will have the ability to create these discount types "on the fly" when needed. Discount types will also drive where a discount is available for selection in the software.

- Click Setup in the left-hand navigation panel.

- Click Discount Types in the Finance section.

- Click the Add button.

- Enter a Name for the discount type.

- Enter a Description for the discount type.

- Select the Discount Account that should be used for this discount type. A discount will result in a debit to this account.

- Select the Deferred Discount Account that should used for this discount type, if this discount is used for a deferred revenue item.

- Select the Discount Type from the list. This selection will dictate where the discount type is available in the software:

- Universal: This discount type will be available to you for providing discounts through-out the software.

- Event Registration: This discount type can be applied to event registrations.

- Event Sponsorship: This discount type can be applied to event sponsorship fees.

- New Memberships: This discount type will be available for setting up discounts on your membership types, and can be used on your membership application.

- Membership Renewal: This discount type can be applied to membership renewals.

- Web Content: This discount type can be used to apply discounts to web content purchases.

- Select the Saleable Item Type that this discount will be used for. Saleable Item Type is a Goods/Service previously created. To be able to use a discount, you must use the goods/service selected here.

- Click Done.

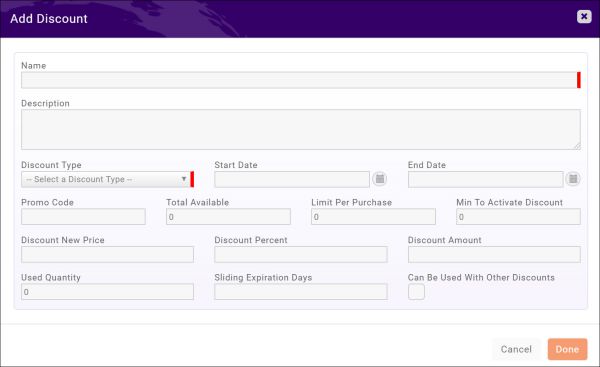

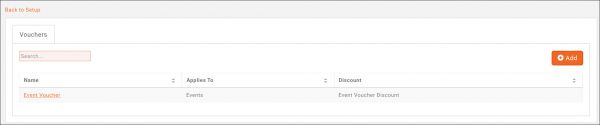

Setup Discounts

Setting up Discounts allow you to configure the default discounts that can be used when creating event registrations, event sponsorship, new memberships, etc. You can pro-actively create these discounts, or you will be able to create discounts "on the fly" when the need arises.

- Click Setup in the left-hand navigation panel.

- Click Discounts in the Finance section. A list of all discounts you have currently setup will be displayed.

- Click the Add button.

- Enter a Name for the discount.

- Enter a Description for the discount.

- Select a Discount Type from the list. The discount type defines where this discount can be used in the software.

- (Optional) Enter a Start Date and End Date for this discount. Discounts will not be granted before or after these dates.

- Enter a Promo Code if applicable.

- Enter the Total Available if you wish to limit the number of this type of discount available. If set to 0, use of the discount is unlimited.

- Enter the Limit Per Purchase if you wish to limit the number of this discount that can be used on a purchase. If set to 0 there is no limit.

- Enter the Min To Activate Discount to set the minimum number of items that must be purchased in order to use this purchase. For example, if two event registrations must be purchased to qualify for a discount.

- Select the discounting methodology:

- Discount New Price: If you wish this discount TO a set price, enter the desired price.

- Discount Percent: If you wish to discount by a percentage, for example 20% off, enter the desired percentage.

- Discount Amount: If you wish to discount BY a certain amount, for example $10 off, enter the desired amount to be subtracted from the price.

- Used Quantity: COMING SOON

- Sliding Expiration Days: COMING SOON

- Can Be Used With Other Discounts: Enable this option if this discount can be used along with other discounts.

- Click Done.

Setup Taxes

If any of your goods/services are taxable, to setup your taxes you will need to configure:

- Product Tax Categories

- Tax Regions

- Tax Rules

- Tax Rates

- Tax Sets

Setup Product Tax Categories

Under Product Tax Categories you will define the categories of products that are taxable. For example, if you are using the store module and are required to collect tax on certain products, you could set up the tax categories based on your store product categories (i.e. apparel, gifts, etc.).

- Click Setup

- Click Taxes in the Finance section.

- On the Product Tax Categories tab, click the Add button.

- Enter a Name for the category.

- Click Done.

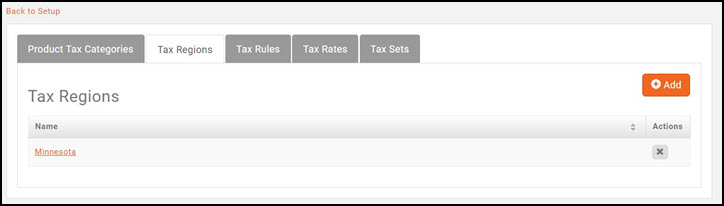

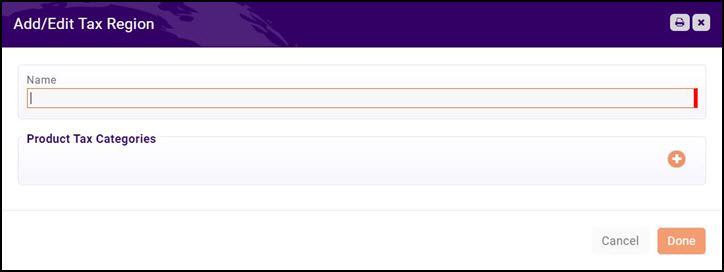

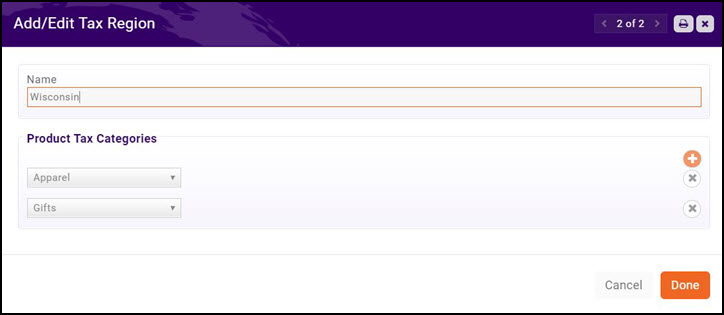

Setup Tax Regions

Tax regions are the region for which you must collect taxes. For example, if you must collect state taxes, you could name the region after the state.

- Click Setup

- Click Taxes in the Finance section.

- On the Tax Regions tab, click the Add button.

- Enter a Name for the new regions.

- Click the

button to associate the product categories that are taxable in this region.

button to associate the product categories that are taxable in this region.

- Repeat the step above to add additional product categories.

- Click Done.

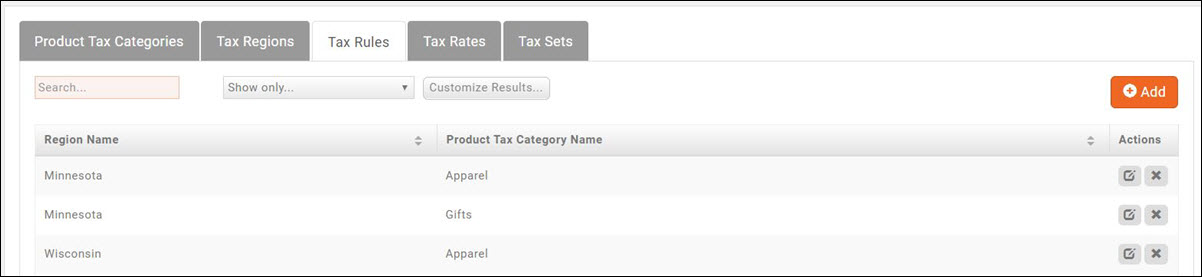

| NOTE: When the product categories are added to the regions, these become the Tax Rules displayed on the Tax Rules tab. |

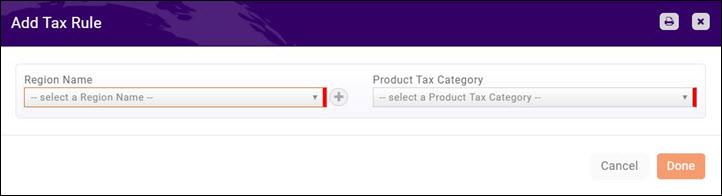

Setup Tax Rules

Tax rules allow you to identify which product tax categories are taxable in which Tax Regions. These tax rules may have been automatically created when you created regions, but you may add additional tax rules on the Tax Rules tab.

- Click Setup

- Click Taxes in the Finance section.

- Click the Tax Rules tab.

- Click the Add button to create a new tax rule.

- Select a Region Name from the drop down box. This is the region in which this rule will apply.

- Select a Product Tax Category from the drop down box. This is the product category that will be taxable in the selected region.

- Click Done.

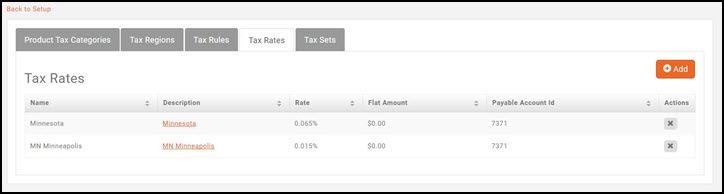

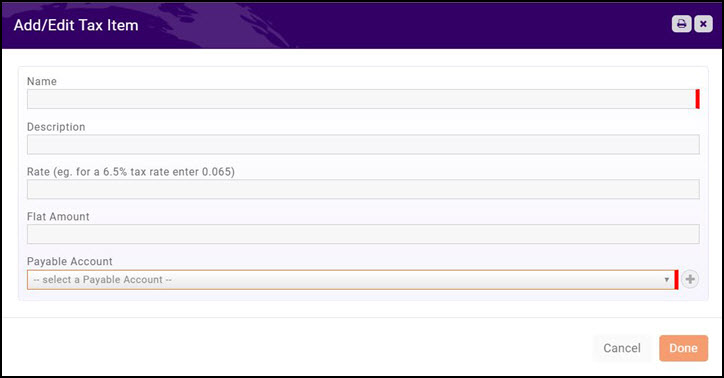

Setup Tax Rates

In most cases, sales tax rates must be configured for the physical location that the chamber/association has a presence (nexus). If you operate in multiple states, you would need to enter the tax rates for each state.

- Click Setup

- Click Taxes in the Finance section.

- On the Tax Rates tab, click the Add button.

- Enter a Name for the tax rate. For Example: Minnesota to identify a Minnesota tax rate.

- Enter an optional Description of the tax rate.

- Enter the rate in decimal format. For Example: 6.5% tax rate enter 0.065.

- If taxing is a Flat Amount enter the flat amount.

- Select the Payable Account that will be used for your taxes payable.

- Click Done.

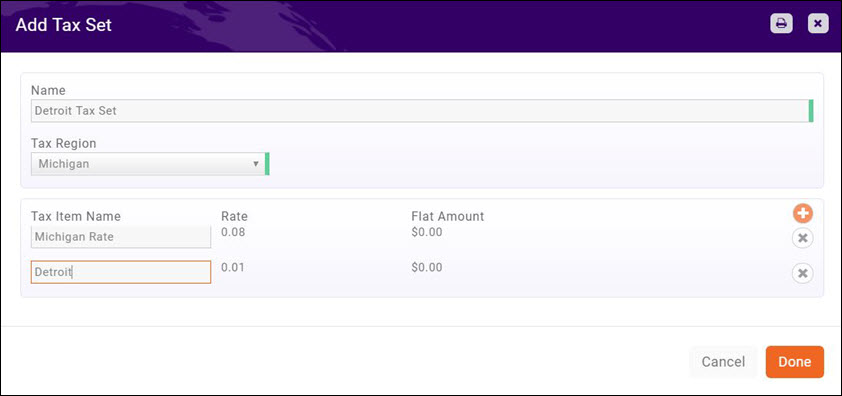

Setup Tax Sets

Tax sets allow you to combine several tax rates together. For Example: If you will have local, state, and county taxes, you can create a set to include each of these tax rates together so you can view the breakdown of the taxes by collecting agency.

| NOTE: Even if you are NOT combining several rates together, sets MUST be created to make the taxes available for selection when creating goods & services. |

- Create individual Tax Rates. Click Here for information on setting up individual tax rates.

- On the Tax Sets tab, click Add.

- Enter a name for the new tax set.

- Select the Tax Region from the drop down box.

- Click the

to select the tax rate to be included in the set.

to select the tax rate to be included in the set. - Repeat step 5 to add additional tax rates to the set. NOTE: If you are simply creating a tax set for an individual tax rate, you need only select the one associated tax rate.

- Click Done.

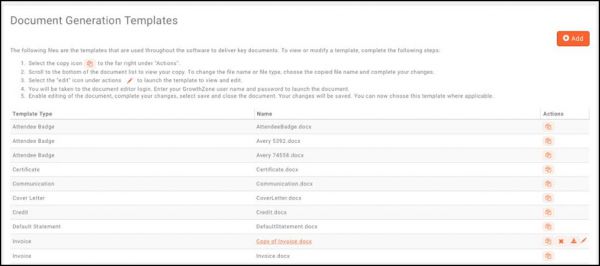

Set Up Your Billing Templates

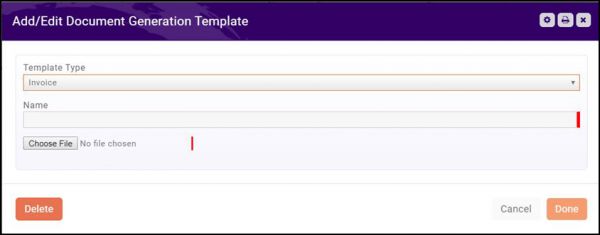

Within your database you will be able to define the templates that you wish to use for invoices, statement, credit memos, etc. The steps described below use your invoice template as an example, but follow these steps to customize other billing documents.

Set Up Your Invoice Template

A standard invoice template is built into the software. You can use this default template, or modify it to meet your business needs. You may also add a logo to the invoice. Alternately, you may import your existing template into the database.

View/Modify Invoice Template (PC Instructions)

- Click Setup in the Navigation Panel.

- Click Document Generation Templates in the Document Generation section. A list of existing templates will be displayed.

- Click the copy icon

for the Invoice template.

for the Invoice template. - Click OK in the confirmation dialog box. A copy of the invoice template will be available in the list of templates.

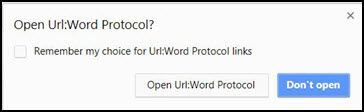

- To view the template, click the pencil icon (Edit Template Document). The Open URL:Word Protocol dialog box will be displayed.

- Click Open URL:Word Protocol. You will be taken to the document editor login. Enter your GrowthZone user name and password to launch the document.

- Enable editing of the document.

- Complete your edits to the document and save to your local PC.

- Return to the Document Generations Template screen, click the Add

button.

button.

- Enter a Name for the new template.

- Click Choose File to navigate to your saved copy and upload.

- Click Done. You will now be able to choose this template where applicable.

View/Modify Invoice Template (MAC Instructions)

- Click Setup in the Navigation Panel.

- Click Document Generation Templates in the Document Generation section. A list of existing templates will be displayed.

- Click the copy icon

for the Invoice template.

for the Invoice template. - Click OK in the confirmation dialog box. A copy of the invoice template will be available in the list of templates.

- To edit the copy, click the download icon

in the Actions column.

in the Actions column. - Open the downloaded file and make desired edits.

- Save the downloaded file.

- On the Document Generations Template screen, click the Add

button.

button.

- Enter a Name for the new template.

- Click Choose File to navigate to your saved copy and upload.

- Click Done. You will now be able to choose this template where applicable.

Configure Invoice & Statement Messages

Automatic messages may be included on your invoices and statements.

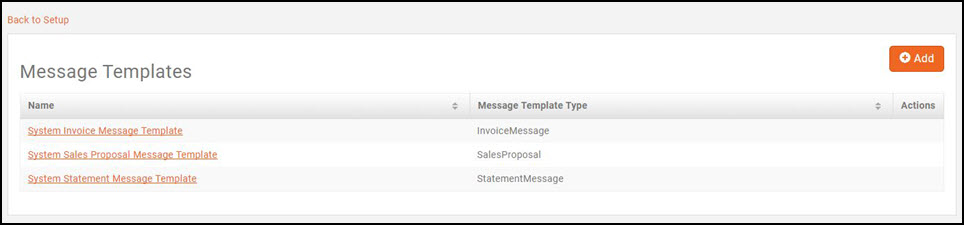

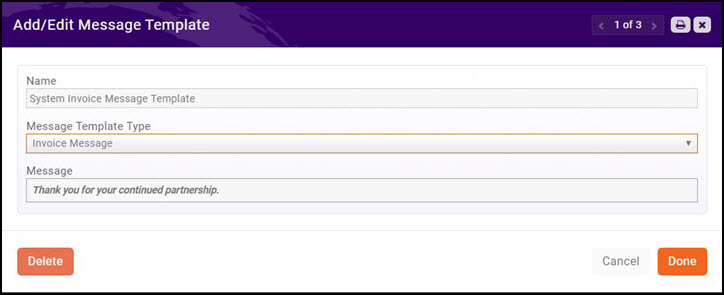

View Default Message Templates

- Click Setup in the Navigation Panel.

- Click Message Templates in the Finance section.

- Click the hyper-link for the message you wish to view.

| NOTE: You may edit an existing message template. However, if edited, a duplicate message template will be created. If you wish to edit, best practice is to enter a new Name for the template to avoid confusion. |

Configure Finance Defaults & Logo for Invoices & Statements

- Click Setup in the Navigation panel.

- Click General Settings in the Finance section.

- Click the pencil icon below Logo for Invoices and Statements. NOTE: the icon is visible when you dwell the mouse below Logo for Invoices and Statements.

- Click Upload to browse to the location of your logo.

- Click Open.

- Crop the image as needed, then click Crop & Save. The logo will now be displayed on all of your invoices and statements.

- For each of the listed accounts, select your default. This default will automatically be applied when you create goods & services, but you will be able to over-ride if needed.

- Select your Default Invoice Template. This is the template that will be used for all of your invoicing, but may be over-ridden in several areas:

- You can apply a specific invoice to a good/service item: Set Up Goods/Services

- You can apply a specific invoice template to a membership type: Add Pricing to A Membership Type

- You can apply a specific invoice template when delivering invoices: Deliver Invoices via Email and Print Invoices for Delivery

- You can apply a specific invoice template when re-delivering invoices: Re-Deliver Past Due Invoices via Email and Re-Deliver Past Due Invoices via Print

- Refer to Setting Up Your Invoice Template for details on setting up a template.

- Select your Default Invoice Terms. Select the terms you wish to use by default.

- Transaction Deletion - This setting determines the number of days in which an invoice or payment may be deleted. Best practice is to limit the transaction window, as once an invoice is deleted, it is completed removed from your view which could cause issues with audits and/or reconciling. Additionally, there is risk that an invoice deleted from the database may already have been posted to your general accounting software. This would cause the two systems to become out of sync. The system provides a Void option that can be used instead of deleting. A void will create a counter entry.

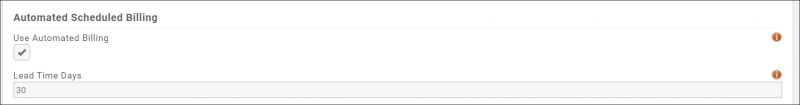

- Automated Scheduled Billing The settings below allow you to automate the process of of generating invoices and processing payments (if a member has a stored profile).

- Click Use Automated Billing to enable the process.

- Enter Lead Time Days: Lead time days is the number of days ahead of Next Bill Date that invoices are created. You will go to the Pending Delivery tab under Billing to actually send the invoices. This lead time gives you time to review invoices, apply credits, and apply un-applied payments, etc. before sending out the invoices. NOTE: Billings that have stored payment profiles will be charged on the actual Next Bill Date. At that time both the invoice and payment are automatically created.

- Months Back Allowed: This setting allows you to set the number of months back you will be able to look back for invoices that need to be created, when manually running upcoming billing from the Upcoming Billing tab in the Billing module.

- My Association typically tracks and records information under the: This setting allows you to configure whether event registrations invoices should be tracked on the business (member) account tab, or the individual account tab.

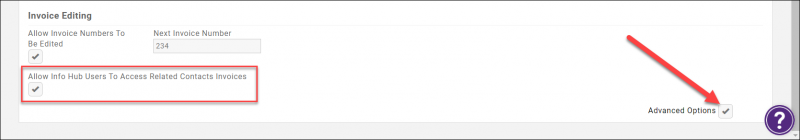

- Invoice Editing:

- Click the Allow Invoice Numbers To Be Edited check-box if you wish to allow for invoices numbers to be edited after an invoice has been created. If this option is enabled, a warning message that will be displayed if an invoice number is duplicated. This setting is disabled by default.

- Next Invoice Number: This field displayed the next sequential invoice number, and would allow you to set the starting number for invoices. It will increase each time a new invoice is created.

- Click Save.

ADVANCED OPTIONS: There is an additional setting if you enable the "Advanced Options" checkbox. "Allow InfoHub Users to Access Related Contacts Invoices" will allow contacts in an organization/business (such as a broker or office manager in a real estate office) to see and potentially pay the invoices of the other contacts in that organization.

The contacts must be assigned an access level that allows full control for the Related Contacts. See Creating a New Access Level - Users (Members) for more information on how to set up an access level.

Setup System to Automatically Generate Invoices for Scheduled Billing

You can configure your system to automatically create invoices for scheduled fees. If enabled, the system will create invoices X numbers of days prior to the next bill date.

- Click Setup in the left-hand navigation panel.

- Click General Settings in the Finance section.

- In the Automated Scheduled Billing section, tick the check-box for Use Automated Billing.

- Enter the Lead Time Days. This is the number of days ahead of the Next Bill Date that invoices will be created. The invoice is NOT automatically emailed, but listed on the Billing Pending Delivery tab for you to review, and send out. NOTE: If the contact has a stored profile, then the invoice is automatically created on the Next Bill Date and the payment profile is charged.

- Click Save.

| NOTE: If you choose not to enabled Automated Billing, you will manually generated the invoices from the Billing module Upcoming Billing tab. See Generating Invoices for Upcoming (Recurring) Billing for further information. |

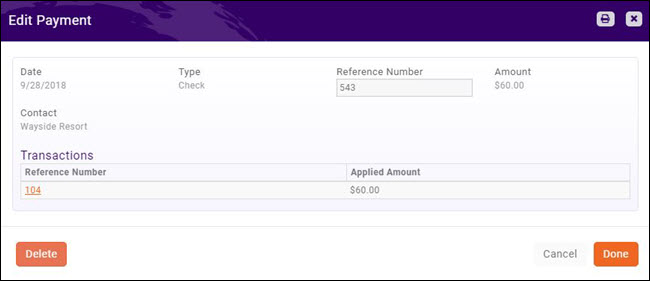

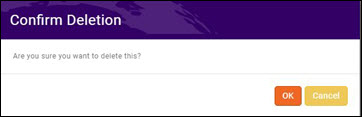

Disable Automated Scheduled Billing

- Click Setup in the left-hand navigation panel.

- Click General Settings in the Finance section.

- In the Automated Scheduled Billing section, deselect the check-box for Use Automated Billing.

- Click Done.

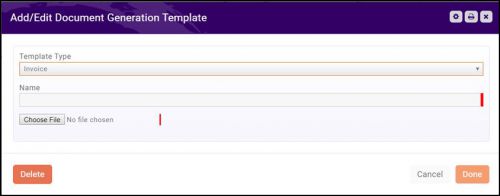

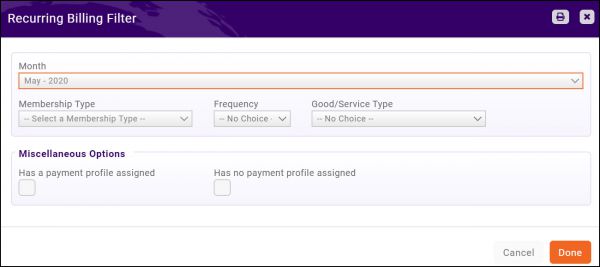

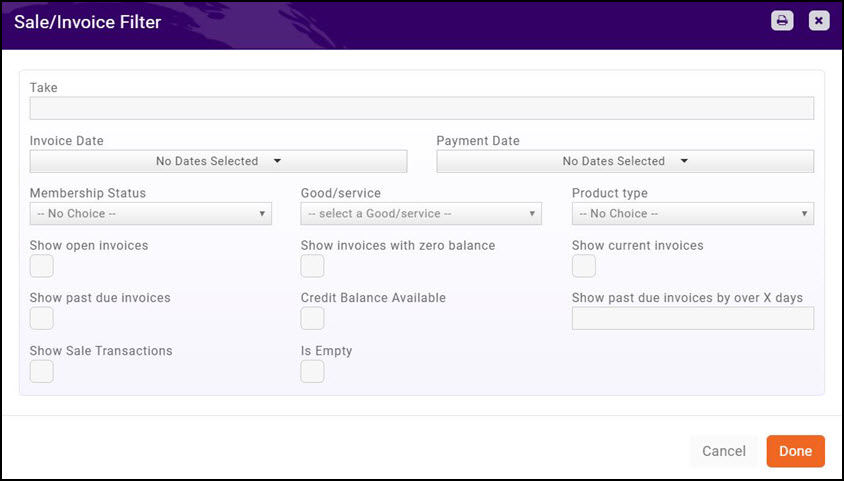

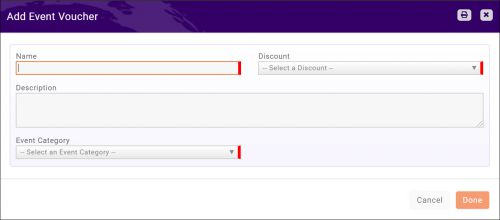

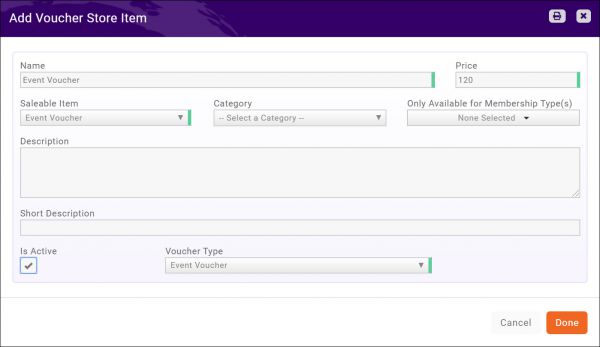

Prevent Members from Making Partial Payments

At times, you members may wish to "cherry pick" the items they are paying for on an invoice, and make a partial payment. If you do not wish to allow partial payments:

- Click Setup in the left-hand navigation panel.

- Click General Settings in the Finance section.

- In the Invoice Editing section, deselect the Allow Partial Payments check-box.

- Click Done.

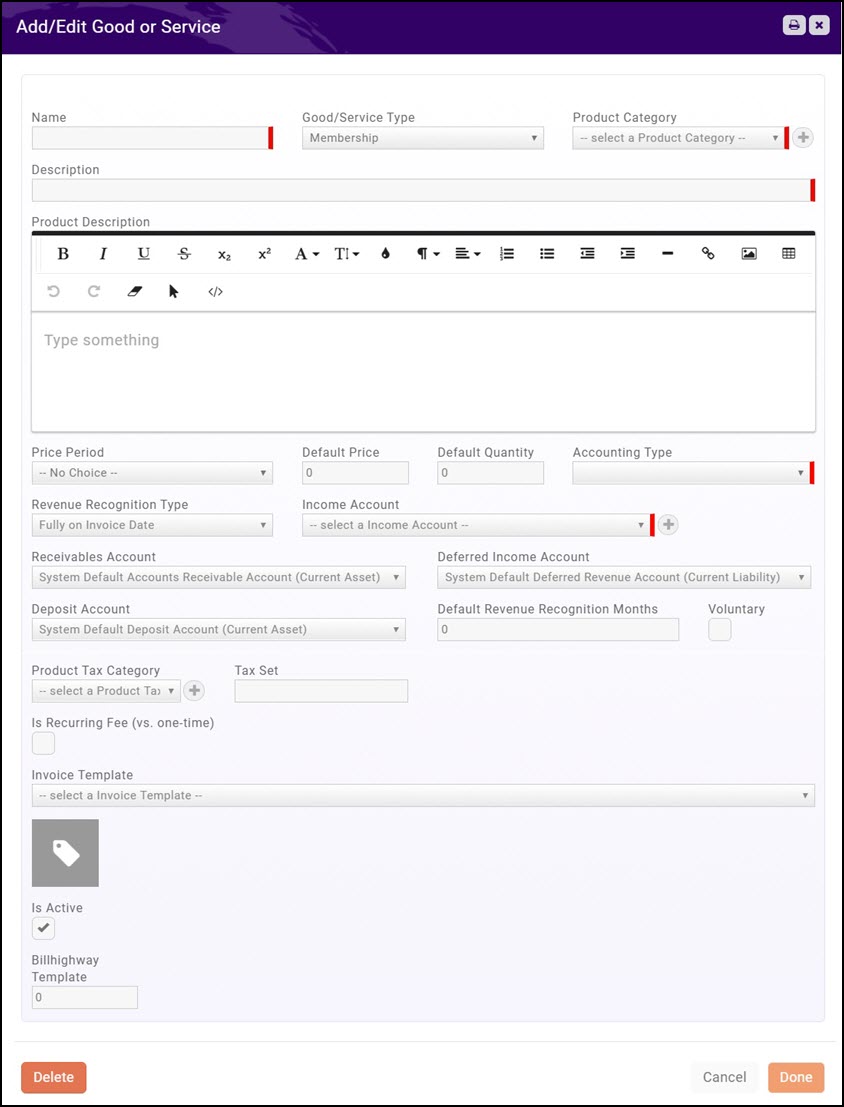

Setting Goods/Services

Goods and Services allow you to define the “products” for the memberships, services and products you provide. Upon initial setup of the system you will add high level categories of the items that you offer. Additional good/services may be added as your business requires.

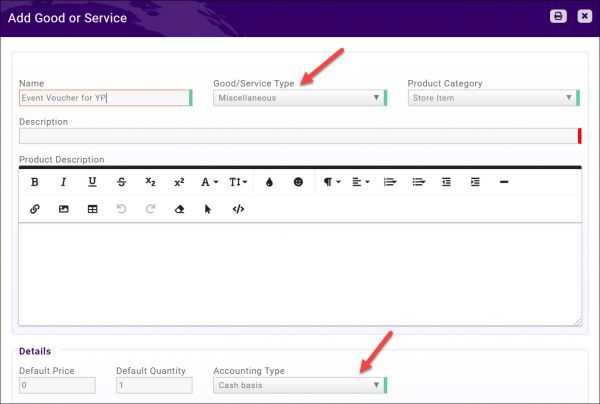

Setup Standard Goods/Services

- Click Setup in the Navigation panel.

- Click Goods/Services in the Services, Products and Commerce section. A list of Goods/Services currently configured in your system will be displayed.

- Click the New button.

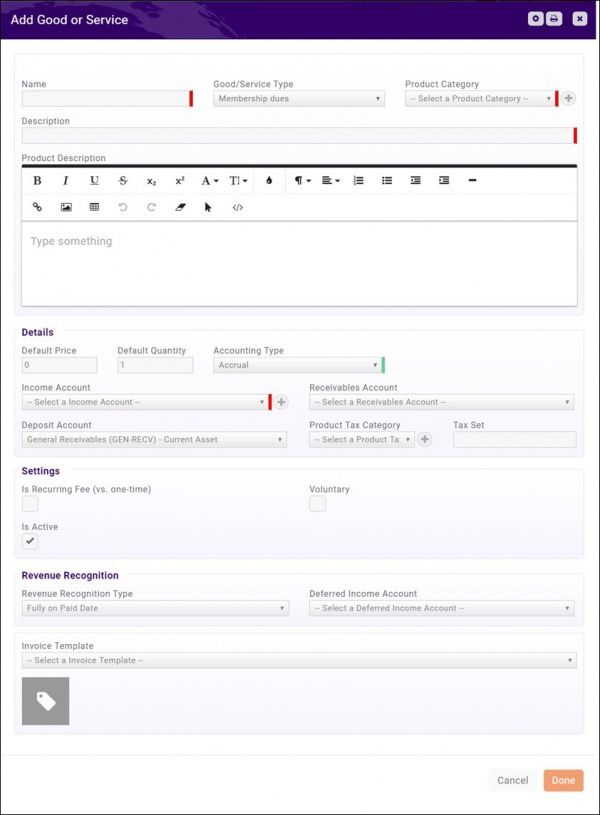

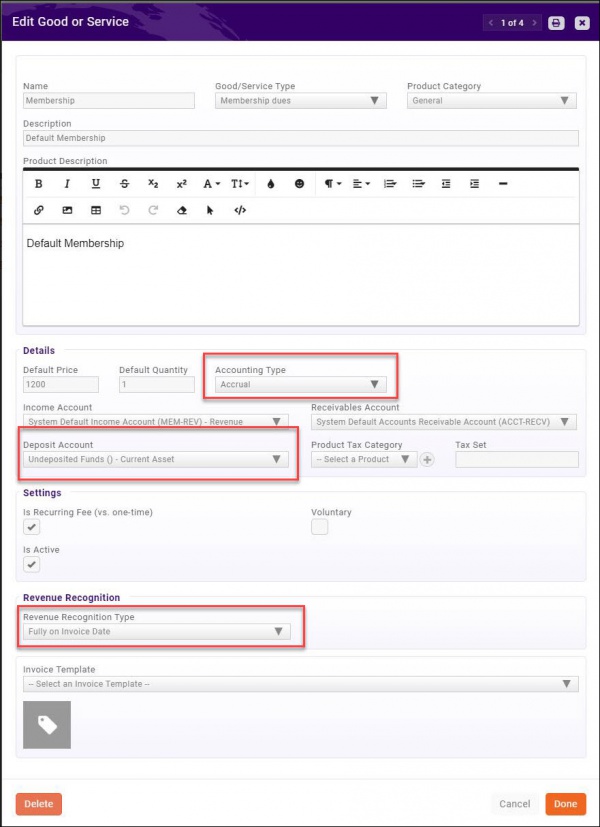

- On the Add/Edit Good or Service screen, configure the following:

- Name - Provide a name for the good/service. This will be displayed when you are selecting goods or services.

- Good/Service Type - Select a type from the drop-down list. Type is used for filtering and reporting.

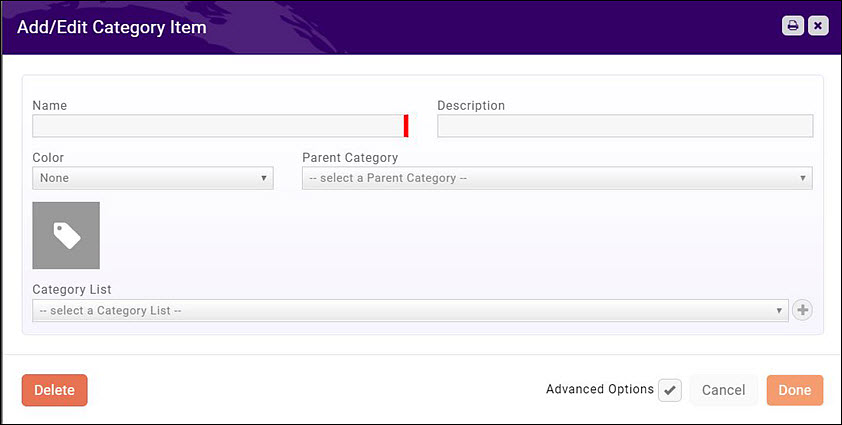

- Product Category - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the + sign.

-

- Enter a Name for the new product category.

- Enter a Description of the new product category.

- Select a Category List from the drop-down, or, to add a new category list, click the + sign.

- Click Done.

- Description - Enter a description of the good/service. This description is displayed in the Goods/Services list.

- Product Description - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description.

- Default Price - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service.

- Default Quantity - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service.

- Accounting Type - Select either Cash or Accrual. If Accrual is selected, the Revenue Recognition Type drop-down list will be displayed at the bottom of the screen. This is the account that is used to "hold" revenue throughout the recognition period.

- Income Account - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the + sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements. This is the account the will be credited when this goods & service is invoiced.

- Receivables Account: Select the accounts receivable account for this good/service. When using accrual basis this is the A/R account that will be used to "hold" the revenue until payment is received. The drop-down list will be populated with the receivables account configured in your Chart of Accounts. This is the account that will be debited when this goods & service is invoiced.

- Deferred Income Account: Select the deferred income account for this good/service. If using accrual accounting. The drop-down list will be populated with the deferred income accounts configured in you Chart of Accounts. If you have chosen to defer the revenue for this event to a specific point in time, the revenue will be held in the deferred income account until that point in time.

- Deposit Account - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts.

- Default Revenue Recognition Months - If the revenue for this good/service will be recognized over a period of time, enter the default number of months over which the revenue will be recognized.

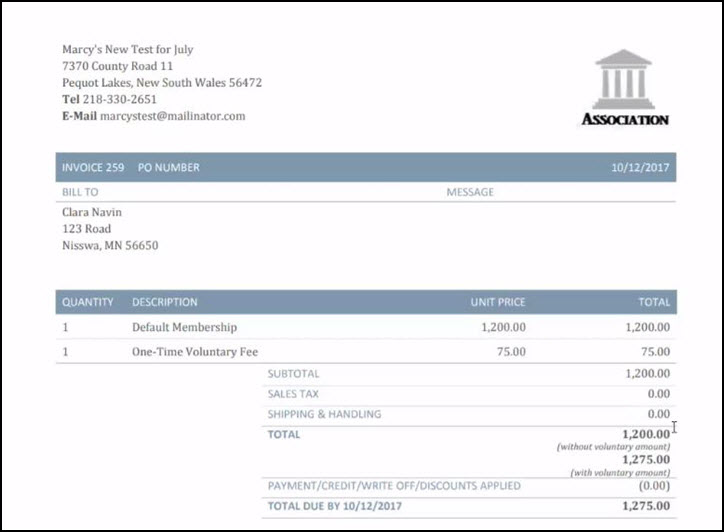

- Voluntary - Select this check-box if the fees for this good/service are voluntary. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount).

- Note: When creating a voluntary fee, you must select Membership as the Goods/Services type. Additionally, when the Voluntary check box is selected, the Accounting Type will automatically be set to Cash and the Revenue Recognition Type will be set to Fully on Paid Date.

- Product Tax Category - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the + button.

- Tax Set - If this good/service is taxable, select the appropriate tax set.

- Is Recurring Fee (vs. one-time) - Select this check-box if this is a recurring fee. Your membership dues, for example, are recurring fees.

- Revenue Recognition - From the Revenue Recognition Type select how you will recognize the revenue for this good/service. For example, if this is an event related fee, and you wish to defer revenue recognition until the start date of the event, you would select Fully on Event Start Date. NOTE: This option is only displayed if you have selected Accrual as Accounting Type for this goods/service.

- Invoice Template - Select the invoice template to be used for this good/service.

- Is Active - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service.

- Click Done to save the new good/service.

Accrual Accounting in GrowthZone

When setting up your goods/services you can elect to use accrual accounting. If you are not certain which accounting methodology you are using, discuss with your accountant. Using Accrual Basis, at the goods/service level, you will define, the various accounts to be used:

- Income (Revenue) Account: This is the revenue account that will be credited based on your revenue recognition settings.

- A/R Account: This is the asset account that represents money due to your organization and will be credited when an invoice is created. When payment is received, this account is debited. The timing of this debit is depended on the Recognition Option set for the goods/service.

- Deferred Revenue Account: This is a liability account to “hold” the revenue until it is to be recognized. Based on the recognition option configured for the goods/service, the account will be credited when the invoice is created and debited on the appropriate recognition day.

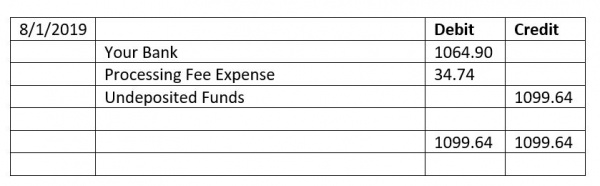

- Deposit Account: This current asset account is debited when payment is received for invoices.

These accounts will be debited and credited based on the revenue recognition type you choose. A debit is an accounting entry that either increases an asset or expense account or decreases a liability or equity account. ... A credit is an accounting entry that either increases a liability or equity account or decreases an asset or expense account. It is positioned to the right in an accounting entry.

Following are the recognition types that may be configured for your goods/services.

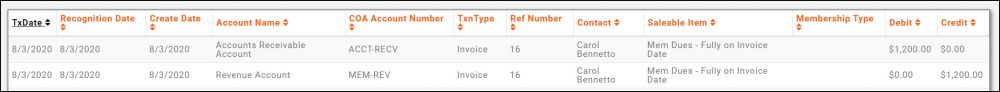

Fully on Invoice Date

If this option is selected, when invoiced, your revenue account is credited the sale immediately and the A/R account is debited. When the invoice is paid, the A/R account is credited, and your deposit account is debited.

Example:

$1200.00 Membership Dues invoice created on 8/3

- Revenue account is credited $1200.00

- A/R account is debited $1200.00

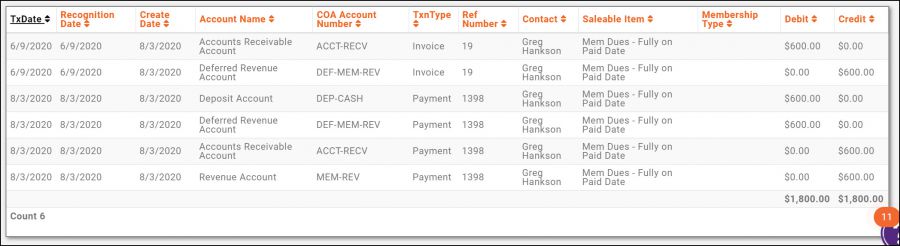

Fully on Paid Date

If Fully on Paid Date is selected, revenue will be credited to your income account when the invoice is paid. The Deferred A/R account will be credited to “hold” the funds until the paid date and the A/R account will be debited. On the day the invoice is paid, the Deferred A/R account will be debited, and the income account will be credited.

Example:

An invoice, for $600.00, was created on 7/7. The invoice is paid on 8/3.

- On 7/7:

- Deferred Revenue account is credited $600.00

- A/R account is debited $600.00

- On Paid Date 8/3:

- Deferred Revenue account is debited $600.00

- A/R account is credited $600.00

- Revenue account is credited $600.00

- Deposit account is debited $600.00

Fully on Invoice Due Date

If Fully on Invoice Due Date is selected, revenue will not be credited to the assigned revenue account until the due date. The Deferred A/R account will be credited to “hold” the funds until the due date and the A/R account will be debited. On the day the invoice is paid, the Deferred A/R account will be debited, and the income account will be credited to the revenue account.

Example:

Invoice for $400.00 is dated 7/27. The due date is 8/1.

- On 7/27:

- Accounts Receivable debited $400.00

- Deferred Revenue credited $400.00

- On Due Date (8/1)

- Accounts Receivable is credited $400.00

- Deferred Revenue is debited $400.00

- A payment at any time will debit Accounts Receivable and credit the Deposit account

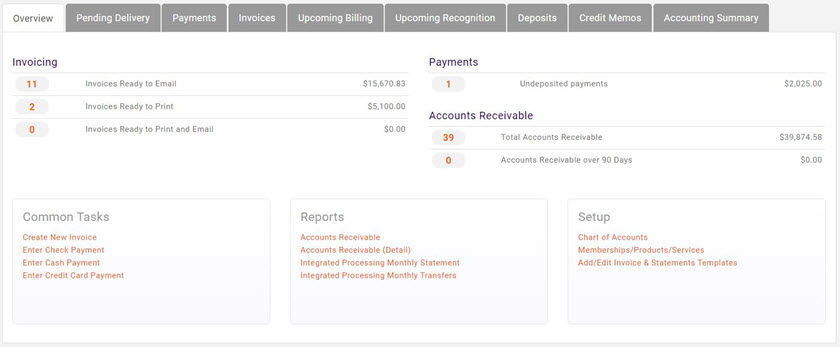

Fully on Event Start Date

If Fully on Event Start Date is selected, revenue will not be credited to the assigned revenue account until the day of the event. The Deferred Revenue account will be credited to “hold” the funds until the event start date and the A/R account will be debited. On the day the event starts, the Deferred A/R account will be debited, and the income will be credited to the event revenue account.

Example

Event registration invoice for $25.00 is created on 8/3. Event begins on 8/4

- On 8/3

- Deferred Revenue Account is credited $25.00

- Accounts Receivable is debited $25.00

- Revenue account is credited $25.00

- A payment at any time will debit Accounts Receivable and credit the Deposit account

Spread Monthly on Invoice Date

For membership dues, even though a payment may be received, up front for the entire year, you may wish to recognize revenue equally across a specific period (generally 12 months). Spread Monthly on Invoice Date allows you to spread equal portions of a payment, across a selected time frame, starting from the invoice date.

Example:

$600 Membership purchased on May 1st. Spread is set to 12 months.

- On May 1st

- A/R account is debited $600.00

- Deferred Revenue account is credited $600.00

- Revenue Account is credited $50 (1/12 of $600.00)

- Deferred revenue is debited $50.00 (1/12 of $600.00)

- Each month there after (for a total of 12 months)

- Revenue account is credited $50.00 (1/12 of the $600.00)

- Deferred Revenue account is debited $50.00 (1/12 of the $600.00)

- A payment at any time will debit Accounts Receivable and credit the Deposit account

Spread Monthly on Payment Date

Spread Monthly on Invoice Payment Date allows you to spread equal portions of a payment across a selected time frame beginning from the date the invoice was paid.

Example

Invoice dated 6/1 for $600.00 Goods/Services set for a 12-month spread

- On 6/1

- Deferred Revenue account is credited $600.00

- Accounts Receivable account is debited $600.00

- Invoice paid on 8/4.

- Deferred revenue is debited 1/12 of $600.00 = $50

- Revenue is credited 1/12 of $600.00 = $50.00

- A/R is credited $600.00

- Deposit Account is debited $600.00

- Each month, on the day of the month the payment was initially received:

- Revenue is credited $50.00

- Deferred Revenue is debited $50.00

| IMPORTANT: This option does NOT “catch up”. It will spread forward from the payment date. |

Spread Monthly on Invoice Due Date

Spread Monthly on Invoice Due Date allows you to spread equal portions of the revenue from the invoice due date forward.

Example:

- On 8/4

- Deferred Revenue account is credited $300.00

- Accounts Receivable account is debited $300.00

- On the invoice due date (9/3), each month $25.00 will be recognized:

- Deferred Revenue account is debited $25.00

- Revenue Account is credited $25.00

- A payment at any time will debit Accounts Receivable and credit the Deposit account

| IMPORTANT: This option does NOT “catch up”. It will spread forward from the invoice due date. |

Set up Voluntary Fees

Voluntary fees may be added to your member invoices and membership applications. With a simple set up you can easily ask for, collect and track voluntary amounts. You may wish to use voluntary fees to ask for extra funds for special projects, such as technology improvements, or fundraising to support specific committee. A voluntary fee may be displayed on an invoice, and the member may choose to or to not pay this fee. If they choose not to pay the fee, it will not be counted against them in any past due invoices reports. Voluntary fees are designed so that it is clear to your members when and if they are opting into the additional fee. For example on invoices, shown below, the amount of the invoice without voluntary fee will always be shown first, and if voluntary amounts are included, it will note that with a phrase (voluntary amount).

- Click Setup in the Navigation panel.

- Click Goods/Services in the Services, Products and Commerce section. A list of Goods/Services currently configured in your system will be displayed.

- Click the New button.

- On the Add/Edit Good or Service screen, configure the following:

- Name - Provide a name for the good/service. This will be displayed when you are selecting goods or services.

- Good/Service Type - Select Membership as the Goods/Services type.

- Product Category - Select a product category from the drop-down list. Product Category is used for filtering and reporting. You can select a previously configured product category from the list, or, to add a new product category, click the + sign.

-

- Enter a Name for the new product category.

- Enter a Description of the new product category.

- Select a Category List from the drop-down, or, to add a new category list, click the + sign.

- Click Done.

- Description - Enter a description of the good/service. This description is displayed in the Goods/Services list.

- Product Description - The Product Description is displayed on the web when this good/service is used. The standard word processing for formatting your text (i.e. bolding, italiczing, etc.) are available. You may also add links and images to the description.

- Price Period - Select how this good/service is billed. You may select: Annually, Monthly, One-time, Semi-annually, or Quarterly. An event good/service would be a one time fee.

- Default Price - Enter a default price for this good/service. This price may be over-ridden when you are assigning the good/service.

- Default Quantity - Enter the default quantity for this good/service. This would be used if a minimum purchase for this good/service is required, and may be overridden when you are assigning the good/service.

- Voluntary - Select the Voluntary check box.

- Accounting Type - Select Cash.

- Revenue Recognition Type - Select Fully on Paid Date.

- Income Account - Select the income account for this good/service. The drop-down list will be populated with the income accounts currently configured in your Chart of Accounts. You may add a new account by clicking the + sign. If you are unsure as to which account should be selected you will want to check with your accountant, as this will affect your financial statements.

- Receivables Account - Select the accounts receivable account for this good/service.The drop-down list will be populated with the receivables account configured in your Chart of Accounts.

- Deferred Income Account - Select the deferred income account for this good/service. The drop-down list will be populated with the deferred income accounts configured in you Chart of Accounts. If you have chosen to defer the revenue for this event to a specific point in time, the revenue will be held in the deferred income account until that point in time.

- Deposit Account - Select the deposit account for this good/service. The drop-down list will be populated with the deposit accounts configured in your Chart of Accounts.

- Default Revenue Recognition Months - Leave this set to 0.

- Note: When creating a voluntary fee, you must select Membership as the Goods/Services type. Additionally, when the Voluntary check box is selected, the Accounting Type will automatically be set to Cash and the Revenue Recognition Type will be set to Fully on Paid Date.

- Product Tax Category - If this good/service is taxable, select the appropriate product tax category. The drop-down list will be populated with tax categories currently configured in your system. If you wish to add a new product tax category, click the + button.

- Tax Set - If this good/service is taxable, select the appropriate tax set.

- Is Recurring Fee (vs. one-time) - Select the recurring fee check box.

- Invoice Template - Select the invoice template to be used for this good/service.

- Is Active - Select this check-box to activate this good/service. Only Active items may be billed and only active items will be displayed when you need to select a good/service.

- Click Done to save the new voluntary good/service.

Voluntary fees can be easily tracked by running the Voluntary Payment Report. Click here for more details.

Billing Functions

The Billing module provides the functions to review invoices, view overdue invoices, accept payments, as well as review reports on accounts receivables, and generate the reports needed to reconcile to your general accounting software.

| NOTE: Via the Billing module you can manage billing for multiple members simultaneously. You may also perform many of these functions individually on a member's Billing tab. |

The Billing module displays nine separate tabs to allow you to manage your billing processes:

- Overview - This tab provides a summary view into the present status of your billing.

- Pending Delivery - This tab will display a list of invoices that are currently waiting to be sent.

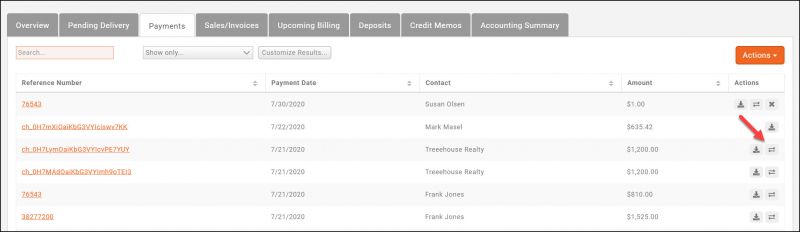

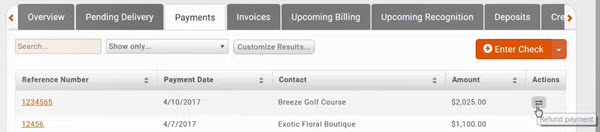

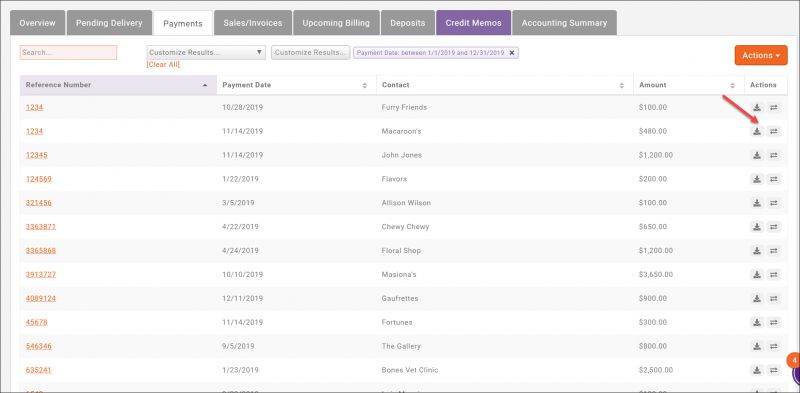

- Payments - This tab displays a list of all payments you have received.

- Invoices - This tab will display list of all invoices that have not yet been sent out.

- Upcoming Billing - This tab displays a list of all future billing.

- Upcoming Recognition - This tab will display a list of all revenue to be recognized in the future.

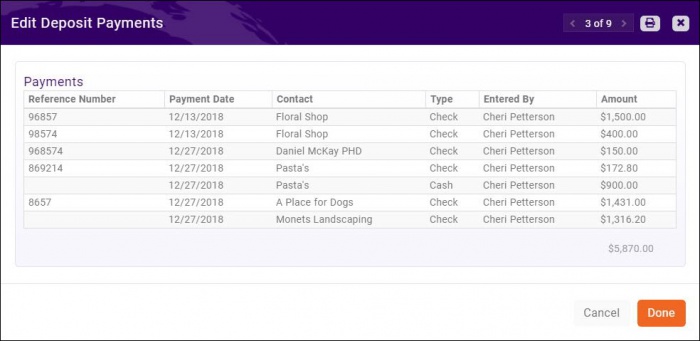

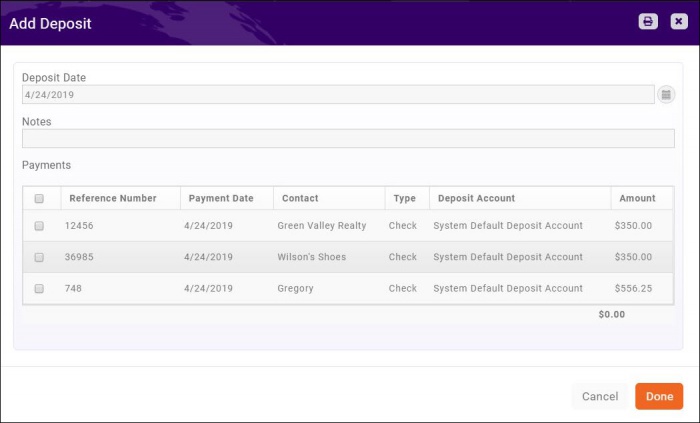

- Deposits - This tab will display a list of all previous deposits.

- Credit Memos - This tab will display a list of all previous credit memos.

- Accounting Summary - This tab will display your accounting summary.

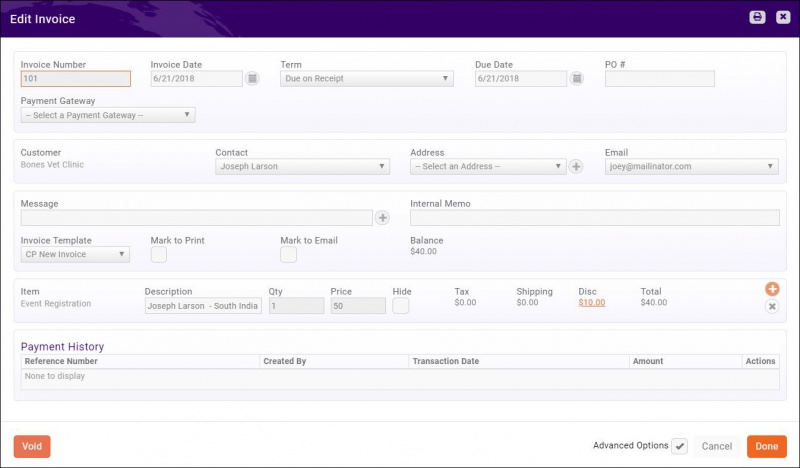

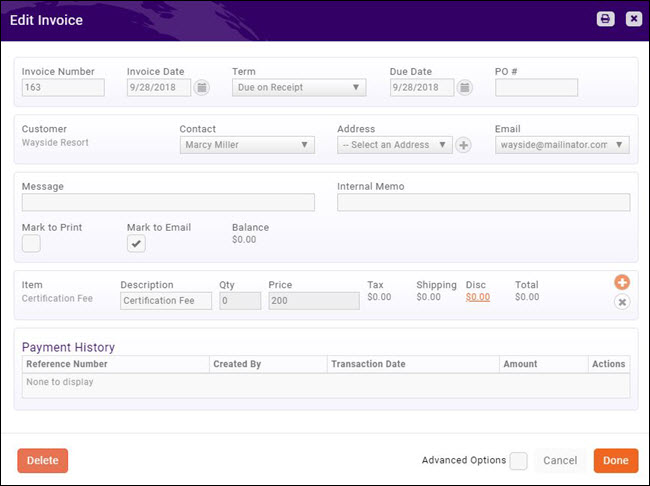

Create a Single Invoice

Single invoices may be created directly on a contact or individual's Billing tab, or from the Billing module. Click Here to view a brief tutorial on creating a single invoice.

| NOTE: It should be very rare that you would need to manually create an invoice within GrowthZone, there should be an action taken (adding a membership, registering an attendee) which will trigger an invoice to be created for you. |

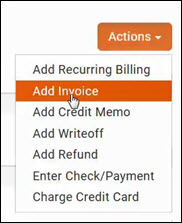

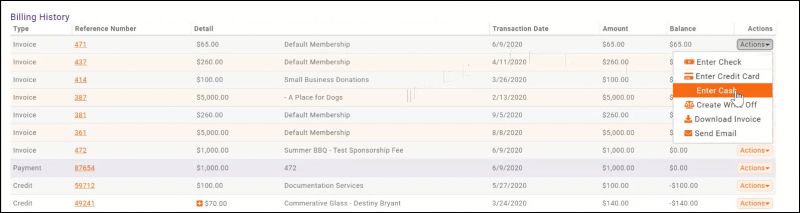

- On a Contact's Billing tab, click the down arrow on the Actions button.

- Click Add Invoice.

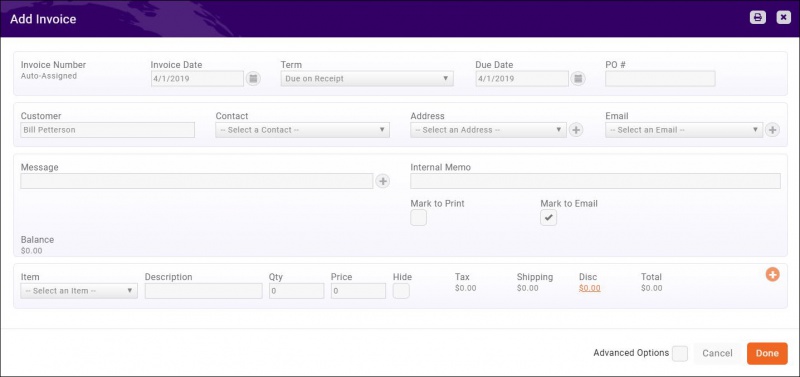

- Configure the following as needed:

- The Invoice Number will default to Auto Assigned, however clicking the Auto Assigned link will allow you to enter your own invoice number. Best practice is to allow the system to auto-assign, however, if you choose to enter an invoice number, the system will trigger an error if you have entered a duplicate number.

- The Invoice Date will default to the current date. You may change this by entering a new date, or clicking the calendar icon and selecting a date.

- The Term will default to the terms you defined in the Finance General Settings. You may select different terms from the drop-down list, or select Select a Term from the list and click the

to add a new term. Click Here for more information on setting up your terms and conditions.

to add a new term. Click Here for more information on setting up your terms and conditions. - The Due Date will automatically be populated with a date derived from the Terms you have selected. For Example: If you have selected Due on Receipt the due date will be the current date. You may over-ride this date by entering a date, or clicking the calendar icon to choose a date.

- PO # - If you have been provided with a PO # you may entered it here. NOTE: If provided with a PO # after an invoice is sent, you may add this by editing the invoice.

- The Purchase Date will default to the current date. You may change this by entering a date, or clicking the calendar and selecting a date.

- Customer will be automatically populated.

- Contact: Select a contact from the drop-down list. If no contact is selected, the contact chosen as the billing contact will be included on the invoice.

- Address: Select an address from the drop-down list. This is optional, however, if you wish to print and mail this invoice, the address is required. Addresses in the drop-down will be those associated to the organization. If no address is available in the drop-down, or if you wish to add an additional address, click Select an Address in the drop-down, and click the

to open the Address dialog box.

to open the Address dialog box. - Email: Select an email from the drop-down list. This is optional, however, if you wish to email this invoice, email is required. Emails in the drop-down will be those associated to the organization. If no email is available in the drop-down, or if you wish to add an additional address, click Select an Email in the drop-down, and click the

to open the Email Address dialog box.

to open the Email Address dialog box. - Message: Enter a message that you would like to appear on the invoice. This is optional. If entered, it will display under the address on the invoice.

- Internal Memo: Enter a memo that will viewed in the back office only (optional).

- Choose how you would like to deliver this invoice. By making this selection, the invoice will be added to your list of Pending Delivery in the Billing module. Mark to Print, Mark to Email. You may select both options.

- Select a goods/service from the Item drop-down list. The list will be populated with all goods/services that have been configured in your system. Click Here for further information on setting up goods/services. You may add additional items by clicking the

icon.

icon. - Description: The description will be populated with the default description associated to the item, you may over-ride.

- Price: The price will be populated with the default price associated to the item. You can over-ride.

- Quantity: Enter the quantity of this item you wish to include on the invoice.

- Hide: If adding multiple goods/services to this invoice, and you wish to roll all items into the first item, click the Hide check-box.

- If the item has been configured as taxable, the Tax field will automatically be populated.

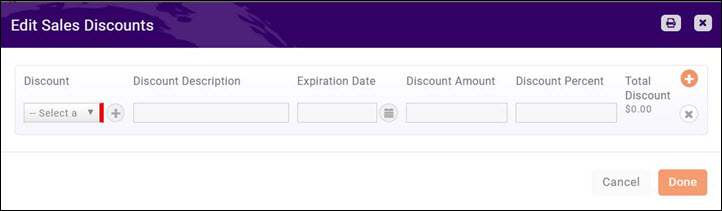

- Disc: (Optional) If you wish to add a discount to this item, click the Disc hyper link.

-

- Select an option from the Discount drop-down, or click the

to add a new discount. The details of the discount (description, expiration date, discount amount, discount percent) will automatically be populated. You can make changes as needed. The Total Discount field will be updated based on your settings. Click Done when discount setup is completed.

to add a new discount. The details of the discount (description, expiration date, discount amount, discount percent) will automatically be populated. You can make changes as needed. The Total Discount field will be updated based on your settings. Click Done when discount setup is completed.

- Select an option from the Discount drop-down, or click the

- Mark to Print and/or Mark to Email: If you wish to mark this invoice for future printing or emailing, select desired option. This will place the invoice on the Pending Delivery list in the Billing Module.

-

- Advanced Options: By default, the system will use the default payment gateway and invoice template configured in your general finance settings. If you wish to over-ride the defaults, slick the Advanced Options check-box, and select desired gateway and template.

- Click Done. The invoice is now created.

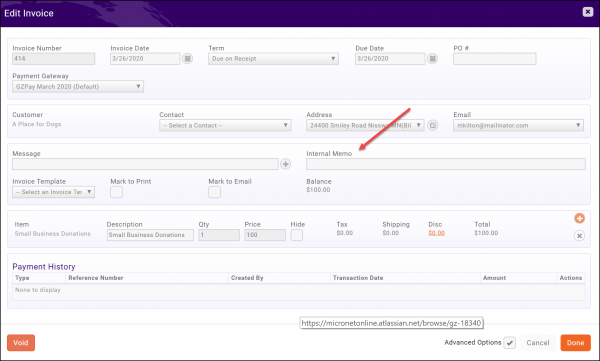

Add an Internal Memo to an Invoice

- Click the link for the desired memo.

- Enter the desired Internal Memo.

- Click Done.

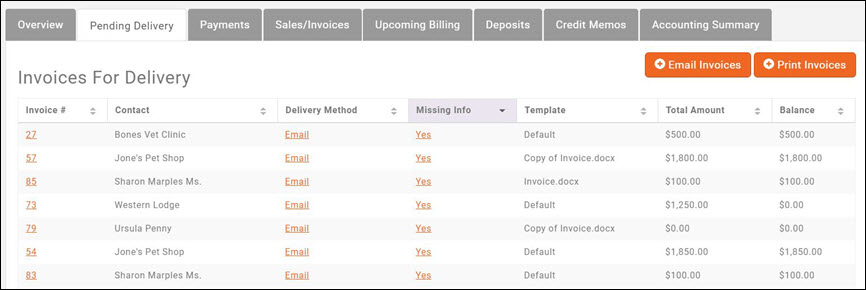

Deliver Invoices Pending Delivery

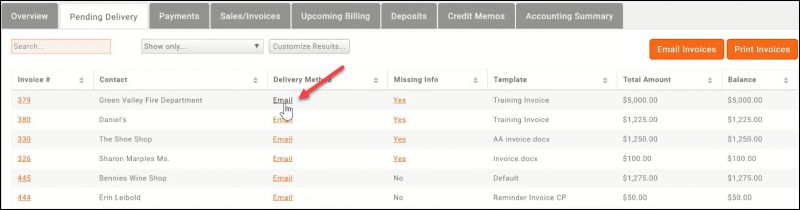

The Pending Delivery tab in the Billing Module will provide a list of invoices that have not been sent out.

How do Invoices Get Place on the Pending Delivery Tab?:

- Invoices created when you run your recurring billing on the Upcoming Billing tab.

- If Automated Scheduled Billing is enabled under Setup > Finance > General Settings.

- If allow invoicing is enabled for events, fundraiser, sponsorship, etc.

- When a one-off invoice is created and Mark to Print or Mark to eMail is selected.

- When membership applications are submitted, and you have allowed the applicant to request to be invoiced.

You may process and send out the invoices in the following manner:

- Select Billing in the Navigation Panel.

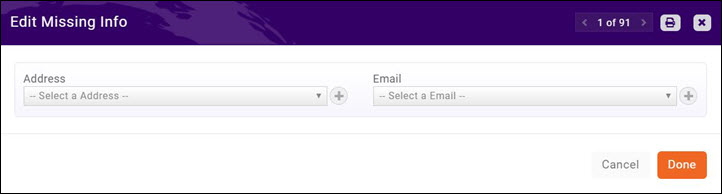

- Click the Pending Delivery tab. A list of all invoices that have not been sent will be displayed. When an invoice is created, you select whether the invoice is to be emailed, printed or both. This choice is displayed in the Delivery Method column. If the database does not have the information needed (address and/or email address) this will be noted by Yes in the Missing Info column. You may click the Yes hyper-link to add the missing information if available.

| NOTE: When no email or address are specified (either during invoice creation, or when a recurring billing is setup) the system will fall back to the billing contact's primary email or address. If there is no billing contact specified it will fall back to the purchased by contact's primary email /address. Only if it can't find an email or address will it show up with Missing Info. |

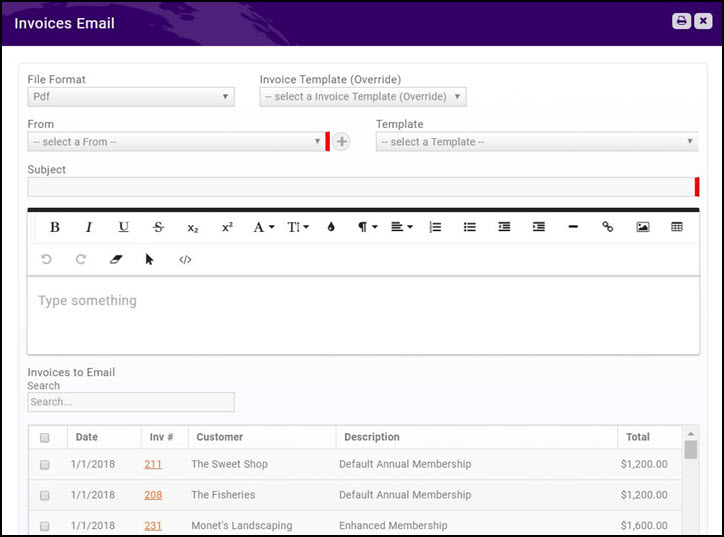

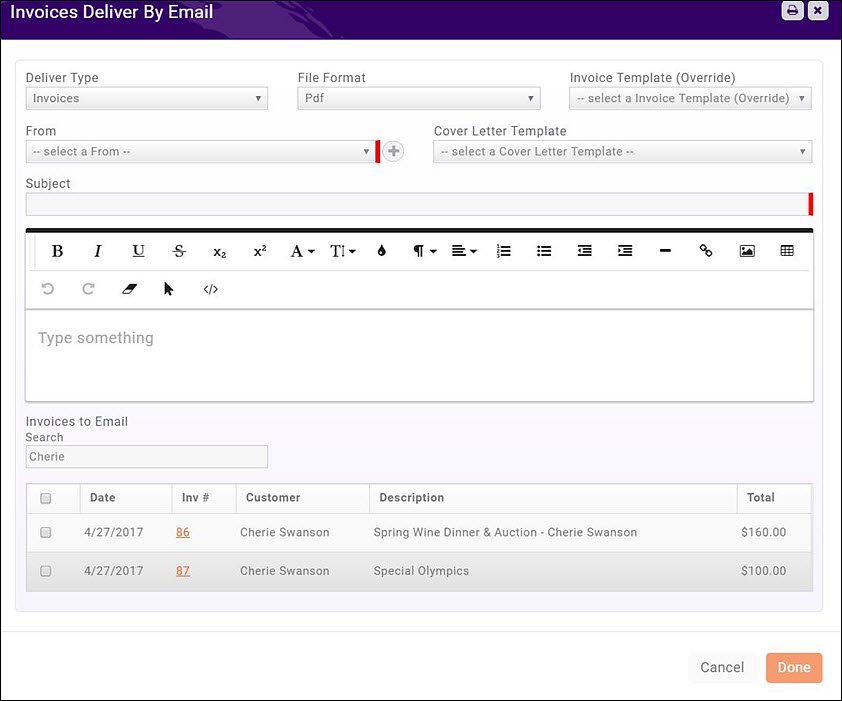

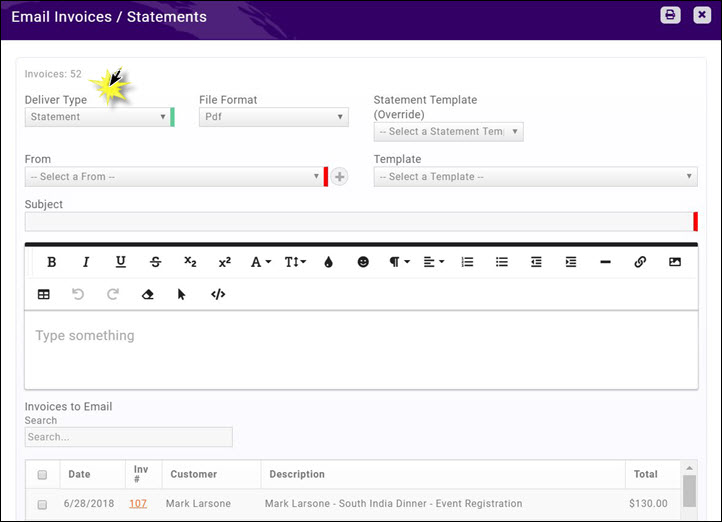

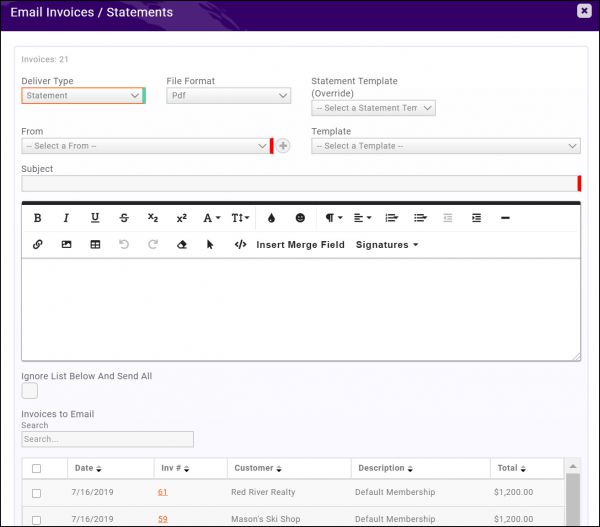

Deliver Invoices via E-mail

- Click Billing in the left-hand navigation panel.

- Click the Pending Delivery tab. A list of all invoices pending delivery will be displayed. NOTE: Invoices that do not have an email will be indicated by Yes in teh Missing Info column. Click the Yes link to update the email address.

- Click the Email Invoices button. A list of invoices to be emailed will be displayed. NOTE: If an email address is not available, the invoice will NOT be displayed in the list. Correct this as described previously.

- Configure the following email settings:

- File Format - Select either PDF or Word Format.

- Invoice Template (Override). This option allows you to over-ride the invoice template that is associated to the fee items included in the invoices you are sending out. You may, for example, wish to select a different invoice template when sending out past due invoices.

- From - Select the from email address.

- Template - If you have created an email template to be used when sending invoices you may select it. If you are not using a template, you will simply be able to type your message.

- Subject - Enter a subject for the email, and type your message into the text box, if you are not using a template.

- Select the Invoices to Email. You may select invoices individually, or click the top check-box to select all invoices in the list. You can search for specific invoice by typing into the Search box.

- Click Done. Your selected invoices have now been emailed.

| NOTE: If an email address is marked as invalid, the email will not be sent out and the Missing Info column on the Pending Delivery tab will be updated to Yes. When you click on pending invoices' "yes" it will open up the dialog to recheck and validate the email address. See Managing Invalid Emails for further instructions. |

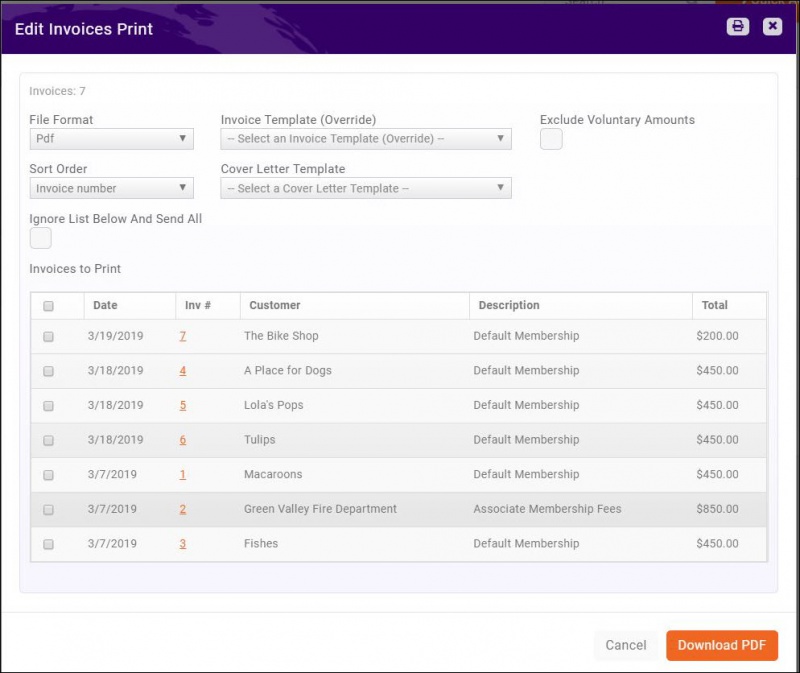

Print Invoices for Delivery

- In the Billing module, select the Pending Delivery tab.

- Click Print Invoices.

- Select the File Format you wish to use.

- Invoice Template (Override). This option allows you to over-ride the invoice template that is associated to the fee items included in the invoices you are sending out. You may, for example, wish to select a different invoice template when sending out past due invoices.

- Select your Cover Letter Template (optional)

- Select desired Sort Order. This will set the order in which the invoices will be printed. You may choose: Customer, Date or Invoice Number.

- Select the Ignore List Below And Send All check-box if you wish to print all invoices. If de-selected, the system will only print the first 500 invoices.

- Select the invoices you wish to print. You may select invoices individually, or click the top check-box to select all the invoices in the list.

- Click Done. The invoices will download and you may proceed with printing.

| NOTE: Only invoices for which you have address information will be available for printing. Correct missing address information as previously described. |

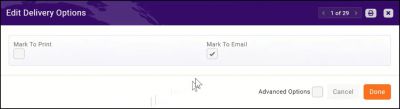

Remove Invoice from Pending Delivery if you do not wish to Deliver

If you do not wish to deliver an invoice, you can "remove" it from the Pending Delivery tab, by changing the Delivery Method to None.

| NOTE: Removing the invoice from the Pending Delivery tab does not delete the invoice. The invoice still exists, and will be visible in the transaction history for the contact, as well as in the Info Hub. |

- In the Billing module, select the Pending Delivery tab.

- For the desired invoice, click the hyper-link for the Delivery Method.

- Deselect Mark to Print and/or Mark to eMail.

- Click Done.

Over-ride the Invoice Template used when Delivering Invoices

Whether emailing or printing invoices, you will have the opportunity to over-ride the invoice template used.

- In the Billing module, select the Pending Delivery tab.

- Click Print Invoices or Email Invoices.

- From the Invoice Template (Over-ride) list, select the desired template.

- Proceed to deliver your invoices as described above.

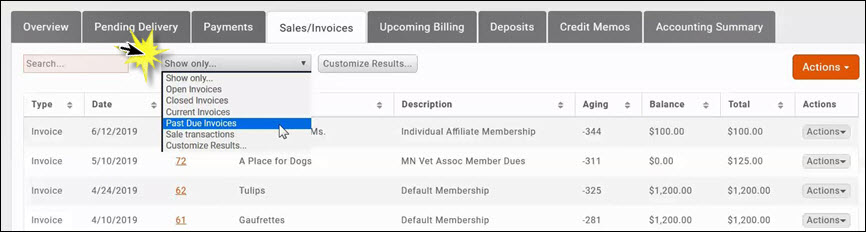

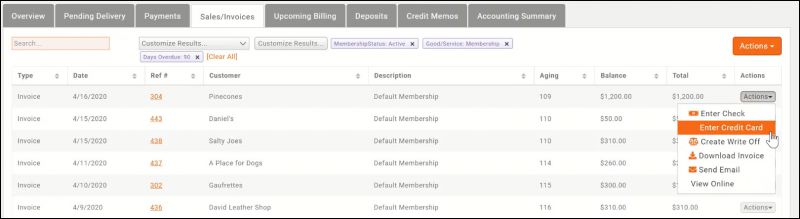

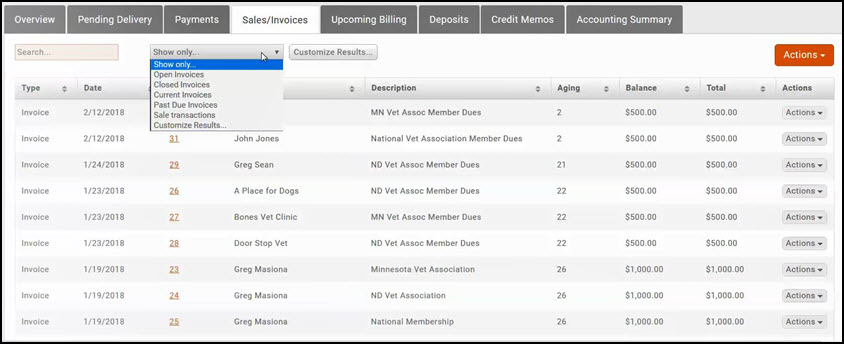

View Past Due Invoices

You can view all invoices on the Sales/Invoices tab. To view only over-due invoices select Past Due Invoices from the Show Only drop-down list. The list of invoices will refresh displaying on your past due invoices.

Re-deliver Past Due Invoices via Email

- On the Sales/Invoices tab, filter the list to Past Due Invoices as described previously.

- Click the drop-down arrow on the New Invoice button.

- Click Email Invoices/Statements.

-

- Select Invoice from the Deliver Type drop-down list.

- Select the desired File Format from the drop-down list.

- Select the desired invoice template from the Invoice Template (Override) drop-down list. This will allow you to select an invoice template to apply to the selected invoices, either by selecting the checkbox at the top to select all or by selecting individual invoices.

- Select a From address from the list.

- Select a Cover Letter Template from the list.

- Enter a Subject and type in your message if you have not selected a cover letter template.

- Click the check-box for the invoices you want to email, or click the top-most check-box to select all invoices in the list.

-

- Click Done. The Past Due invoices have now been emailed.

Re-deliver Past Due Invoices via Print

- On the Sales/Invoices tab, filter the list to Past Due Invoices as described previously.

- Click the drop-down arrow on the New Invoice button.

- Click Print Invoices.

- Select the desired File Format from the list.

- Select the desired invoice template from the Invoice Template (Override) drop-down list. This will allow you to select an invoice template to apply to the selected invoices, either by selecting the checkbox at the top to select all or by selecting individual invoices.

- Select the desired Cover Letter Template from the list.

- Click the check-box for the invoices you want to print. Click the top-most check box to select all invoices in the list.

- Click Done to print the invoices.

Deliver Statements

Statements can be delivered from the Billing module, or you can also deliver statements from an individual contact's Billing tab.

Email Statements

- On the Sales/Invoices tab, filter the list as needed to find the members to whom you wish to deliver statements.

- Click the Actions button.

- Click Email Invoices/Statements.

-

- Select Statement from the Deliver Type drop-down list.

- Select the desired File Format from the drop-down list.

- (Optional) Select the desired statement template from the Statement Template (Override) drop-down list. This option allows you to over-ride the statement template you selected in your general finance settings. If no selection is made, the default will be used.

- Select a From address from the list.

- Select the template that you wish to use for the body of the email from the Template drop-down list.

- Enter a Subject and type in your message, if you have not selected a template.

- Click the check-box for the members to whom you want to send statements, or click the top-most check-box to select all members in the list.

-

- Click Done. Statements are now emailed.

Print Statements

- On the Sales/Invoices tab, filter the list as needed to find the members to whom you wish to deliver statements.

- Click the Actions button.

- Click Print Statements.

- Select the desired File Format from the list.

- If you wish to over-ride the default statement, select the desired statement template the you wish to use from the Statement Template (Override) list.

- Select the desired Cover Letter Template from the drop-down list.

- Ignore List Below And Send All: The system is limited to displaying 500 statements in the list. If you have more than 500, select this option to ensure that all statements are printed.

- Click the check-box for the statements you want to print. Click the top-most check box to select all invoices in the list. You can also enter search criteria, that will look to the description, to limit the list.

- Click Done to download and print the statements.

Print Statement from the Contact's record

See Print an Individual Statement.

Accept Payments

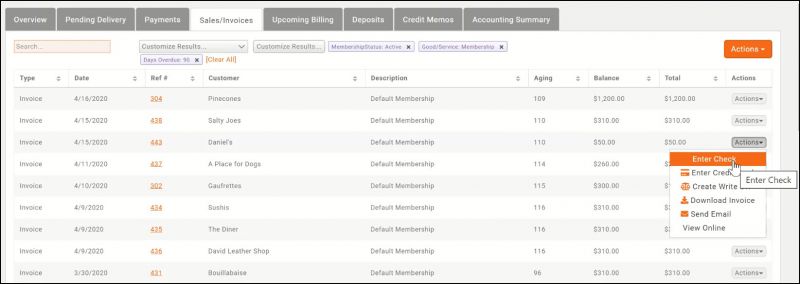

The Invoice tab will display all of your invoices, whether they have been paid or not. You can use this tab to analyze aging and make payments. The list may be filtered to just open invoices to make it easier to manage payments.

| NOTE: You may also make payments on the individual members' Account tab. |

You can view the details of an invoice by clicking into the hyper-link for a particular invoice.

- Select Billing in the Navigation Panel.

- Click the Invoices tab. Customize the list to display only unpaid invoices to make it easier to locate the invoices for which you are accepting payment.

- Click the payment type in the Actions list. You may choose: check or credit card.

| IMPORTANT: Partial Payments may be accepted. When a partial payment is received, if there are multiple items on the invoice, the payment will be applied to the smallest items first. |

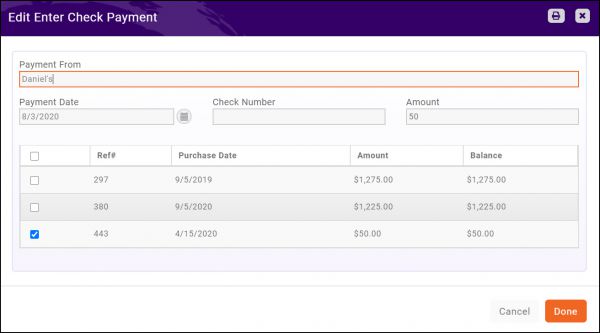

Accept a Check Payment

Check payments may be accepted via the Billing module, or on an individual contact Billing tab.

- From the Billing Sales/Invoices tab.

- Click the Enter Check icon in the Actions list.

- Payment From: This will display the name of the contact to whom the invoice was sent. You may change this if necessary.

- Payment Date: This will display the current date. You may change this at initial creation of payment, however, once the payment is saved you will not be able to change the date.

- Check Number: Enter the check number as a reference.

- Amount: The invoice against which you wish to apply payment is automatically selected and the full amount of the invoice will be displayed by default. You can select additional invoices, and the system will total those invoices. You may also change the amount if needed.

- Click Done.

| NOTE: If you have inadvertently entered the wrong check number, click on the payment hyper-link to update the number. |

Enter a Cash Payment

Cash payments may be entered from a contact's Billing tab.

- Click Contacts in the left-hand navigation panel.

- Select the desired contact.

- Click the Billing tab.

- Click Enter Cash. All open invoices will be displayed.

- Payment From: This will display the name of the contact to whom the invoice was sent. You may change this if necessary.

- Payment Date: This will display the current date. You may change this at initial creation of payment, however, once the payment is saved you will not be able to change the date.

- Amount: Select the invoices to which the cash payment is to be applied; the amount will automatically total. You may change this if necessary.

- Click Done.

Accept a Credit Card Payment - Integrated

- Select Billing > Sales/Invoices tab.

- Click the Enter Credit Card icon in the Actions list.

- Payment From: This will display the member to which the invoice was sent. You may change this if necessary.

- Stored Payment Methods: If a credit card has been stored for this member, you will be able to select this payment from the list.

- Card Information: Select the appropriate Payment Gateway. If no gateway is selected, the system default will be used.

- Enter Card Information: Enter the required credit card information fields.

- Store Payment Info For Future: If the member wishes you to do so, you may click this check-box to store this credit card number for future use.

- Amount: Enter the amount to process in this transaction. The amount due on the invoice will be displayed by default, but you may change this.

- Click Done to process the credit card payment.

Accept a Credit Card Payment - Outside Processor

If you are processing credit cards outside of the GrowthZone software, best practice is to enter the payment as a check payment, described in Accept a Check Payment. Best Practice: In the check number field, enter identifying information such as the card type and/or the last four digits of the card.

Can I apply a Surcharge to a Credit Card Payment via GrowthZone?

GrowthZone does not have the ability to apply a percentage charge to invoices to cover credit card fees. We did investigate the option for a while, but due to the complexity of the implementation, it was decided that it was not a feature we would be able to develop:

Surcharging, or the action of passing the credit card fees of a transaction onto the purchaser only recently became legal in the United States in 2013, however it requires adhering to regulations that can be quite complex. The calculation of the surcharge has to take into consideration potential variables like state laws, shipping address, customer address, and the amount and the type of card used to avoid running afoul of the law and violating the merchant agreement. Several states, including Minnesota, do not allow surcharging practices at all. Trying to simplify the calculated surcharge on a given transaction by using a flat percentage rate for all transactions paid by credit card is not an option for us because it is grossly non-compliant. Given our core competencies of software we build, we can’t logistically engineer and maintain a surcharge calculation tool accurate enough to remain in compliance. While we are not able to offer this capability at this time, there are emerging technologies in the market to offload these calculations via a third party. We are actively monitoring such services and may be able to take advantage of them when they become more compatible and feasible to integrate with our eCommerce architecture.

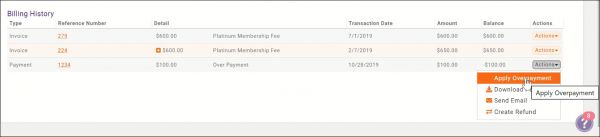

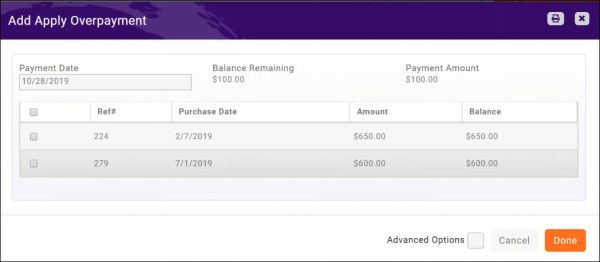

Apply Over-payments